India's Hidden Gold Empire: $3.8T In Homes Plus Billions More In Temple Vaults

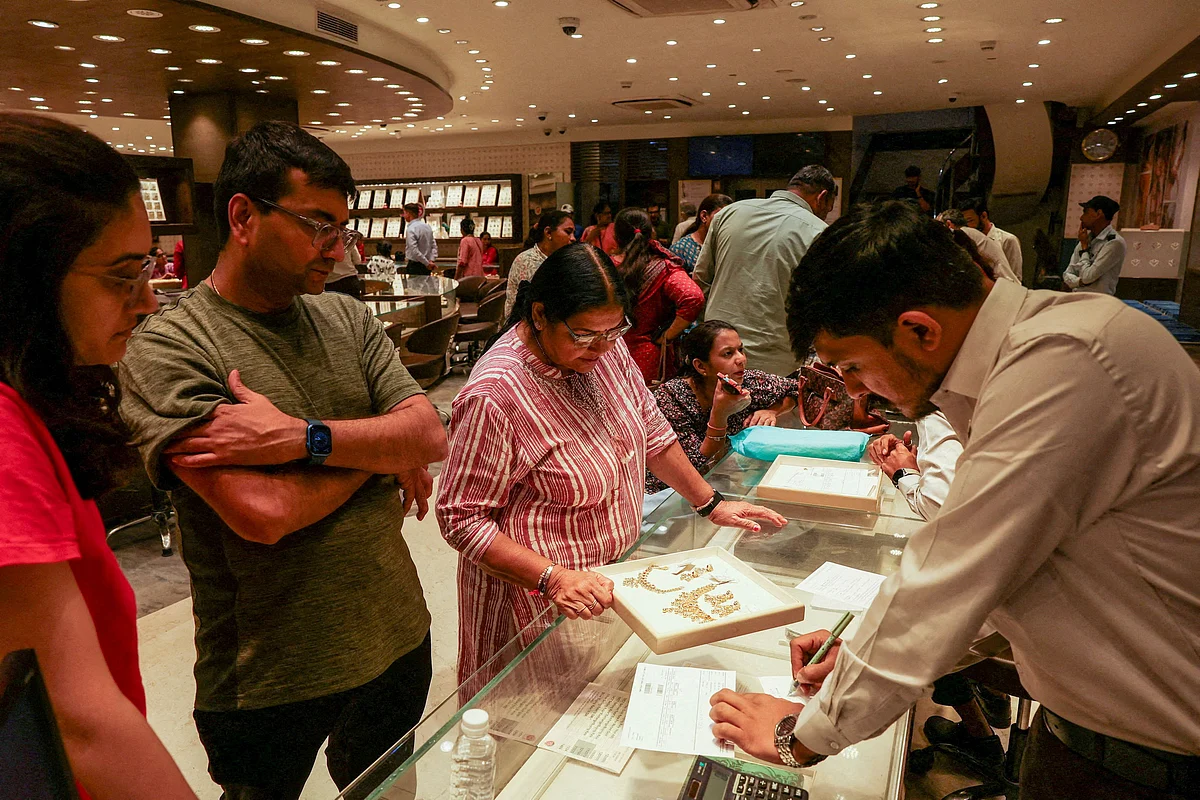

India's centuries-old love affair with gold has created a fortune that outshines entire nations.

According to Morgan Stanley, Indian households now hold an estimated $3.8 trillion worth of gold, equivalent to nearly 89 per cent of the country's GDP. Weighing close to 25,000 tonnes, this is by far the largest privately owned stockpile of gold in the world - a gleaming reserve of cultural pride, emotional security, and economic resilience.

Recommended For YouThe surge has been fuelled by gold's stellar run this year. Prices have jumped about 62 per cent, pushing domestic rates to around Rs 127,000 per 10 grams - a record high. The appreciation has strengthened household balance sheets, creating what economists call a“wealth effect” that underpins consumer confidence and spending.

But India's gold story goes far beyond its households. A parallel treasure lies behind the stone walls of its ancient temples - the sacred vaults of faith that also serve as some of the largest single repositories of precious metal anywhere in the world.

Estimates suggest that Indian temples collectively hold between 2,500 and 4,000 tonnes of gold in jewellery, coins, bars, and ornaments - the result of centuries of donations from devotees. The Padmanabhaswamy Temple in Kerala alone is believed to store around 1,300 tonnes, while other famous shrines such as Tirupati, Shirdi, and Vaishno Devi have each accumulated hundreds of kilograms.

In India, gold transcends economics. It is wealth, worship, and heritage woven into one. From the bracelets adorning brides to the treasures sealed in temple vaults, gold reflects both the material prosperity and the spiritual soul of a civilisation that has always believed - in good times and bad - that real wealth shines brightest in gold.

When combined, India's households and temples are sitting on an astonishing 27,500 to 29,000 tonnes of gold - an amount unmatched by any other nation. For perspective, the Reserve Bank of India (RBI), custodian of the country's official reserves, holds just 880 tonnes, about 13 to 14 per cent of total foreign exchange reserves.

Globally, only a handful of countries possess comparable quantities, even at the sovereign level. The United States leads with 8,133 tonnes, followed by Germany (3,351 tonnes), Italy (2,452 tonnes), France (2,437 tonnes), and China (2,298 tonnes). All the world's central banks together hold about 36,000 tonnes - barely more than India's total private holdings.

The World Gold Council (WGC) notes that India accounts for nearly 26 per cent of global gold demand, up from a five-year average of 23 per cent, second only to China's 28 per cent. While jewellery continues to dominate with a two-thirds share, investment in bars and coins has risen sharply from 24 per cent in 2020 to 32 per cent in 2025, reflecting gold's growing appeal as a wealth-preservation tool.

Even as the cultural bond with gold endures, India's financial mindset is shifting. The share of bank deposits in household savings has declined to 35 per cent in FY25 from 46 per cent pre-pandemic, while equity investments have climbed to 15.1 per cent, from just 4 per cent. Analysts say this financialisation trend will continue, driven by rising incomes, regulatory reforms, and broader investor participation.

However, the vast troves of“sleeping gold” - in homes and temple vaults - remain largely untapped. Economists argue that if even a small portion of this were monetised or used as collateral, it could unleash a powerful wave of capital into India's economy, supporting credit growth and infrastructure spending. Yet cultural reverence and trust barriers continue to keep much of it idle.

For central banks, gold remains a hedge against inflation and geopolitical risk, and the RBI has steadily added to its reserves - about 75 tonnes in 2024 alone. Globally, official purchases have exceeded 1,000 tonnes a year for three consecutive years, underscoring a renewed faith in the metal's timeless value.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment