Trump Meme Coin ETF Gains DTCC Listing Status

A proposed ETF tracking the TRUMP meme coin has appeared on the Depository Trust & Clearing Corporation's system - an infrastructural step that signals intent, though it falls short of regulatory approval.

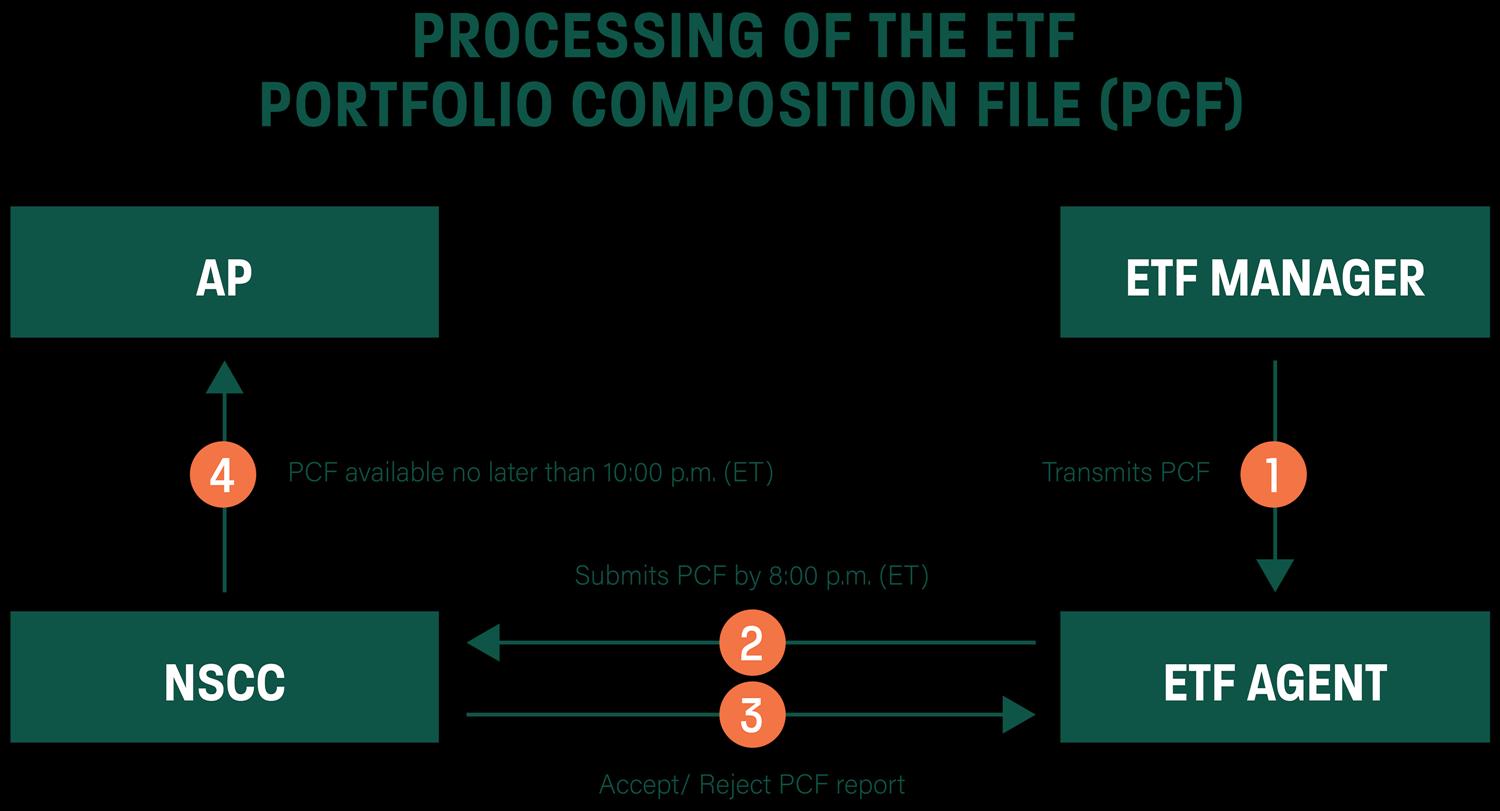

Canary Capital , which filed an S-1 registration with the U. S. Securities and Exchange Commission for the ETF, now sees its TRUMP Coin fund listed in DTCC systems alongside other altcoin ETF candidates . The DTCC listing enables clearing and settlement readiness should approval arrive.

Analysts view the development as a technical milestone. Bloomberg ETF specialist Eric Balchunas observed that once a ticker appears on DTCC's eligibility file, it rarely retracts - underscoring the forward momentum for the product. Nonetheless, he and others caution that DTCC inclusion is procedural and does not guarantee SEC consent.

Canary's filing proposes that the ETF would offer exposure to the price dynamics of TRUMP token without requiring investors to self-custody the asset. To cover transaction costs inherent in the blockchain architecture , the filing permits the fund to hold up to 5 percent in Solana's native token SOL , although it will not treat SOL as a core investment.

The TRUMP coin is a Solana Program Library token whose market value hinges heavily on political sentiment, community engagement and volatility rather than fundamental utility. Critics have raised concerns about the blending of political interests with speculative finance, warning of conflicts of interest and reputational risks to the broader crypto ecosystem.

This development coincides with DTCC's addition of other altcoin ETFs - namely Fidelity's Solana ETF and Canary's XRP and Hedera funds - to its eligibility files. These moves have injected renewed optimism into altcoin ETF markets, though all such listings still await the SEC's green light.

See also Crypto Market Faces Significant Liquidation in Last HourMomentum for altcoin ETFs has accelerated since spot Bitcoin and Ethereum funds gained approval. Still, the SEC has kept other proposals on ice, deferring decisions and delaying rulings. The regulator's patience underscores the risk-management pressures it faces in balancing innovation and investor protection.

Canary's TRUMP ETF filing follows earlier efforts by Trump Media & Technology Group, which has sought SEC approval for a suite of thematic“Truth Social Funds” ETFs covering areas such as energy, infrastructure and American icons.

Arabian Post – Crypto News Network

Notice an issue? Arabian Post strives to deliver the most accurate and reliable information to its readers. If you believe you have identified an error or inconsistency in this article, please don't hesitate to contact our editorial team at editor[at]thearabianpost[dot]com . We are committed to promptly addressing any concerns and ensuring the highest level of journalistic integrity.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Crypto Market Update: Pepeto Advances Presale With Staking Rewards And Live Exchange Demo

- Kucoin Appeals FINTRAC Decision, Reaffirms Commitment To Compliance

- Cregis And Sumsub Host Web3 Compliance And Trust Summit In Singapore

- Chartis Research And Metrika Release Comprehensive Framework For Managing Digital Asset Risk

- Nodepay Launches Crypto's Largest Prediction Intelligence Platform

- Schoenherr Opens London Liaison Office As Gateway To Central Eastern Europe

Comments

No comment