The Week In Charts: RBI's Caution, EM Race, India's Billionaires

From the Reserve Bank of India's (RBI's) cautious growth outlook amid US tariff hikes, sources of information for investors being dominated by recommendations from friends, family and influencers, India losing the top position in emerging market (EM) ranking in August, and a revealing sleep gap among Indians-here's a compilation of this week's news in numbers.

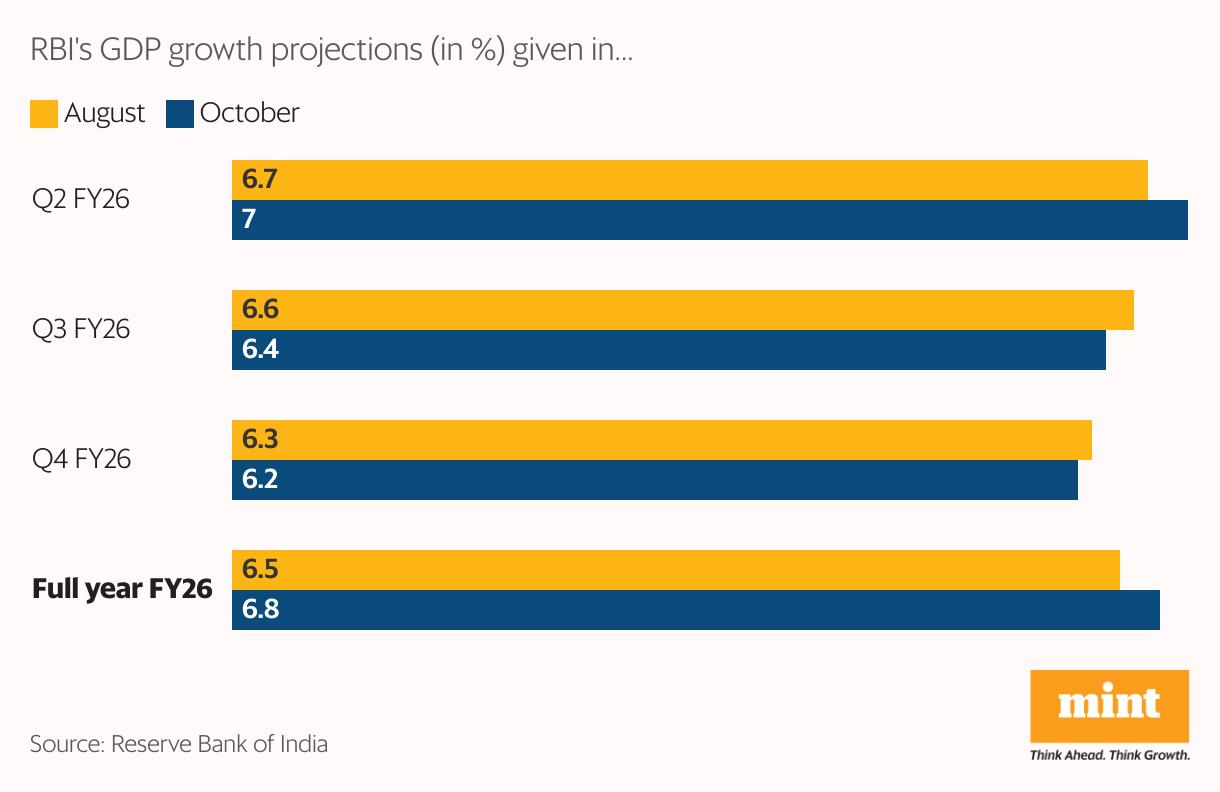

Cautious optimismThe RBI has warned that US tariff hikes could disrupt supply chains and hinder disinflation, while volatile markets and adverse weather pose additional risks to India's economic outlook. Even as it raised the 2025-26 growth projection by 30 basis points (bps) to 6.8%, driven by higher-than-anticipated 7.8% growth in Q1 and a 7% growth expectation in Q2, it expected a weaker performance in the second half of the year. The RBI cut the Q3 growth forecast by 20bps to 6.4% and the Q3 projection by 10bps to 6.2%.

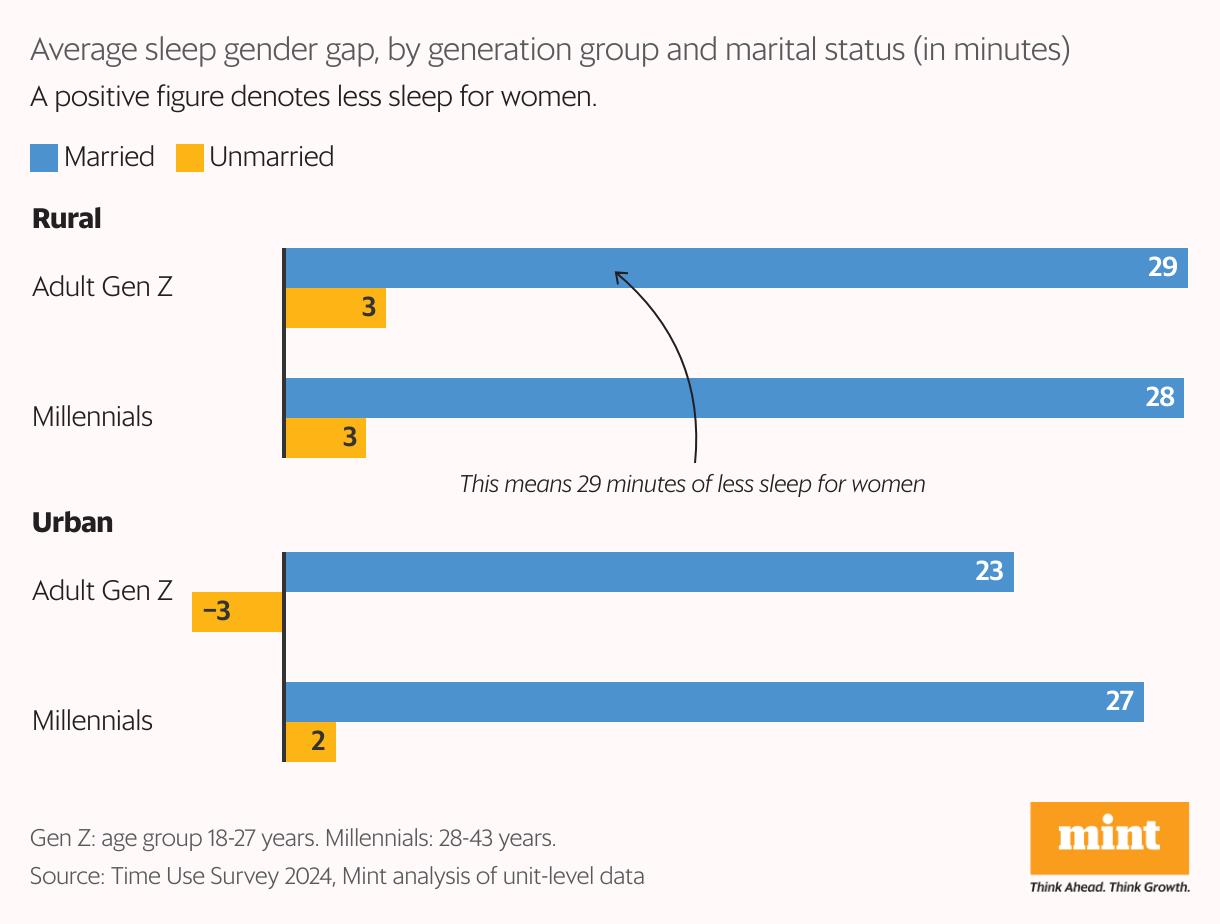

Bedtime bias

Marriage is a primary factor driving the nighttime sleep gap between genders, regardless of the generation to which they belong, according to a Mint analysis of the 2024 Time Use Survey. Among singles, across all generations, women roughly get as much essential sleep as men. However, among married women, sleep deficiency rises significantly. They end up with 23-29 minutes less sleep compared to the men in the same cohort. Rural Gen Z married women face the largest disparity, with 29 minutes less sleep. Urban Gen Z married women fare slightly better with a 23-minute gap.

Also Read | The sleep divide: How gender, age, and work shape India's bedtim

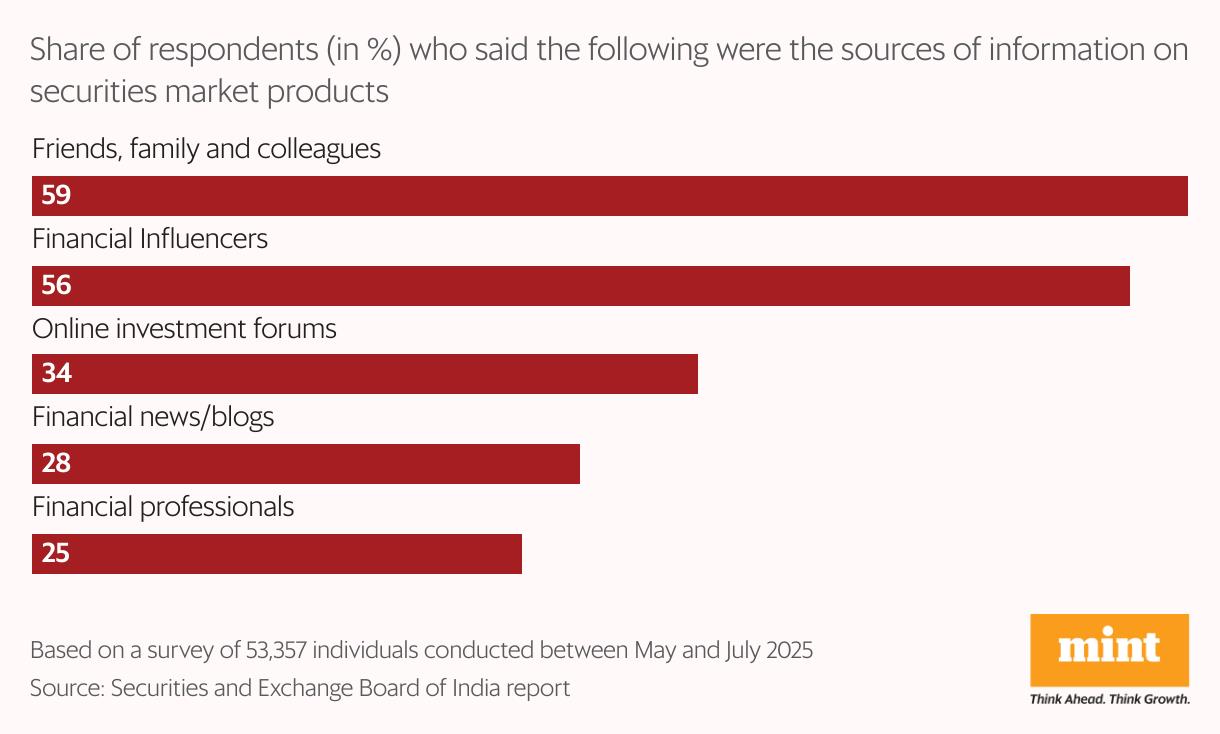

Finfluencers rule

The Sebi Investor Survey 2025 revealed that 62% of retail investors base some or most of their investment decisions on recommendations from finfluencers. In fact, financial influencers on social media (56%) are the second most common source, surpassing formal mediums such as financial news and professionals (28%). They were only behind family and friends (59%). This highlights a limited trust in formal financial channels. The report also pointed out that Indians remained risk-averse, with 80% of households prioritizing capital preservation over returns.

Numbers talk

₹1 trillion: The amount of investment commitments the government has made with 26 domestic and international companies in the food processing sector. The investment is projected to generate direct employment for over 64,000 people and create indirect opportunities for more than 1 million individuals in the country.

Also Read | Funding is available, yet private capex is tepid: Why businesses are cautiou

₹4.32 trillion: The amount of capital expenditure the Centre undertook during April-August. While the capex is up 43% year-on-year, it is running below its strike rate, having achieved 38.5% of the budgeted aim in the first five months of 2025-26 as opposed to the 41.7% needed.

$1-1.2 billion: The valuation of a deal that Adar Poonawalla , owner of the vaccine maker Serum Institute, is evaluating to buy the Indian Premier League team Royal Challengers Bengaluru, Mint reported. In October 2024, Poonawalla's Serene Productions acquired a 50% stake in filmmaker Karan Johar's Dharma Productions.

89: The number of pharmacy colleges the Pharmacy Council of India (PCI) has barred in Maharashtra from admitting first-year students for the 2025-26 academic session, after inspections revealed lapses, including insufficient teaching staff, as well as poor infrastructure and safety measures.

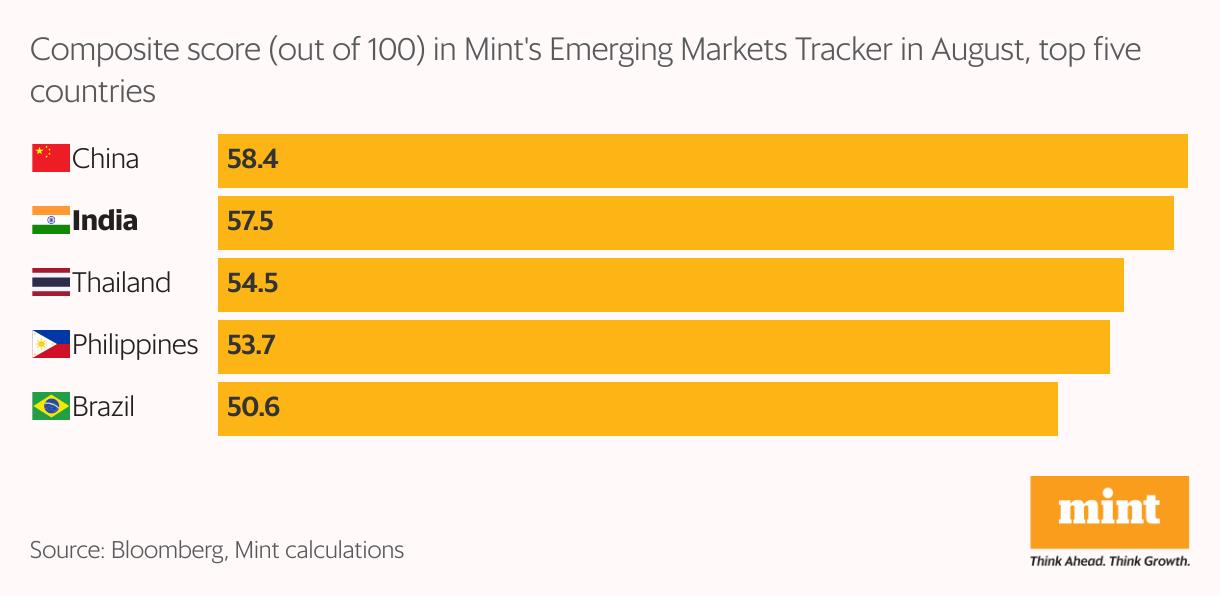

China overtakesAfter securing the top rank among its emerging market peers for four straight months, India slipped to second place, behind China, in August, according to Mint's latest EM tracker. During the month, a weak stock market and currency performance overshadowed strong GDP growth and manufacturing activity. With this, India posted a composite score of 57.5, narrowly trailing China's 58.4. Nevertheless, robust April-June GDP growth, a strong manufacturing purchasing managers' index (PMI), and solid export performance kept India ahead of other EM peers. China, despite facing deflation, a sign of weakness in the economy, achieved the top rank due to decent performance on other indicators.

Also Read | How slowing nominal GDP growth may hurt Centre's Budget mat

Riches reset

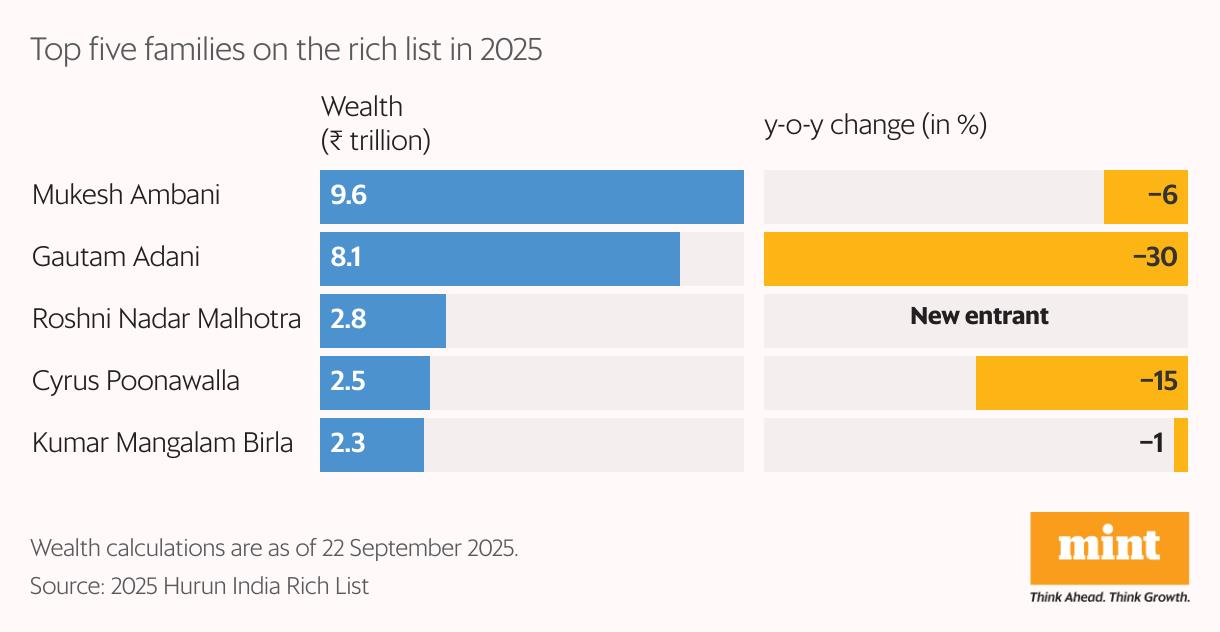

Reliance Industries chairman Mukesh Ambani reclaimed the title of India's richest person from Gautam Adani in 2025, according to Hurun India's latest annual list. Ambani regained the top spot despite a 6% on-year decline in wealth, as Adani's net worth fell more sharply, by 30%.

Roshni Nadar Malhotra of HCL Technologies made her debut in the top five with a net worth of ₹2.8 trillion, becoming both India's richest woman and the youngest billionaire on the list. Cyrus Poonawalla, with ₹2.5 trillion in wealth, and Kumar Mangalam Birla, with ₹2.3 trillion, secured the fourth and fifth spots.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Financewire And Tipranks Partner To Redefine Financial News Distribution

- Ethereum-Based Defi Crypto Mutuum Finance (MUTM) Reaches 50% Completion In Phase 6

- Stonehaven Circle Marks 13Th Anniversary With Hadrian Colwyn Leading Calvio Ailegacyx Innovation

- Citadel Launches Suiball, The First Sui-Native Hardware Wallet

- Motif AI Enters Phase Two Of Its Growth Cycle

- Dubai At The Centre Of Global Finance: Forex Expo 2025 Redefines The Trading Landscape

Comments

No comment