Cashin' Or Caution? Decoding India's Festive-Season Spending Habits

The second half of the year, a whirlwind of celebrations from Ganesh Chaturthi to Diwali, is here, bringing with it the smell of festive sweets and the sight of decorated homes. But this season is more than just a time for family and feasting – it's a make-or-break period for many businesses.

As the economy grapples with a prolonged demand slowdown, many consumer-centric companies are feeling the pinch and pinning their hopes on a busy festive season. The government has done its part by implementing income tax and GST cuts, putting more money in people's pockets. Will Indians splurge this extra cash over the next couple of months or will caution win out?

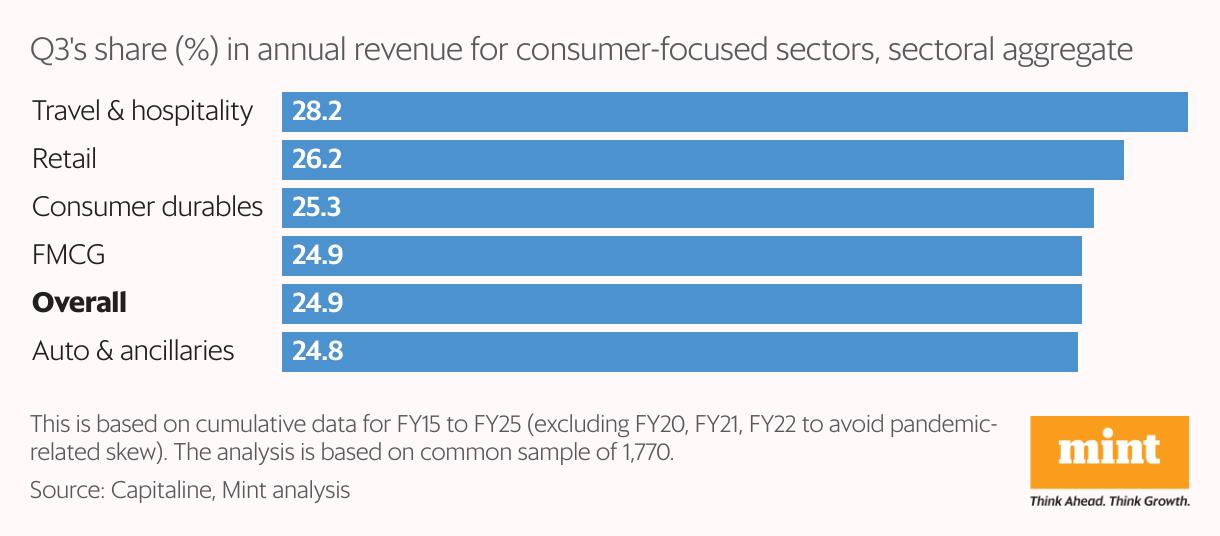

Also Read | IT's profit at 5-year low. Will a wave of visa fees drown the sector 'Tis the seasonFor many Indian businesses, the October-December quarter accounts for a significant portion of their annual revenue. Those in the travel and hospitality segment earn close to 30% of their annual revenue during this period, while automobile and consumer durables companies typically earn 25%.

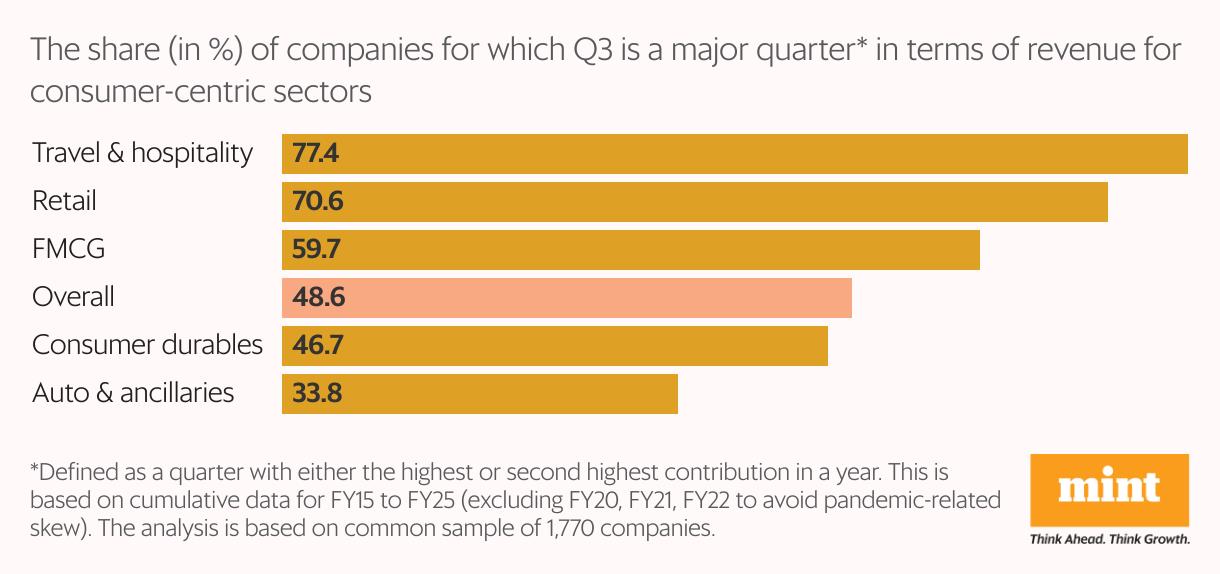

For almost half of the firms we analysed, the December quarter accounts for the largest or second-largest share of annual revenue. This trend is particularly pronounced in consumer-focused segments: over 66% of companies in retail, travel, and hospitality achieve their largest or second-largest annual contribution during this period. For FMCG and consumer durables companies, this number is around 45%.

“Festive seasons in India typically spark a demand boost, and this year the timing appears favourable. The government's GST cuts and income tax relief should leave consumers with more disposable income, which could translate into higher spending on essentials, discretionary items, and big-ticket purchases. Retailers, auto makers and consumer goods companies are already gearing up with festive offers to capture this demand," said Sujan Hajra, chief economist & executive director, Anand Rathi Group.

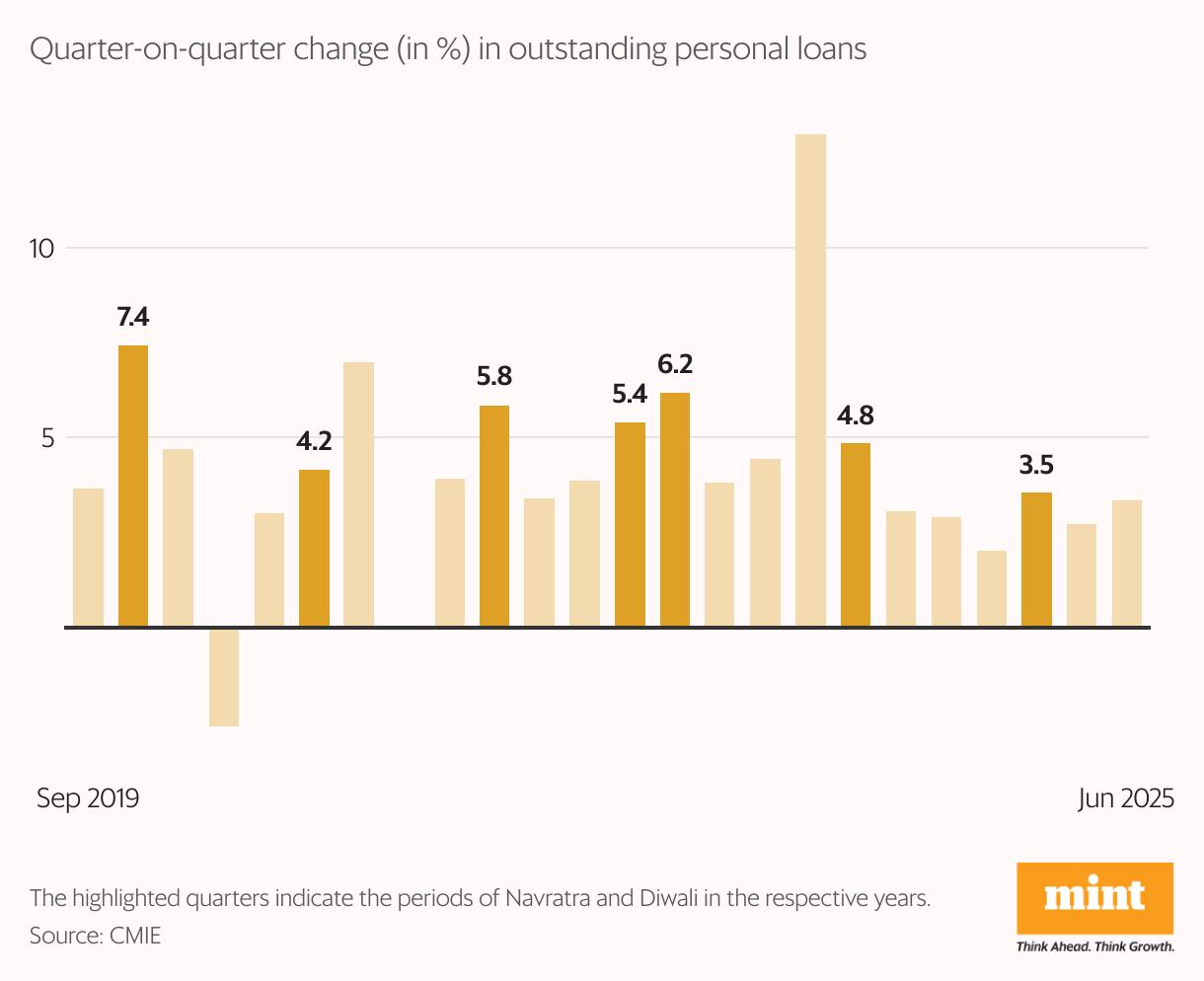

Also Read | Four charts on what Trump's 100% drug tariffs mean for Indi Banking on a splurgeIncreased festive-season spending is often accompanied by higher demand for bank loans, especially for houses, vehicles, and consumer durables, which tend to see a sales spike during the quarter. With subdued consumption already slowing bank credit, the industry is pinning its hopes on a festive-season splurge to revive the stagnant loan market.

What UPI data shows

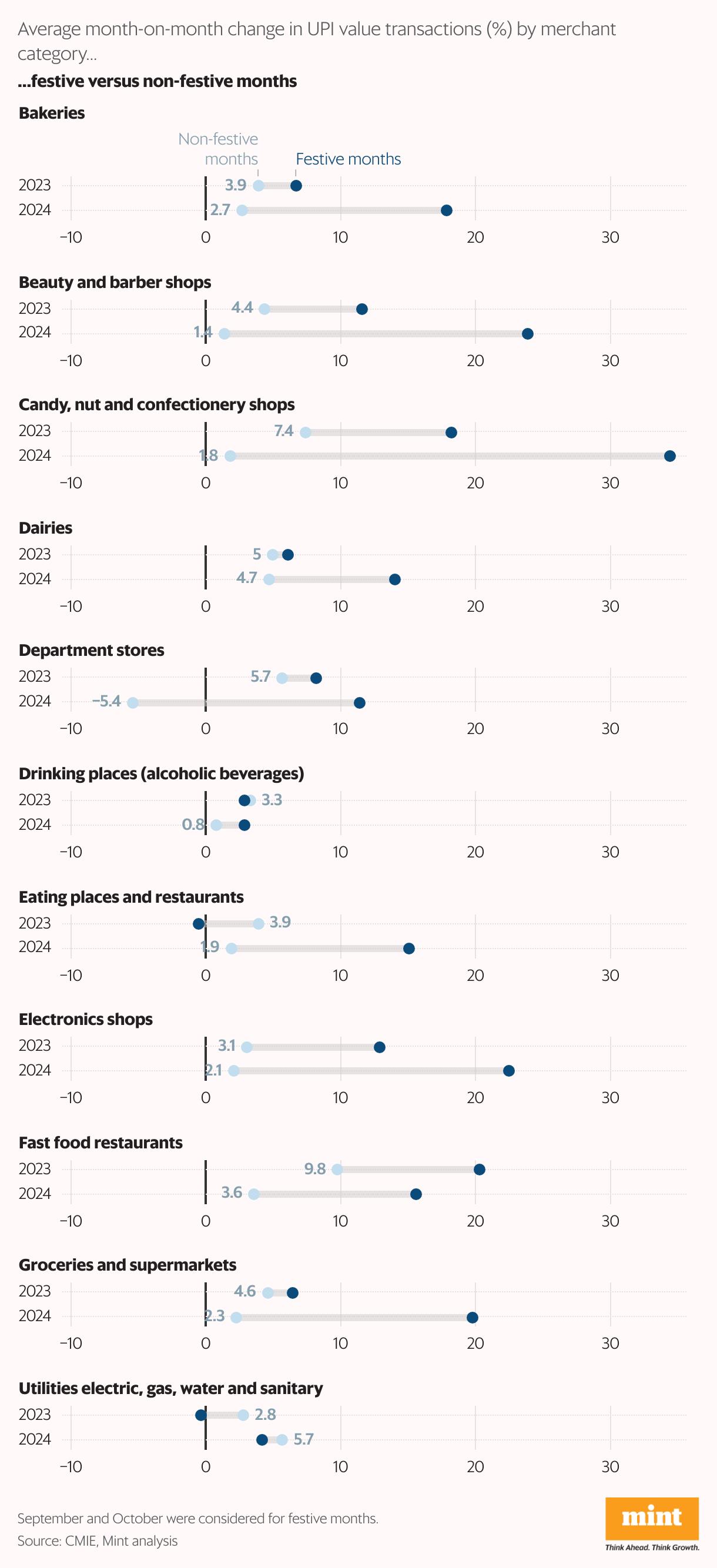

Beyond big-ticket purchases of electronics and appliances, a closer look at UPI data by merchant category tells a more personal story. Historical month-on-month trends reveal that Indians don't just buy electronics and consumer durables during the festive season, they also spend big at beauty parlours and hairdressers, stock up on groceries for festive feasts and, of course, indulge their sweet tooth.

The festive rally

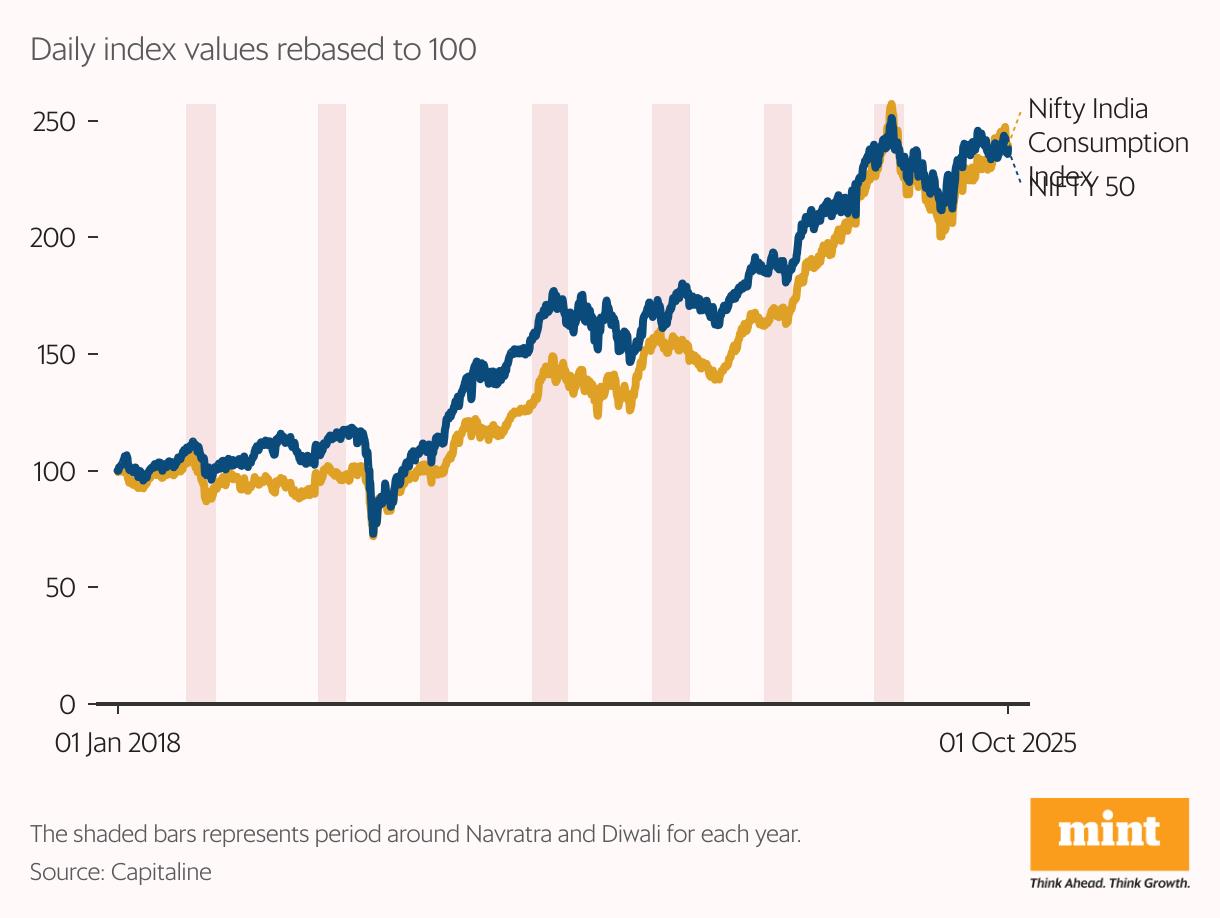

This trend of festive spending is eventually reflected in investor sentiment. The Nifty Consumption Index, which tracks the performance of companies in the consumption sector, typically sees a surge in investor interest during these periods. Festive-season shopping often lifts market sentiment, mirroring the performance of the benchmark Nifty 50, which also tends to do well as the Indians celebrate and spend.

“Historically and in a comparative context, the second half of the year tends to be more favourable for the Indian economy," said Manoranjan Sharma, chief economist, Infomerics Valuation and Rating.

While there is a surge in demand across many consumer-centric sectors, challenges remain.“Persistent inflation, global issues such as fluctuating oil prices, supply chain disruptions and geopolitical tensions, along with concerns around rural demand, continue to pose risks. Structural challenges also linger, including the need for sustained job creation in high-paying sectors and increased investments in critical infrastructure like highways and metro systems," he said.

Also Read | What India's festive sales reveal about the state of e-commerc Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Financewire And Tipranks Partner To Redefine Financial News Distribution

- Ethereum-Based Defi Crypto Mutuum Finance (MUTM) Reaches 50% Completion In Phase 6

- Stonehaven Circle Marks 13Th Anniversary With Hadrian Colwyn Leading Calvio Ailegacyx Innovation

- Citadel Launches Suiball, The First Sui-Native Hardware Wallet

- Motif AI Enters Phase Two Of Its Growth Cycle

- Dubai At The Centre Of Global Finance: Forex Expo 2025 Redefines The Trading Landscape

Comments

No comment