Bitcoin Surges To $118K Post-U.S. Shutdown: Key Insights & Next Steps

- Risk aversion rises: Yields on US 10-year Treasurys drop as investors seek safety amid government shutdown uncertainty. Crypto inflows surge: Spot Bitcoin ETFs see $430 million in inflows, signaling increasing institutional interest and growing independence from equities. Traditional assets strengthen: Gold prices hit record levels, reflecting a rally in classic safe-haven investments. Historical context: Previous shutdowns have impacted Bitcoin and stock markets differently, raising questions about future market reactions.

Bitcoin (BTC ) surged to a two-week high on Wednesday, buoyed by the escalation of the U.S. federal government shutdown. Unlike traditional stocks, which showed minimal immediate reaction, cryptocurrency markets displayed resilience, with inflows into spot Bitcoin exchange-traded funds (ETFs) reaching $430 million. This suggests growing investor confidence in Bitcoin's role as a hedge during times of geopolitical and economic uncertainty.

Meanwhile, traders flocked to traditional safe-haven assets, pushing US 10-year Treasury yields lower, indicating a preference for lower-risk assets amid deteriorating fiscal negotiations. Gold prices soared to a record $3,895 per ounce, underscoring strong demand for traditional wealth preservation during economic turbulence. The apparent flight to safety underscores a classic risk-off environment, impacting both traditional markets and crypto assets differently.

Bitcoin's Past Response to Government ShutdownsIn December 2018, during the last major government shutdown, Bitcoin experienced a 9% decline. However, the decline was relatively modest compared to the broader stock market correction, which began 10 days prior and eventually corrected by approximately 12%. Despite Bitcoin's temporary dip, investors who held through the period saw net gains, illustrating its emerging role as an alternative asset class.

During that period, Bitcoin's price fell from about $3,900 to $3,550 amid rising regulatory concerns-specifically, the implementation of stricter anti-money laundering measures by the Financial Action Task Force (FATF). These regulatory developments increased uncertainty and contributed to the volatile crypto market, which has since matured significantly, attracting institutional investors and further distancing itself from purely speculative trading.

S&P 500 futures (left) vs. Bitcoin/USD in 2018-19. Source: TradingView / CointelegraphThe current environment suggests Bitcoin could continue to benefit over the next month as government uncertainty persists, even as traditional markets face pressure from macroeconomic indicators such as job data revisions and political stalemates. The inflow of institutional capital into Bitcoin ETFs and a decoupling from equities point to a potential long-term shift as digital assets carve out a more independent role in the global financial ecosystem.

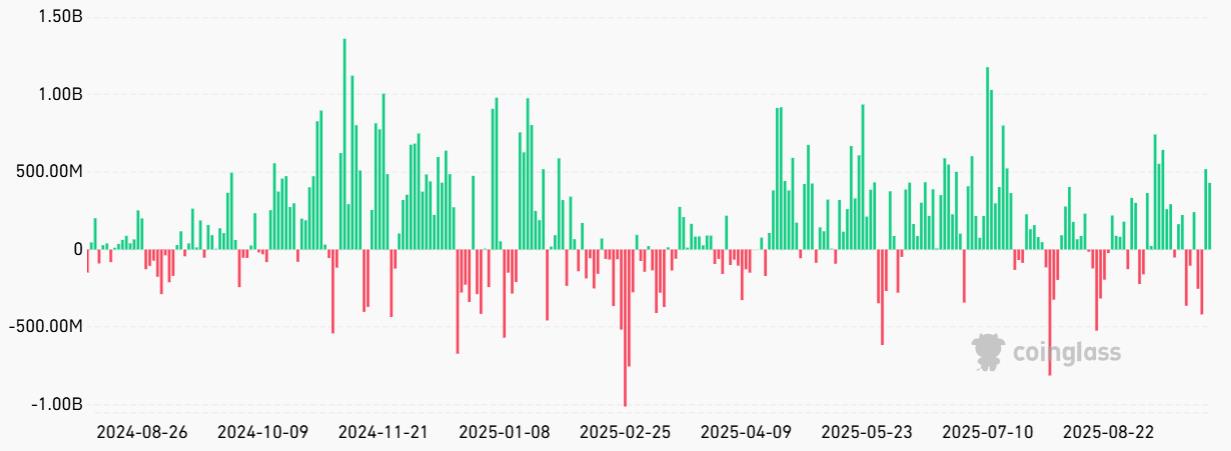

Spot Bitcoin ETF daily net flows, USD. Source: CoinGlass

With nearly $147 billion managed in Bitcoin ETFs-measured against traditional assets like gold, which commands over $460 billion in ETF assets-the cryptocurrency's potential as a hedge asset is increasingly recognized. As the debate over regulatory clarity continues and investor interest grows, Bitcoin's resilience during periods of economic or political stress suggests it will remain a key asset for diversifying portfolios amid uncertainty.

This overview aims to provide a comprehensive understanding of recent market developments involving cryptocurrencies and traditional finance. It does not constitute financial advice or endorse specific investment actions. Readers should conduct their own research or consult with a financial advisor before making any investment decisions.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Financewire And Tipranks Partner To Redefine Financial News Distribution

- Ethereum-Based Defi Crypto Mutuum Finance (MUTM) Reaches 50% Completion In Phase 6

- Stonehaven Circle Marks 13Th Anniversary With Hadrian Colwyn Leading Calvio Ailegacyx Innovation

- Citadel Launches Suiball, The First Sui-Native Hardware Wallet

- Motif AI Enters Phase Two Of Its Growth Cycle

- Dubai At The Centre Of Global Finance: Forex Expo 2025 Redefines The Trading Landscape

Comments

No comment