Mexican Gold Signs Definitive Agreement To Acquire Tatatila Project In Mexico

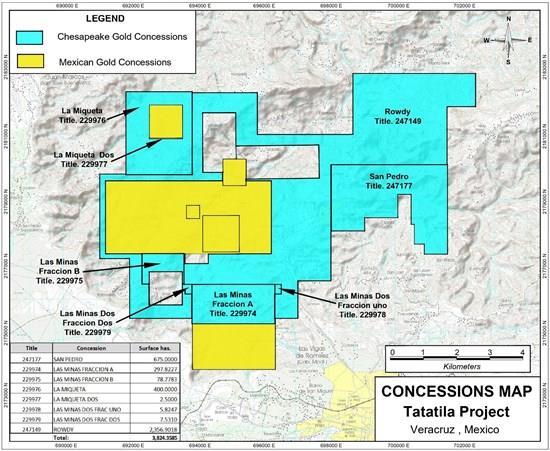

Figure 1: Tatatila Mining Concessions (shaded in blue)

To view an enhanced version of this graphic, please visit:

The Tatatila concessions surround Mexican Gold's Las Minas Project. Several skarn prospects, including possible extensions of the Las Minas existing resource, have been discovered on the Tatatila Project by Chesapeake.

In exchange for the Interest, the Company shall issue Chesapeake an aggregate of 4,451,361 common shares of the Company (the“ Consideration Shares ”), each issued at a deemed value of $0.05 for an aggregate deemed value of $222,568. Once issued, the Consideration Shares will represent 14.99% of the total issued and outstanding common shares of the Company. As further consideration for the Interest, the Company shall grant to Chesapeake Mexico a net smelter returns royalty (" Royalty ") in an amount equivalent to 1.5%. The Company shall have a buy-back option on the Royalty that provides Roca Verde with the right to purchase 0.5% of the Royalty from Chesapeake Mexico for US$500,000 during the 10 years following the date of execution of the Assignment Agreement, which would reduce the Royalty to 1%.

All Consideration Shares will be subject to a statutory hold period of four months from the date of issuance in accordance with applicable Canadian securities legislation. In addition, the Consideration Shares will be subject to further lock up restrictions (the " Lock Up ") such that on the one (1) year anniversary of the date of issuance and every six (6) months thereafter, 25% of the Consideration Shares shall be released from the Lock Up such that all Consideration Shares shall be released from Lock Up two and a half (2.5) years from the date of issuance.

Completion of the transaction is subject to acceptance by the TSX Venture Exchange, as well as customary closing conditions for a transaction of this kind.

About Mexican Gold Mining Corp.

Mexican Gold is a Canadian-based mineral exploration and development company committed to building long-term value through ongoing discoveries and strategic acquisitions of prospective precious metals and copper projects in the Americas. Mexican Gold is exploring and advancing the Las Minas Project, which is located in the core of the Las Minas mining district in Veracruz State, Mexico, and host to one of the newest, under-explored skarn systems known in Mexico.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment