Polish Inflation Holds Steady Amid Food Price Relief

Poland's CPI inflation remained steady at 2.9% year-on-year in September. This was the same level as in August, although we had expected an increase to 3.0% YoY due to base effects on gasoline prices.

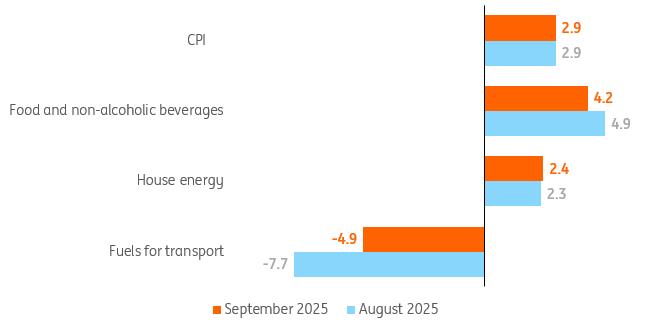

In September 2024, fuel prices fell substantially in monthly terms. Data released today confirmed that this month's decline in fuel prices moderated to 4.9% YoY from -7.7% YoY in August, but its upward impact on CPI inflation was negated by developments in food prices. Prices of food and non-alcoholic beverages declined by 0.5% month-on-month (we expected an increase of 0.2% MoM), and the annual inflation in food prices eased to 4.2% YoY from 4.9% YoY in August. That prevented a rise in headline inflation in September from the previous month. We estimate that core inflation (the measure excluding food and energy prices) continued its downward trend, dropping to 3.1% YoY from 3.2% YoY in August.

Food price inflation moderated in SeptemberCPI and its main components, %YoY (flash estimate)

Source: GUS.

The fact that inflation remained stable in September could provide yet another argument for the Polish Monetary Policy Council (MPC) to ease monetary policy, especially when taking into account that price growth is expected to continue slowing in the coming months; we see CPI inflation at 2.6% YoY at the end of 2025.

However, the Council maintains a cautious approach and may postpone another rate cut until November, when the new National Bank of Poland macroeconomic staff projection confirms a sustainable decline in inflation to the target over the medium term. A 25bp rate cut at the policy sitting next week cannot be completely ruled out, though, especially given that a bill prolonging the freeze in energy prices until the end of this year has recently been signed. In turn, electricity prices won't increase in the final months of this year, which had previously been the central bank's baseline scenario.

Given the current level of real interest rates, monetary policy remains restrictive, as acknowledged by NBP Governor Adam Glapiński at the press conference following September's policy meeting. That is why we still see room for further rate cuts ahead. Apart from one more 25bp cut this year, we foresee two more 25bp rate cuts in 2026, leaving the main policy rate at the end of next year at 4.00%.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment