Standard Uranium Executes Definitive Agreement To Option Rocas Uranium Project And Initiates Inaugural Exploration Program

| | Consideration Payments | Consideration Shares | Exploration Expenditures |

| Year 1 | $75,000 | (1)(3)$100,000 | $1,500,000 |

| Year 2 | $50,000 | (2)(3)$275,000 | $1,500,000 |

| Year 3 | $125,000 | (2)(4)$325,000 | $1,500,000 |

| Total | $250,000 | $700,000 | $4,500,000 |

Notes:

(1) Issuable at a deemed price equivalent to the last closing price of the common shares of the Optionee on the Canadian Securities Exchange immediately prior to entering into the Option Agreement.

(2) Issuable at a deemed price equivalent to the volume-weighted average closing price of the common shares of the Optionee on the Canadian Securities Exchange in the thirty (30) trading days immediately prior to issuance.

(3) Subject to an eighteen (18) month escrow, with three (3) equal releases on the six (6), twelve (12) and eighteen (18) month anniversaries of issuance.

(4) Subject to a twelve (12) month escrow, with two (2) equal releases on the six (6) and twelve (12) month anniversaries of issuance.

Prior to exercise of the Option, the Company will act as the operator of the Project and will be entitled to charge a 10% fee on expenditures in Year 1, increasing to 12% in Year 2 and Year 3.

Following successful completion of the obligations of the Option (i.e., at the end of Year 3), Optionee will acquire a 75% equity in the Property, with Standard retaining 25% as well as a 2.5% net smelter returns royalty on the Project, of which 1.0% may be purchased back at any time for a one-time cash payment of $1,000,000.

The parties intend on forming an unincorporated joint venture for the further development of the Project. No finders' fee is payable by the Company in connection with the Option.

Qualified Person Statement

The scientific and technical information contained in this news release has been reviewed, verified, and approved by Sean Hillacre, P.Geo., President and VP Exploration of the Company and a "qualified person" as defined in NI 43-101.

Historical data disclosed in this news release relating to sampling results from previous operators are historical in nature. Neither the Company nor a qualified person has yet verified this data and therefore investors should not place undue reliance on such data. The Company's future exploration work may include verification of the data. The Company considers historical results to be relevant as an exploration guide and to assess the mineralization as well as economic potential of exploration projects.

References

1 Mineral Assessment Report 74B09-0007: Uranex Ltd., 1977 & SMDI# 2465:

2 Mineral Assessment Report 74B09-0032: Forum Uranium Corp., 2007

*The Company considers uranium mineralization with concentrations greater than 1.0 wt% U3O8 to be "high-grade".

**The Company considers radioactivity readings greater than 300 counts per second (cps) to be "anomalous".

About Standard Uranium (TSXV: STND)

We find the fuel to power a clean energy future

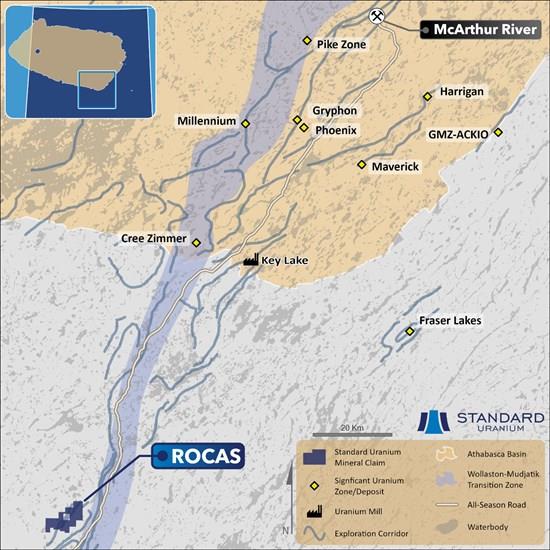

Standard Uranium is a uranium exploration company and emerging project generator poised for discovery in the world's richest uranium district. The Company holds interest in over 235,435 acres (95,277 hectares) in the world-class Athabasca Basin in Saskatchewan, Canada. Since its establishment, Standard Uranium has focused on the identification, acquisition, and exploration of Athabasca-style uranium targets with a view to discovery and future development.

Standard Uranium's Davidson River Project, in the southwest part of the Athabasca Basin, Saskatchewan, comprises ten mineral claims over 30,737 hectares. Davidson River is highly prospective for basement-hosted uranium deposits due to its location along trend from recent high-grade uranium discoveries. However, owing to the large project size with multiple targets, it remains broadly under-tested by drilling. Recent intersections of wide, structurally deformed and strongly altered shear zones provide significant confidence in the exploration model and future success is expected.

Standard Uranium's eastern Athabasca projects comprise over 43,185 hectares of prospective land holdings. The eastern basin projects are highly prospective for unconformity related and/or basement hosted uranium deposits based on historical uranium occurrences, recently identified geophysical anomalies, and location along trend from several high-grade uranium discoveries.

Standard Uranium's Sun Dog project, in the northwest part of the Athabasca Basin, Saskatchewan, is comprised of nine mineral claims over 19,603 hectares. The Sun Dog project is highly prospective for basement and unconformity hosted uranium deposits yet remains largely untested by sufficient drilling despite its location proximal to uranium discoveries in the area.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment