China's Economy Continues To Slow, Strengthening Case For Fresh Stimulus

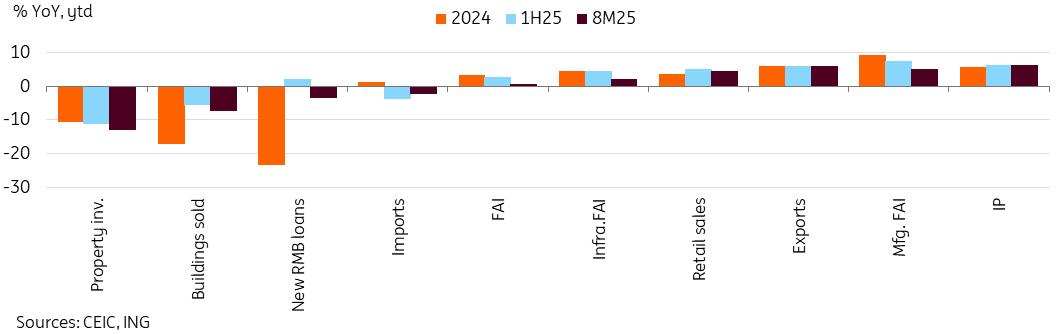

China's economy continued to slide in August, with all key activity readings falling short of market forecasts once more. Retail sales growth of 3.4% year on year marks the lowest level since November 2024. Industrial production growth of 5.2%, meanwhile, marked a 12-month low. Fixed-asset-investment growth of just 0.5% YoY, year-to-date, is the lowest level since 2020, dragged down by real estate investment and soft private sector investment. This deceleration can no longer be simply explained away as a temporary weather-related blip. Growth has been slowing for several months now, with data generally falling short of market forecasts each month.

A similar story unfolded around the same time last year, when a slowdown in July and August data further dampened sentiment. That was before the People's Bank of China unveiled an easing package in September. A more marked shift toward stimulus overall helped generate a strong bounce back in the fourth quarter of 2024, enabling Chinese growth to end the year at 5%. However, unlike last year, asset markets have been faring better. And while investment looks significantly softer, retail sales and industrial production have both fared better year-to-date.

China's economic activity has slowed across the board so far in 3Q25

Weak confidence remains the biggest drag on domestic economy

Sentiment remains soft despite a slew of measures over the past year. One major concern is the continued slump in the property market. August's 70-city sample of property prices showed a continued decline, with new home prices down -0.3% month-on-month, and used home prices down -0.58% MoM, both declining at around the same pace as July. While 13 cities saw rising new home prices, only one saw rising used home prices. This suggests pressure on homeowners continues.

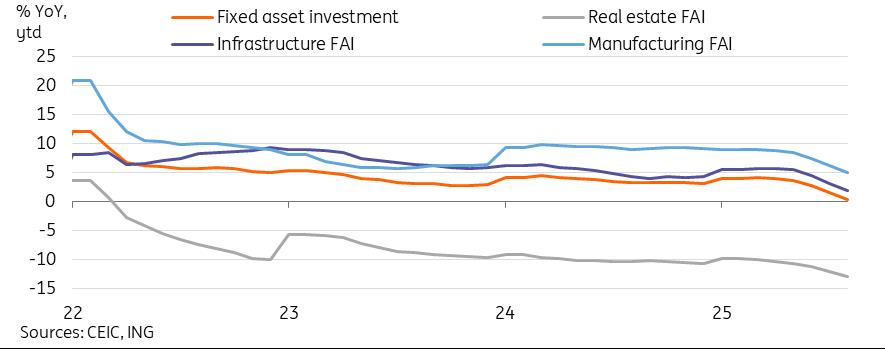

This property market slump is also reflected in soft FAI data, as property investment dropped to -12.9% YoY ytd, the lowest level since the breakout of the pandemic in 2020. But excluding real estate, the National Bureau of Statistics noted, FAI was a comparatively robust 4.2% YoY ytd. The overall wait-and-see sentiment from corporates amid elevated uncertainty and soft sentiment was illustrated by private FAI falling to -2.3% YoY ytd, the lowest level since 2020.

The property market decline is a key driver behind soft consumer sentiment, which continues to dampen retail sales. As we warned in previous months, signs were that we were near the peak of the stimulus effect from the trade-in policy. As it faded, the risk was that consumption would soften further. This appears to be unfolding, as previous outperformers like household appliances (14.2%) and communication appliances (7.3%) both softened. A consumer loan subsidy programme, which is set to subsidise 1% of interest costs for loans of up to RMB 50k, started in September. This could offer some support for retail sales moving forward, though we expect the impact may be modest.

Property market slowdown continues to drag investment and overall confidence

External demand resilience continued to support manufacturing

In data released earlier this month, trade beat forecasts in August, managing a 4.4% YoY gain despite the continued contraction of exports to the US.

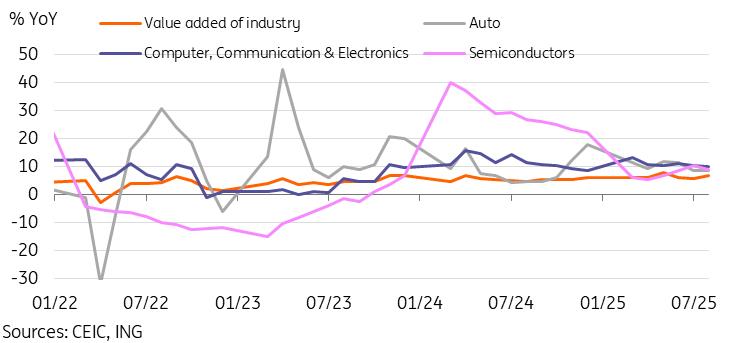

Resilient external demand led to industrial production remaining solid as well. Although the value added of industry growth of 5.2% YoY fell short of forecasts, it's still a relative outperformer. Key bright spots include continued strong growth in hi-tech manufacturing (9.3%), rail, ships, and aeroplanes (12.0%), autos (8.4%), and computers (9.9%). Many of China's faster-growing categories have a limited reliance on the US market. As such, they are likely to continue to outperform.

Industrial production has held up relatively well

Data strengthens case for more stimulus to close out year

It's possible that a strong first half encouraged policymakers to shift attention toward longer-term concerns, such as the anti-involution drive to reduce excessive price competition and planning for the 15th Five-Year Plan. Yet given the slowdown of the past few months, we expect that there's a strong case for additional short-term stimulus efforts. While it's too early to gauge the impact of the consumer loan subsidies coming into effect this month, it's likely that more policy support is needed as activity slows across the board. We continue to see a high possibility for another 10bp rate cut and 50bp reserve-requirement-ratio cut in the coming weeks.

A strong start to 2025 still keeps this year's growth targets within reach. But, similar to where we were at this time last year, further stimulus support could be needed to ensure a strong finish to the year.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- What Does The Europe Cryptocurrency Market Report Reveal For 2025?

- United States Kosher Food Market Long-Term Growth & Forecast Outlook 20252033

- Utila Triples Valuation In Six Months As Stablecoin Infrastructure Demand Triggers $22M Extension Round

- Meme Coin Little Pepe Raises Above $24M In Presale With Over 39,000 Holders

- FBS Analysis Highlights How Political Shifts Are Redefining The Next Altcoin Rally

- 1Inch Becomes First Swap Provider Relaunched On OKX Wallet

Comments

No comment