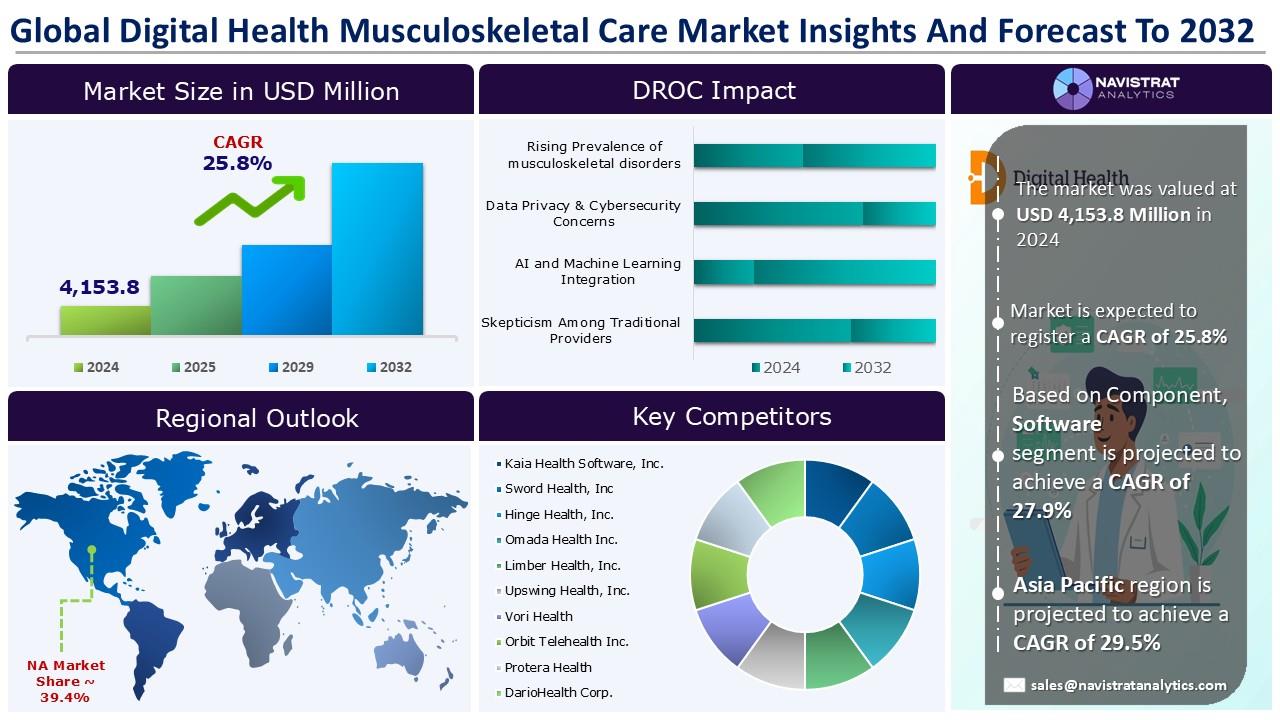

Digital Health Musculoskeletal Care Market Size to Reach USD 26,165.0 million in 2032

(MENAFN- Navistrat Analytics) September 12, 2025- The increasing prevalence of musculoskeletal disorders is a major factor driving revenue growth in the digital health musculoskeletal care market. According to the World Health Organization (WHO), approximately 1.71 billion people globally suffer from musculoskeletal conditions, with prevalence differing by age group and specific diagnosis. In industrialized countries, around 441 million individuals are affected, while the WHO Western Pacific region accounts for 427 million cases, and the South-East Asian region has about 369 million cases. Nearly 40% of people over the age of 60 experience musculoskeletal issues, and 80% report having low back pain.

In May 2024, Hinge Health introduced Hinge Health Global, a comprehensive solution designed to tackle the global workforce’s chronic pain burden. This platform enables multinational companies to deliver personalized digital musculoskeletal (MSK) care across the globe. Hinge Health Global offers tailored, consistent digital MSK treatments, including individualized care plans, full-body treatment programs, TrueMotion workout feedback, and instant access to care, all through a single platform.

However, data privacy and cybersecurity concerns represent a significant challenge to market growth. Encouraging consistent patient use of wearable devices remains difficult, as factors like device comfort, usability, and patient education are critical to improving adherence. Many patients face difficulties in regularly using these devices or correctly interpreting the data, which may reduce the effectiveness of continuous monitoring solutions.

Segments market overview and growth Insights

Based on the component, the digital health musculoskeletal care market is segmented into software & services and hardware. Software & services segment contributed the highest growth rate during the forecasted period. Advancements in commercial AI and deep learning are transforming every phase of the musculoskeletal (MSK) patient journey. These technologies enhance pre-visit triage and patient intake processes, accelerate clinical workflows during appointments, and improve diagnostic imaging and surgical planning. Additionally, advanced predictive models support clinical decision-making, while digital therapeutics are emerging to boost rehabilitation outcomes.

Regional market overview and growth insights

North America held the largest market share in the Digital Health Musculoskeletal Care market in 2024. The market is being driven by rising demand rising prevalence of musculoskeletal disorders and expansion of telehealth & virtual physical therapy. The National Safety Council (NSC) reports that in 2023, exercise equipment was responsible for the highest number of sports and recreation-related injuries, with approximately 482,886 cases. Moreover, the CDC indicates that over 2.5 million adolescents and teenagers visit emergency rooms annually for sports-related injuries.

Competitive Landscape and Key Competitors

The Digital Health Musculoskeletal Care market is characterized by a fragmented structure, with many competitors holding a significant share of the market. list of major players included in the Digital Health Musculoskeletal Care market report are:

o Kaia Health Software, Inc.

o Sword Health, Inc

o Hinge Health, Inc.

o Omada Health Inc.

o Limber Health, Inc.

o Upswing Health, Inc.

o Vori Health

o Orbit Telehealth Inc.

o Protera Health

o DarioHealth Corp.

o Kemtai

o MPOWERHealth

o Optum, Inc.

o LainaHealth Inc

o EviCore healthcare

Major strategic developments by leading competitors

Stance Health: In April 2025, Stance Health, a healthcare company specializing in musculoskeletal care, secured USD 1 million in pre-seed funding to advance its structured, technology-enabled MSK care model in India. The investment round was led by General Catalyst, with contributions from Antler, DEVC, EX Capital, and angel investors including Swiggy and Onsurity.

Hinge Health: In April 2025, Hinge Health announced a new collaboration with a national health plan. Clients of Cigna who opt into the program gain streamlined access to Hinge Health’s digital platform, offering comprehensive, on-demand MSK care anytime and from any location.

Navistrat Analytics has segmented the Digital Health Musculoskeletal Care market based on component, solution, delivery mode, indication, end-use, and region:

• Component Outlook (Revenue, USD Million; 2022-2032)

o Software & Services

o Hardware

• Solution Outlook (Revenue, USD Million; 2022-2032)

o Virtual Consultations

o Remote Monitoring

o Pain Management & Therapy Programs

o Condition-specific Digital Therapeutics

o Others

• Delivery Mode Outlook (Revenue, USD Million; 2022-2032)

o Web-Based Platforms

o Mobile Applications

o Hybrid Platforms

• Indication Outlook (Revenue, USD Million; 2022-2032)

o Back and Spine Disorders

o Knee & Lower Leg Pain

o Neck & Shoulder Pain

o Foot & Ankle Disorders

o Hip & Pelvic Conditions

o Arthritis and Osteoarthritis

o Post-Surgical Rehabilitation

o Sports Injuries

• End-Use Outlook (Revenue, USD Million; 2022-2032)

o Healthcare Providers

o Payers

o Corporate Wellness Programs

o Individual Patients

• Regional Outlook (Revenue, USD Million; 2022-2032)

o North America

a. U.S.

b. Canada

c. Mexico

o Europe

a. Germany

b. France

c. U.K.

d. Italy

e. Spain

f. Benelux

g. Nordic Countries

h. Rest of Europe

o Asia Pacific

a. China

b. India

c. Japan

d. South Korea

e. Oceania

f. ASEAN Countries

g. Rest of APAC

o Latin America

a. Brazil

b. Rest of LATAM

o Middle East & Africa

a. GCC Countries

b. South Africa

c. Israel

d. Turkey

e. Rest of MEA

~@Navistrat Analytics

In May 2024, Hinge Health introduced Hinge Health Global, a comprehensive solution designed to tackle the global workforce’s chronic pain burden. This platform enables multinational companies to deliver personalized digital musculoskeletal (MSK) care across the globe. Hinge Health Global offers tailored, consistent digital MSK treatments, including individualized care plans, full-body treatment programs, TrueMotion workout feedback, and instant access to care, all through a single platform.

However, data privacy and cybersecurity concerns represent a significant challenge to market growth. Encouraging consistent patient use of wearable devices remains difficult, as factors like device comfort, usability, and patient education are critical to improving adherence. Many patients face difficulties in regularly using these devices or correctly interpreting the data, which may reduce the effectiveness of continuous monitoring solutions.

Segments market overview and growth Insights

Based on the component, the digital health musculoskeletal care market is segmented into software & services and hardware. Software & services segment contributed the highest growth rate during the forecasted period. Advancements in commercial AI and deep learning are transforming every phase of the musculoskeletal (MSK) patient journey. These technologies enhance pre-visit triage and patient intake processes, accelerate clinical workflows during appointments, and improve diagnostic imaging and surgical planning. Additionally, advanced predictive models support clinical decision-making, while digital therapeutics are emerging to boost rehabilitation outcomes.

Regional market overview and growth insights

North America held the largest market share in the Digital Health Musculoskeletal Care market in 2024. The market is being driven by rising demand rising prevalence of musculoskeletal disorders and expansion of telehealth & virtual physical therapy. The National Safety Council (NSC) reports that in 2023, exercise equipment was responsible for the highest number of sports and recreation-related injuries, with approximately 482,886 cases. Moreover, the CDC indicates that over 2.5 million adolescents and teenagers visit emergency rooms annually for sports-related injuries.

Competitive Landscape and Key Competitors

The Digital Health Musculoskeletal Care market is characterized by a fragmented structure, with many competitors holding a significant share of the market. list of major players included in the Digital Health Musculoskeletal Care market report are:

o Kaia Health Software, Inc.

o Sword Health, Inc

o Hinge Health, Inc.

o Omada Health Inc.

o Limber Health, Inc.

o Upswing Health, Inc.

o Vori Health

o Orbit Telehealth Inc.

o Protera Health

o DarioHealth Corp.

o Kemtai

o MPOWERHealth

o Optum, Inc.

o LainaHealth Inc

o EviCore healthcare

Major strategic developments by leading competitors

Stance Health: In April 2025, Stance Health, a healthcare company specializing in musculoskeletal care, secured USD 1 million in pre-seed funding to advance its structured, technology-enabled MSK care model in India. The investment round was led by General Catalyst, with contributions from Antler, DEVC, EX Capital, and angel investors including Swiggy and Onsurity.

Hinge Health: In April 2025, Hinge Health announced a new collaboration with a national health plan. Clients of Cigna who opt into the program gain streamlined access to Hinge Health’s digital platform, offering comprehensive, on-demand MSK care anytime and from any location.

Navistrat Analytics has segmented the Digital Health Musculoskeletal Care market based on component, solution, delivery mode, indication, end-use, and region:

• Component Outlook (Revenue, USD Million; 2022-2032)

o Software & Services

o Hardware

• Solution Outlook (Revenue, USD Million; 2022-2032)

o Virtual Consultations

o Remote Monitoring

o Pain Management & Therapy Programs

o Condition-specific Digital Therapeutics

o Others

• Delivery Mode Outlook (Revenue, USD Million; 2022-2032)

o Web-Based Platforms

o Mobile Applications

o Hybrid Platforms

• Indication Outlook (Revenue, USD Million; 2022-2032)

o Back and Spine Disorders

o Knee & Lower Leg Pain

o Neck & Shoulder Pain

o Foot & Ankle Disorders

o Hip & Pelvic Conditions

o Arthritis and Osteoarthritis

o Post-Surgical Rehabilitation

o Sports Injuries

• End-Use Outlook (Revenue, USD Million; 2022-2032)

o Healthcare Providers

o Payers

o Corporate Wellness Programs

o Individual Patients

• Regional Outlook (Revenue, USD Million; 2022-2032)

o North America

a. U.S.

b. Canada

c. Mexico

o Europe

a. Germany

b. France

c. U.K.

d. Italy

e. Spain

f. Benelux

g. Nordic Countries

h. Rest of Europe

o Asia Pacific

a. China

b. India

c. Japan

d. South Korea

e. Oceania

f. ASEAN Countries

g. Rest of APAC

o Latin America

a. Brazil

b. Rest of LATAM

o Middle East & Africa

a. GCC Countries

b. South Africa

c. Israel

d. Turkey

e. Rest of MEA

~@Navistrat Analytics

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- What Does The Europe Cryptocurrency Market Report Reveal For 2025?

- United States Kosher Food Market Long-Term Growth & Forecast Outlook 20252033

- Utila Triples Valuation In Six Months As Stablecoin Infrastructure Demand Triggers $22M Extension Round

- Meme Coin Little Pepe Raises Above $24M In Presale With Over 39,000 Holders

- FBS Analysis Highlights How Political Shifts Are Redefining The Next Altcoin Rally

- 1Inch Becomes First Swap Provider Relaunched On OKX Wallet

Comments

No comment