Turkey's Current Account Surplus Beats Consensus In July

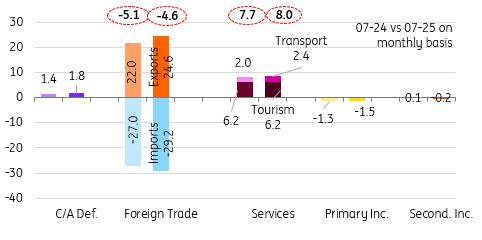

Turkey's current account posted a surplus of US$1.8bn, surpassing the market forecast of $1.5bn but not quite reaching our estimate of $2.0 bn. A closer look at the monthly figures shows that the surplus widened compared to the same month last year, primarily due to a lower trade gap, which recovered from -$5.1 bn to -$4.6 bn.

This improvement was mostly driven by the net energy balance and core trade items, despite a slight worsening in the balance of net gold trade. Additionally, the shift of secondary income into negative territory was more than offset by higher primary and services incomes.

As a result, the 12-month rolling current account deficit, which began rising in November of the previous year, dropped in July to $18.8bn, or approximately 1.4% of GDP, from $19.2bn a month ago

Breakdown of the current account (monthly, US$bn)

Source: CBT, ING

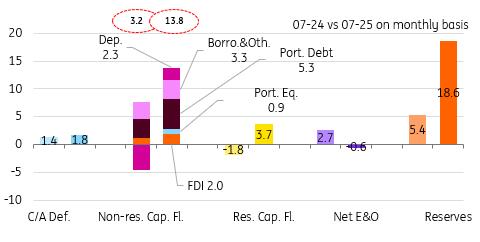

The capital account witnessed its largest-ever monthly inflows amid expectations of the central bank starting its rate-cutting cycle in July. With a modest net outflow from errors and omissions of $0.6bn, and considering the current account surplus, official reserves expanded by a record $19.6bn.

Further analysis reveals that resident activities generated an inflow of $3.7bn, mainly due to reductions in deposits held by domestic banks abroad and repayments on loans previously extended to foreign entities despite rising trade credits. Additionally, non-resident activity led to inflows totalling $13.8bn, primarily from debt-related channels.

Key components of non-resident inflows include: a) $2.0bn of purchases in the government bond market, b) a $2.4bn debt issuance by the Treasury, c) a $1.8bn gross FDI, d) a $1.5bn increase in trade credits, e) $0.9bn purchases in the equity market, f) $2.3bn deposited in local banks by foreign investors, and g) $2.1bn net borrowing, driven mainly by the corporate sector. Long-term borrowing of the banking sector, on the other hand, was matched by short-term debt repayments. Consequently, long-term debt rollover ratios reached 188% for corporations and 196% for banks, compared to 149% and 164%, respectively, on a 12-month rolling basis.

During the first seven months of 2025, resident outflows decreased sharply, falling from $22.0bn in 2024 to $12.9bn. However, foreign inflows dropped significantly as well, coming in at $30.6bn, compared to $37.7bn during the same period in 2024. As a result, the capital account recorded $17.6bn inflows, compared to $15.6bn in the previous year.

In addition, outflows via net errors and omissions remained elevated, totalling -$4.9bn vs -$3.6bn in 2024. Taken together with the widening current account deficit, which grew from -$12.9bn to -$21.2bn, official reserves were depleted by $8.6bn – a deeper decline than the $0.9bn drop recorded a year earlier.

Breakdown of financing (monthly, US$bn)

Source: CBT, ING

In summary, Turkey's current account surplus in July exceeded expectations, while the capital account once again played a crucial role due to significant inflows. Preliminary customs data from the Ministry of Trade suggests further improvement in the August current account, as the foreign trade deficit appears to have improved from last year. Looking forward, a combination of external risks – including developments in global trade and geopolitical tensions – as well as the impact of recent domestic political changes and resulting tighter financial conditions, is expected to shape the path of the current account balance in the coming months.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- What Does The Europe Cryptocurrency Market Report Reveal For 2025?

- United States Kosher Food Market Long-Term Growth & Forecast Outlook 20252033

- Utila Triples Valuation In Six Months As Stablecoin Infrastructure Demand Triggers $22M Extension Round

- Meme Coin Little Pepe Raises Above $24M In Presale With Over 39,000 Holders

- FBS Analysis Highlights How Political Shifts Are Redefining The Next Altcoin Rally

- 1Inch Becomes First Swap Provider Relaunched On OKX Wallet

Comments

No comment