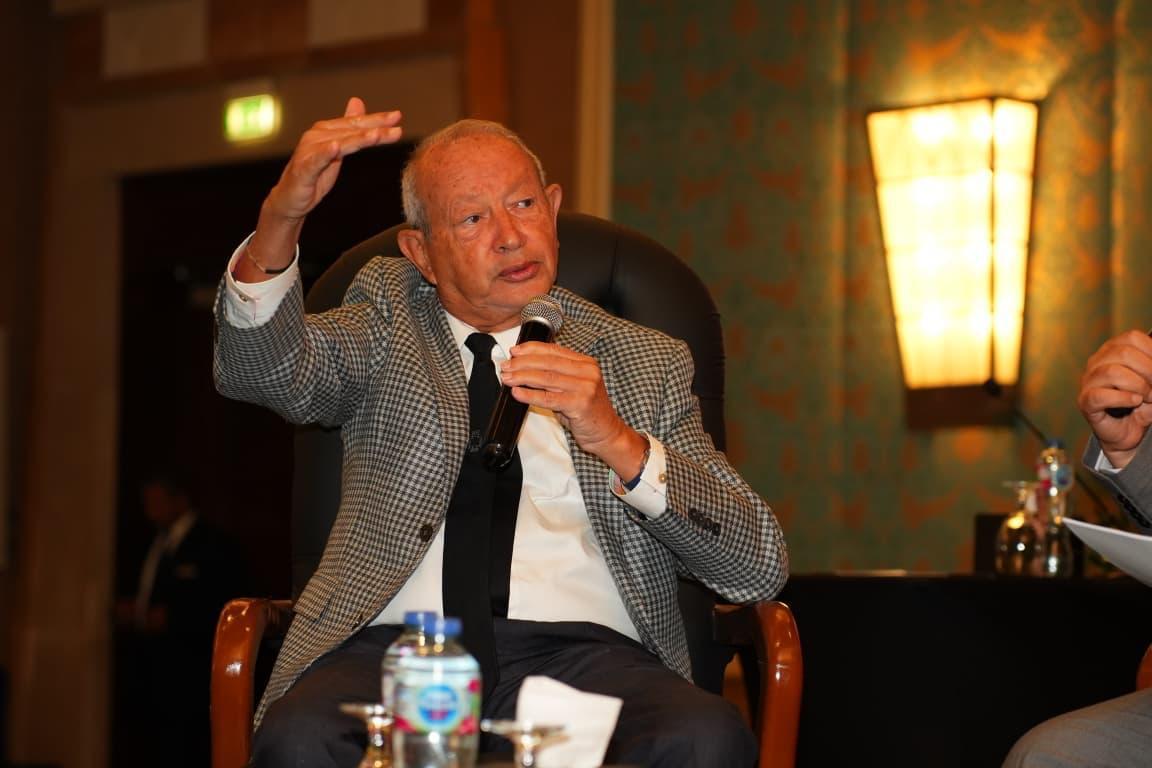

Red Sea Marassi To Drive Growth, Jobs, But Developers Struggle With USD Volatility, High Rates: Sawiris

Sawiris's remarks came during the opening of the ninth edition of the Think Commercial roundtable, held under the theme:“The Real Estate Industry Driving Investment and Exports.” The event was organised under the auspices of the Ministry of Housing, Utilities and Urban Communities and the Real Estate Development Chamber at the Federation of Egyptian Industries.

He noted that Egypt had previously succeeded in strategically planning new cities, which in turn created jobs. However, he stressed that today's unemployment problem is partly due to labour shortages across multiple economic sectors.

Turning to the New Administrative Capital, Sawiris argued that the project would have been better executed by the private sector, and suggested slowing down the launch of its second phase. He contrasted the profit-driven efficiency of private companies with the state's mass-production model, adding:“The government's delay in developing the North Coast worked in our favour, giving us the space to implement our projects and meet our financial obligations.”

Sawiris also criticised long-term repayment schemes of 12 to 15 years, describing them as damaging to the market. He explained:“Globally, there is a mortgage system tied to the client's income. But in Egypt, developers are offering long repayment periods with interest rates reaching 25%. This means that 70% of the unit's price becomes interest, making it unsustainable for developers.”

He urged a review of interest rates and rejected retroactive fees imposed on North Coast projects, stressing that companies should be judged by profitability rather than sales volumes. According to him, some firms achieve profit margins as low as 1–2%, while others operate at a loss.“Repayment periods must be shorter than what developers currently offer,” he said.

Sawiris further pointed out that despite aggressive expansion over the past decade, developers' profitability has been eroded by sharp fluctuations in the US dollar and rising interest rates.

Looking ahead, he argued that government priorities should focus on reducing public debt while continuing to support key sectors such as tourism, which is driven 90% by private investment. He also highlighted the importance of maximising remittances from Egyptians abroad, especially after the recent currency stabilisation.

Sawiris called for a stronger role for the private sector and warned against mixed economic models, remarking:“A system that is half socialist and half capitalist does not work. China and Russia moved towards capitalism, and we must stop raising slogans and embrace genuine transformation.”

Concluding his remarks, Sawiris cautioned:“I fear that continuing, halting, or cooperating with the International Monetary Fund (IMF) may no longer be a matter of choice for the Egyptian government.” He urged the state to draw on the expertise of Egypt's many specialists when deciding how to proceed with IMF negotiations.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment