Hungarian Retail Sales And Industry Suggest Weak Start To The Third Quarter

| -1.0% |

Industrial production (YoY, wda)

ING estimate: -3.5% / Previous: - 4.9% |

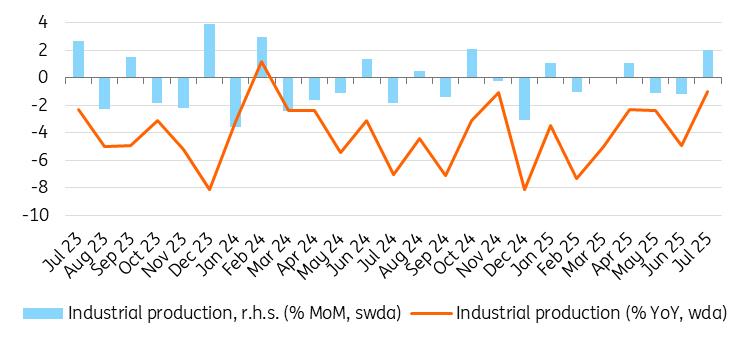

After two months of weakness, Hungary's industrial performance was a positive surprise in July. Industrial production volume increased by 2.0% compared to the previous month, translating into a 1.0% year-on-year decline.

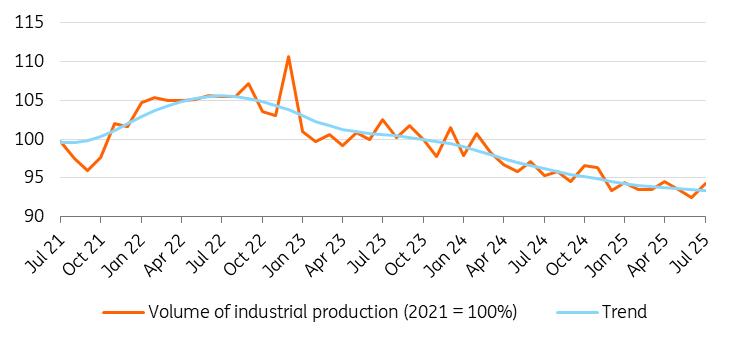

Perhaps even more telling is the development of the fixed-base index. Following the decline seen in the previous two months, production levels essentially corrected back to April levels in July. In terms of numbers, industrial output is now 5.7% below the 2021 monthly average. While longer-term trends indicate a decline in industrial performance, the current correction offers hope that industrial output may stabilise at this level until the global growth and inventory cycles turn in a favourable direction.

Volume of industrial production

Source: HCSO, ING

Although detailed data is still pending, preliminary figures from the HCSO suggest that electrical equipment manufacturing continues to be one of the sectors experiencing the biggest contraction. Meanwhile, vehicle manufacturing showed growth in July. The question remains whether this positive change in this key sector is temporary or the start of an uptrend.

Unfortunately, based on various soft indicators and order book trends, we can conclude that we are only seeing a temporary change in the automotive industry, and in general, there are no clear signs of a lasting turnaround in industrial prospects. Industrial capacity utilisation remains relatively low, and a significant proportion of the companies complain that a lack of demand is the main factor hindering growth.

What's more, the latest German industrial order data fell far short of expectations, with the volume of new orders shrinking for three consecutive months (May–July). At the same time, German industrial orders are again 15% lower than the monthly average for 2021, which means that the outlook is hardly encouraging.

Performance of Hungarian industry

Source: HCSO, ING

Overall, the outlook for local industrial companies that produce for export remains bleak, and no general improvement is anticipated. It is unclear whether the EU-US tariff agreement will meaningfully change industrial company activity. At the European level, a global turnaround in the inventory cycle would be much more important in order to trigger a surge in demand for industrial goods. Currently, there are no signs of this happening.

Hungarian retail data is worse than the most pessimistic forecast| 1.7% |

Volume of retail sales (YoY, wda)

ING estimate: 2.6% / Previous: 3.0% |

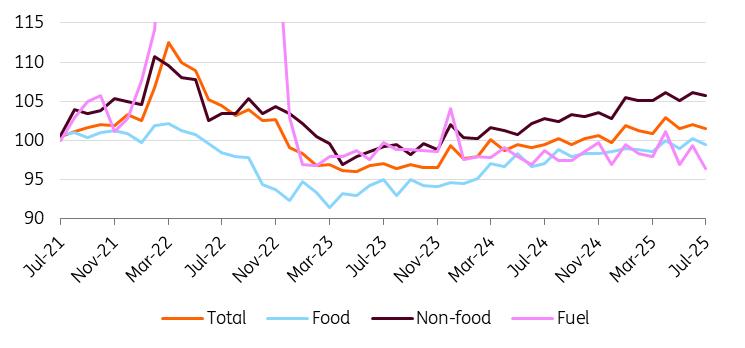

The third quarter got off to a poor start for retailers, according to the latest data. This is surprising not only because it fell short of even the most pessimistic forecast (ours), but also because July's labour market data suggested a rather favourable direction. In July 2025, Hungarian retail sales decreased by 0.5% from the previous month, translating to a year-on-year increase of just 1.7%.

Therefore, it remains true that retail sales volume has been expanding since the end of 2023, albeit in a "two steps forward, one step back" pattern. Now, it is time for the "one step back." However, the fixed-base index shows that compared to the big jump in April, a negative trend is beginning to emerge (or, optimistically, a stagnating trend). Compared to the 2021 monthly average, retail sales volume was higher by 1.5% in July 2025.

Retail sales volume in detail (2021 = 100%)

Source: HCSO, ING

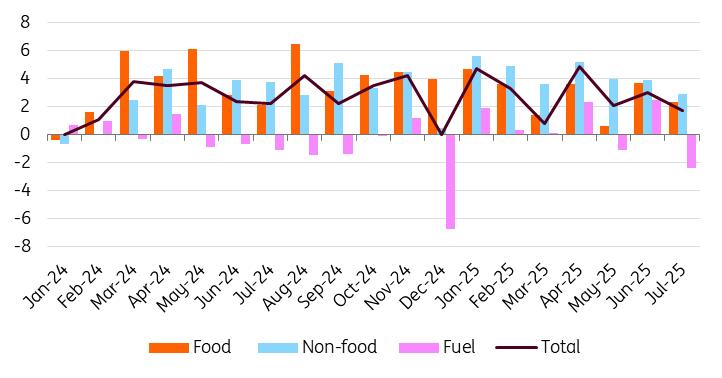

Food store sales corrected again on a monthly basis at the start of the second half of the year. Despite seasonal and calendar adjustments, the sector's performance has fluctuated significantly over the past four months, which have been characterised by sawtooth patterns. A similar pattern can be seen in non-food retail, though the July decline was moderate. This sector's performance was greatly boosted by a 4% month-on-month increase in sales of second-hand goods, and significant growth was also observed in books and newspapers.

Following growth in June, fuel sales declined by roughly the same pace in July. Due to last year's high base, this segment significantly contributed to the negative surprise. The data resonates well with the weakness in domestic tourism seen in July, in our view.

Breakdown of retail sales (% YoY, wda)

Source: HCSO, ING

Overall, therefore, we have observed a deteriorating performance in all subsectors. This suggests that even if there are a few better months, minor shocks or uncertainty among the households could slow down consumption growth, given the low level of consumer confidence.

For now, what seems certain is that volatility will remain with us for the rest of the year. The slight decline in retail performance seen in recent months will likely reverse as the economic effects of government measures to stimulate demand take hold. However, if this demand-stimulating effect fails to materialise, it could pose a serious problem because consumption is currently the only factor capable of pulling the Hungarian economy out of the slump. Without this growth, even a 0.5% GDP growth for this year would be a pleasant result.

In total, the latest retail and industrial data paint a rather unfavourable picture of Hungary's GDP outlook for the third quarter. Both sectors must perform better in August and September for us to be confident of a more dynamic economic growth. Another disappointing month would pose a significant obstacle to the Hungarian economy achieving 1-2% annual growth in the second half of this year.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Latin America Mobile Payment Market To Hit USD 1,688.0 Billion By 2033

- BTCC Announces Participation In Token2049 Singapore 2025, Showcasing NBA Collaboration With Jaren Jackson Jr.

- PLPC-DBTM: Non-Cellular Oncology Immunotherapy With STIPNAM Traceability, Entering A Global Acquisition Window.

- Bitget Launches PTBUSDT For Futures Trading And Bot Integration

- Ecosync & Carboncore Launch Full Stages Refi Infrastructure Linking Carbon Credits With Web3

- Bitmex And Tradingview Announce Trading Campaign, Offering 100,000 USDT In Rewards And More

Comments

No comment