Copper Fox Provides Execution Plan For PFS On Van Dyke ISCR Project

In 2020, Copper Fox completed an updated Mineral Resource Estimate (MRE) and Preliminary Economic Assessment (PEA) on Van Dyke using a US$3.15 per pound (lb) copper price for the base case economic model. The significant increase in copper price, the potential social and financial benefit to the town of Miami and surrounding communities support Copper Fox's decision to prepare the Plan to assess the timeline, work programs and estimated cost to complete a Prefeasibility Study (PFS) on the Van Dyke project. Among other findings, the PEA indicated:

each US$0.25/lb increase in copper price increased the project's after-tax NPV by ~US$90 million (M), significant exploration potential to increase the project's mineral resources, and recommendation to advance the project to PFS stage.Highlights of the Plan

- Outlines plan for completion of a PFS level report on the Van Dyke project. Outlines the objectives, work programs and expected timelines for the main components of the study. A two-phase, multi-purpose drilling program (12,620 meter (m)) focused primarily on expanding and upgrading the resource categories within the Van Dyke copper deposit. Estimated three years completion time, subject to time required to complete metallurgical testwork. Estimated cost of ~ US$23.4M including a 10% (US$2.17M) contingency.

Elmer B. Stewart, President and CEO of Copper Fox, stated, "Copper Fox thanks the team of mining professionals led by Stantec, a global leader in surface and underground mining engineering, design, and project delivery, for preparation of the Plan. The team's knowledge and work experience at two other advanced-stage ISCR projects in Arizona contributed to the development of a concise, focused plan, including a permitting strategy to achieve a PFS level study on the Van Dyke project. A decision to proceed to advance the project to the PFS stage is expected to be made before the end of October 2025."

A brief discussion of the main components of the Plan follows.

Project Management

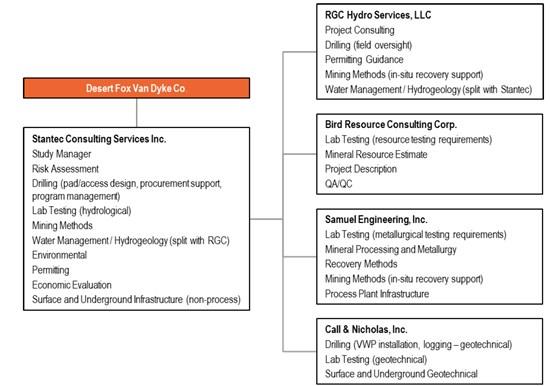

The consultants and responsibilities of the team preparing the Plan are outlined in Figure 1.

Figure 1 - Project Management for Van Dyke PFS Execution Plan

To view an enhanced version of this graphic, please visit:

Drilling

A two-phase drilling program is proposed focused on upgrading the mineral resource categories to meet the requirements of a PFS level study and allows for additional metallurgical and geotechnical sampling, and installation of hydrogeological monitoring and water quality sampling stations.

The program consists of 12,620m of reverse-circulation (RC) and diamond core (core) drilling in 25 locations. Phase I (estimated 6 months to complete) focuses primarily on resources and consists of 11,120m in 21 holes with Phase II consisting of 1,500m in 4 holes for additional hydrogeology monitoring wells, a deeper aquifer pump test well and two geotechnical core holes if required for portal selection. The timing between Phase I and Phase II depends on laboratory turnaround, particularly for metallurgical testwork plus time for analysis and interpretation.

Laboratory Testwork

The Plan outlines additional metallurgical, geotechnical, hydrogeological and water quality testwork to enable completion of prefeasibility studies and engineering works to support a PFS level of study.

Metallurgical testing includes sample characterization, mineralogy, locked-cycle and/or small pilot-scale leaching tests to evaluate/confirm optimum acid addition and consumption, leach cycle, and copper recovery; tracer tests to evaluate effluent conductivity over time (indicative of copper leaching progression in-situ); and pressurized rinse tests.

Geotechnical testwork includes core sampling to determine rock strength and elastic properties of the Gila Conglomerate, small-scale direct shear tests, Atterberg limits testing, and USCS particle size classification of bulk samples to characterize material properties.

The water quality monitoring wells and vibrating wire piezometers (VWPs) established during the drilling program allows for the collection of hydrogeological data, water level measurements, and sampling for ground water quality analysis in accordance with EPA and Arizona state requirements.

Updated Resource and Initial Reserve Estimates

The results of the proposed drilling program would be used to complete an updated MRE in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects incorporating updated geological, structural, mineral zonation and hydrogeological models, geotechnical data, and estimated copper recoveries by zone/material type. Provided that a PFS level of study is achieved, a reserve statement would be completed that quantifies mineralization with reasonable expectation of economic extraction.

Mine Plan

Additional geotechnical characterization of the site incorporating geotechnical and structure orientation data from the Gila Conglomerate to access the Van Dyke copper deposit is required. The mine plan would be scheduled to a PFS level and incorporate trade-off studies related to the portal type and site selection, mining methodology, mine design, ventilation, ground support design and an assessment to determine if the historical mine workings could be incorporated into the mine plan. The mine plan also includes lateral and vertical development distances, tonnages and rock volumes that follows a leaching schedule and the mobile equipment to support the life-of-mine (LOM) activities. The "Deswik" scheduling software would be used to create the mine plan and schedule for development and production activities.

ISCR

Understanding the hydrogeological conditions is a significant parameter in predicting future copper production in an ISCR operation. The mineralization in the Van Dyke deposit is hosted in oxidized and weathered Pinal Schist primarily in fractures with lesser concentrations occurring along schistosity surfaces and in quartz veinlets.

Copper recovery using ISCR techniques was historically successful on the Van Dyke property by Occidental Minerals Corp, following hydraulic fracturing of several injection and recovery test wells within a localized area near the Van Dyke shaft. Historic ISCR well spacings at Van Dyke ranged between 24m to 38m.

The injection and recovery wellfield would be designed using a distributed pattern of injection and recovery wells, typically consisting of one central injection well to four surrounding recovery wells, with calculated spacing between collars.

Hydrogeological data would be used to determine interconnectivity between the injection and recovery wells and establish conceptual operational layouts to assist with drilling and construction diameters required for operation of injection and recovery pump equipment in operational designs. Sweep efficiencies obtained from baseline hydrogeology testing would be used to determine the operational flows required to maintain interconnectivity between injection and recovery wells within the mineralized zone.

Reclamation of leach blocks would be achieved by injecting and recovering a fresh water solution to return the formation to pre-leaching water quality conditions or Aquifer Water Quality Standards (AWQS) as defined in an Aquifer Production Permit.

Mineral Processing and Recovery

Additional metallurgical testwork results, would be used to update the Conceptual Geometallurgical Model and develop prediction algorithms for copper recovery, product quality, operating cost, throughput rates to better inform deposit variability in terms of leach kinetics, acid consumption, and deleterious elements to allow evaluation of various processing options and optimization of short- and long-term operational performance.

The eight VWP locations and three water quality monitoring locations installed during the drilling program expands the hydrogeology and groundwater coverage to establish hydraulic gradients across the site and guide water management options to better characterize the hydrogeology of the Van Dyke deposit guide water management options and support permitting efforts. Groundwater monitoring wells would be designed to meet or exceed "Special Well Construction and Abandonment Procedures for Pinal Creek, Water Quality Assurance Revolving Fund Site" guidelines.

PFS Infrastructure Engineering

The infrastructure required for an ISCR operation includes the solvent extraction/electrowinning (SX/EW) plant, water treatment/neutralization, power distribution, surface infrastructure and all infrastructure associated with the underground wellfield. Base engineering criteria would include significant infrastructure areas (e.g., surface civil) to support a PFS level of study and lay the foundation for each major engineering discipline (civil, mechanical, electrical, instrumentation and controls, and structural) for future engineering studies/designs in compliance with applicable codes and standards. Prefeasibility and engineering studies include data analysis, modeling, trade-off evaluations, and engineering design to identify risk, explore potential options, and assess the viability of the project to optimized cost and schedule outcomes.

Economic Evaluation

The Plan included the use of "InEight" estimating software to an AACEI Class 4 prefeasibility level of detail with a -15%/-30% (Low Side) to +20%/+50% (High Side) level of accuracy to estimate capital and operating costs based on basic engineering with costs developed from similar ISCR projects, benchmarked data and general arrangement drawings to develop direct, indirect and operating costs. The project's indirect costs including EPCM and owner costs would be factored based on the direct cost of the project.

The preparation of a market study that includes the sale of copper and aggregate based on product pricing, marketability, offtake or sales agreements, long-term view of the copper market and local supply/demand for aggregate is planned.

The preparation of a financial model and sensitivity analysis following industry standards includes pre- and after-tax calculations, net present value (NPV), internal rate of return (IRR), and payback period, estimated annual cash flows, operating and sustaining costs, and predicted copper sales is planned. The sensitivity analysis includes four key cost and revenue drivers, discount rate, copper price and capital and operating costs to assess the impact on cashflow, NPV, IRR and payback period. Monte Carlo simulations would be used to show the distribution of NPV based on sensitivity analysis and key factors, such as grade, production, and schedule.

Environmental

The Plan contemplates development of Environmental and Water Management Plans focused on proactive waste management and waste reduction practices addressing; waste and vegetation management, water, noise, air quality and hazardous goods and outlines responsibilities, procedures, training, as well as communication, mitigation, emergency response and incident investigation and reporting, reclamation, permitting, social and community factors related to the project. The WQARF designation to the project site means extra care is required to seal off potentially contaminated groundwater within alluvium and upper Gila aquifers to prevent mixing. Community outreach, engagement, and public information based on the ongoing Desert Fox Community Relations Program with Town of Miami officials and the local community is proposed.

Permitting

The Plan outlines the estimated timeline and anticipated permitting requirements to complete the work programs required to support completion of the PFS. The project permitting strategy would be to apply for all inclusive APP and UIC permits after completion of the proposed PFS level study outlined in the Plan.

Qualified Person

Elmer B. Stewart, MSc. P. Geol., President, and CEO of Copper Fox, is the Company's non-independent, nominated Qualified Person pursuant to National Instrument 43-101, Standards for Disclosure for Mineral Projects, and has reviewed and approves the scientific and technical information disclosed in this news release.

About Copper Fox

Copper Fox is a Canadian resource company focused on copper exploration and development in Canada and the United States. The principal assets of Copper Fox and its wholly owned subsidiaries, being Northern Fox Copper Inc. and Desert Fox Copper Inc., are the 100% ownership of the Van Dyke oxide copper project located in Miami, AZ, the 100% interest in the Mineral Mountain and Sombrero Butte porphyry copper exploration projects located in Arizona, the 25% interest in the Schaft Creek Joint Venture with Teck Resources Limited on the Schaft Creek copper-gold-molybdenum-silver project and the 100% owned Eaglehead polymetallic porphyry copper project each located in northwestern British Columbia. For more information on Copper Fox's mineral properties and investments visit the Company's website at .

On behalf of the Board of Directors

Elmer B. Stewart

President and Chief Executive Officer

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment