Strong Japanese Wage Growth Boosts Chances Of October Rate Hike

| 4.1% YoY |

Labour cash earnings

Real cash earnings up 0.5% |

| Higher than expected |

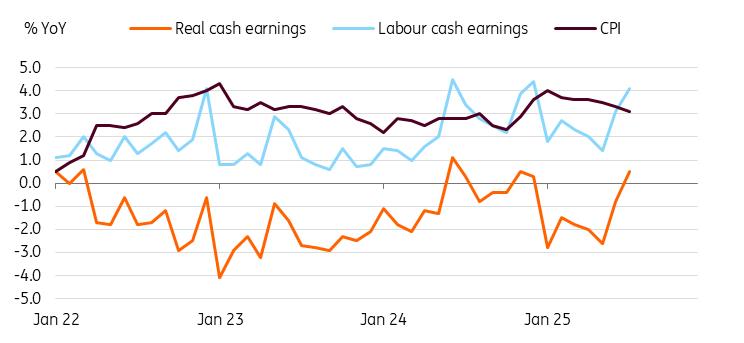

Japan's labour cash earnings rose 4.1% year on year in July, accelerated from 3.1% in June, beating the market consensus of 3.0%. Bonus pay (7.9%) rose significantly, while base pay (2.6%) also rose firmly. The same-sample cash earnings, the preferred measure of the Bank of Japan, rose 2.4% in August from 2.3% in July, missing the consensus of 2.5%. Meanwhile, real labour cash earnings unexpectedly rebounded 0.5% in July (vs -0.8% in June), rising for the first time since Dec 2024. A separate report showed that household spending rose 1.4% YoY in July, which was lower than market consensus but marking the third consecutive month of growth.

Local wires reported that the minimum wage in Japan is expected to rise to 1,121 yen ($7.6) from the current 1,055 yen ($7.1), the highest jump in history. Thus, this will likely maintain firm wage growth and support a sustainable inflation trend.

Cash earnings advanced firmly in July

Source: CEIC We continue to believe the BoJ to deliver a 25 bp hike in October

President Trump signed the US-Japan trade agreement executive order on Thursday, bringing more trade certainty to the 15% tariff agreement between the two nations. Meanwhile, stronger-than-expected first half GDP suggests the economy is resilient. Today's data reinforces our expectation of the BoJ to hike rates in October.

However, the BoJ may defer its interest rate hike decision if there are more concerns regarding the potential economic impact of increased US tariffs. Another key risk to our outlook is the current state of Japanese domestic politics. Prime Minister Ishiba Shigeru may face potential leadership challenges if the Liberal Democratic Party initiates an early leadership vote, which could introduce political uncertainty and lead to abrupt movements in financial markets.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment