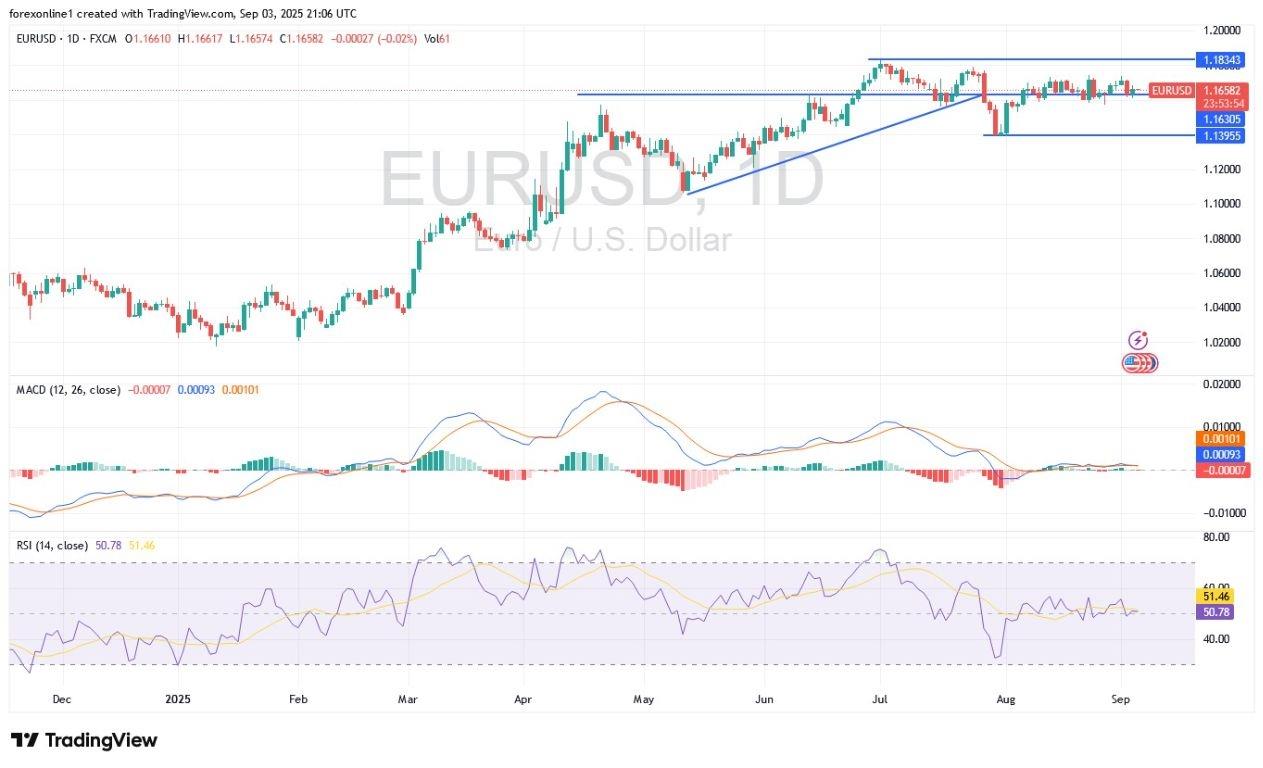

EUR/USD Analysis 04/09: Faces Neutral Performance (Chart)

- Overall Trend: Neutral with a downward bias. Today's Support Levels: 1.1600 – 1.1560 – 1.1470. Today's Resistance Levels: 1.1700 – 1.1770 -1.1830.

- Buy EUR/USD from the 1.1540 support level, with a target of 1.1800 and a stop-loss at 1.1500. Sell EUR/USD from the 1.1770 resistance level, with a target of 1.1600 and a stop-loss at 1.1820.

According to forex trading, the EUR/USD exchange rate made a more successful break above the resistance level of 1.1700, trading around 1.1735 at the beginning of the week's trading, amid a weaker US dollar and further gains in the Chinese yuan. According to trading experts, there is enough negativity in the US dollar for the EUR/USD pair to trade through the resistance level of 1.1750 and test its high this year at 1.1830. Experts believe that a breakout of the 1.1780 resistance level is necessary to signal sustainable progress.

EURUSD Chart by TradingViewThe movement of technical indicators confirms neutral performance. The 14-day RSI is around 51, not far from the neutral midline, and the MACD lines are also in a neutral path, awaiting strong factors for bulls and bears to quickly take control. On the fundamental analysis front, the EUR/USD will be affected today by the announcement of Eurozone retail sales figures at 12:00 PM Cairo time. The most important announcement will be the ADP US non-farm payrolls at 3:15 PM Cairo time. The weekly jobless claims and US trade balance figures will be released at 3:30 PM Cairo time, concluding with the announcement of the ISM US services PMI.Keep in mind that the main catalysts for the EUR/USD this week are US jobs data and Fed policy risks. The US labor market data will be crucial, culminating in Friday's main employment report. Last month's weak report, especially the significant downward revisions, was a key factor that triggered frenzied speculation about a shift in the Fed's policy. The concerns surrounding this week's release were exacerbated after President Trump's decision to fire the head of the Bureau of Labor Statistics (BLS) following last month's data.In the forex market, the Chinese yuan has also continued to gain in global markets, which will support the EUR/USD pair. Recently, we have seen a rebound in demand for the yuan-denominated in dollars overseas, especially from hedge fund clients. By allowing the yuan to appreciate slightly ahead of the US trade talks in the fall, it could help create a more supportive environment for reaching an agreement Tips:Traders are advised to await the market's reaction to the US jobs data to determine the most suitable EUR/USD trading positions.Ready to trade our Forex EUR/USD forecast ? We've shortlisted the best European brokers in the industry for you.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- SPAYZ.Io White Paper Explores Opportunities, Challenges And Ambitions In Payments Industry

- Ceffu Secures Full VASP Operating License From Dubai's VARA

- Cregis And Sumsub Host Web3 Compliance And Trust Summit In Singapore

- Tokenfi And New To The Street Announce National Media Partnership To Reach 219M+ Households

- Chartis Research And Metrika Release Comprehensive Framework For Managing Digital Asset Risk

- Xone Chain Announces Ecosystem Evolution Following Sunflower Letter

Comments

No comment