Revised GST Slabs To Ease Burden On Msmes, Small Traders: Mos Finance

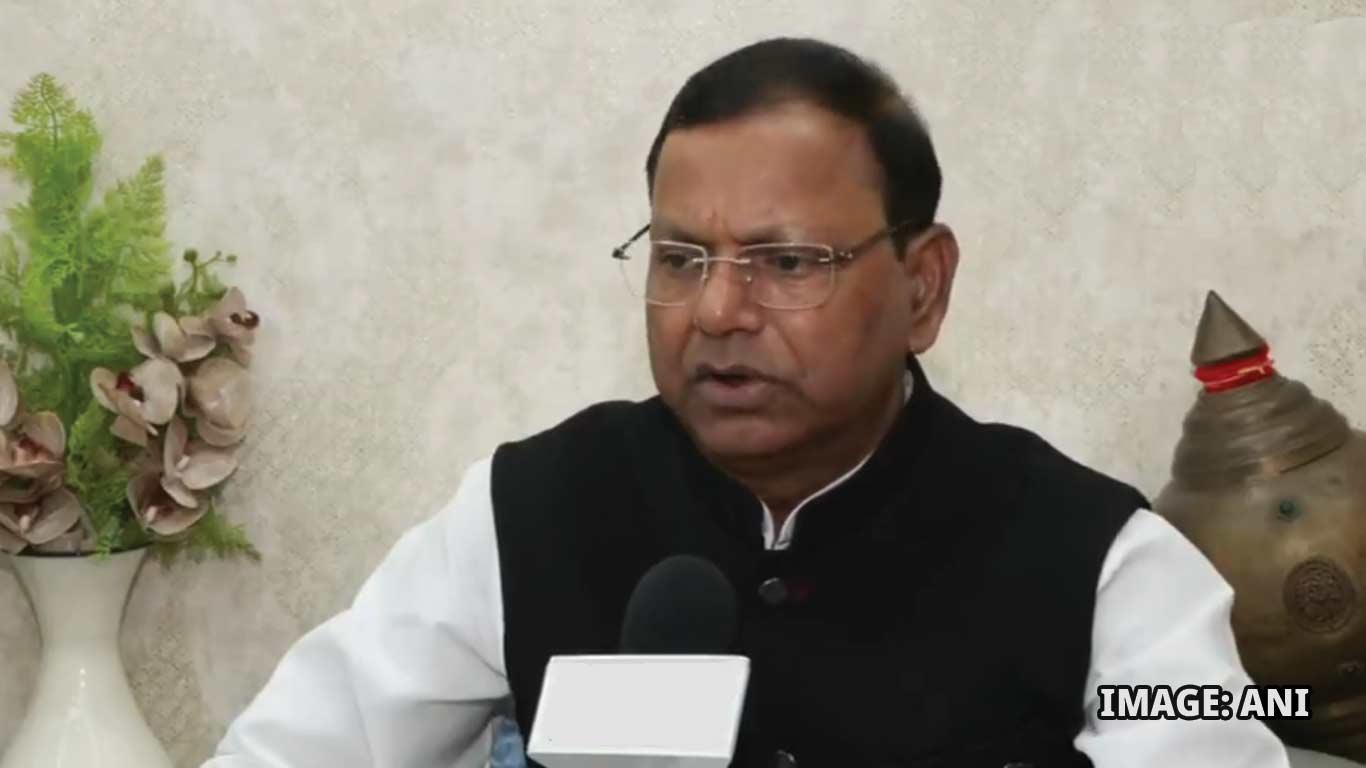

Speaking to ANI, Chaudhary explained, "The purpose behind making two slabs was that earlier there used to be four slabs, 5 percent, 12 percent, 18 percent, 28 percent and a lot of confusion was created in it. This has been done to remove that and to make the work of making GST easier."

The rationalisation reduces the levy on a wide range of raw materials vital for micro, small and medium enterprises (MSMEs), with rates in several cases lowered from 12 percent to 5 percent.

The introduction of two slabs, he noted, is intended to simplify GST, making compliance easier while providing relief to key stakeholders.

He further added that the rate rationalisation committee had been working on the reform for nearly two years, with consensus among all states on the need for change.

The proposal put forward by the Government of India was subsequently approved unanimously by the GST Council.

Finance ministry officials said the measures are expected to benefit India's 66 million MSMEs by reducing input costs, easing compliance and accelerating refunds.

The sector, which accounts for roughly 30 percent of the economy and 45 percent of exports, is seen as a key beneficiary of the reform.

Tax reductions extend across household goods, food products, agriculture and healthcare. Finished food items such as Indian breads, ultra-high temperature milk and paneer will now be exempt from GST.

Beyond rates, procedural reforms aim to simplify GST registration and refunds. Low-risk applicants and businesses with limited tax liabilities will be eligible for automatic registration within three working days.

Small enterprises supplying through e-commerce operators will also be able to register with fewer hurdles, addressing long-standing concerns about interstate operations.

The Council also cleared faster refunds for MSMEs affected by the inverted duty structure, with a provision for 90 percent provisional refunds similar to zero-rated supplies.

(KNN Bureau)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Daytrading Publishes New Study On The Dangers Of AI Tools Used By Traders

- Primexbt Launches Empowering Traders To Succeed Campaign, Leading A New Era Of Trading

- Wallpaper Market Size, Industry Overview, Latest Insights And Forecast 2025-2033

- Excellion Finance Scales Market-Neutral Defi Strategies With Fordefi's MPC Wallet

- ROVR Releases Open Dataset To Power The Future Of Spatial AI, Robotics, And Autonomous Systems

- Ethereum-Based Meme Project Pepeto ($PEPETO) Surges Past $6.5M In Presale

Comments

No comment