403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

GBP/USD Signal 02/09: Breakdown To More Downside? (Chart)

(MENAFN- Daily Forex) Today's GBP/USD SignalsShort Trade Idea

- Short entry between $1.35203 and $1.35500, the intra-day low of the breakdown and the intra-day high of the failed breakout. Place your stop loss level 20 pips above your entry level. Adjust the stop loss to break even once the trade is 50 pips in profit. Take off 50% of the position as profit when the price reaches 50 pips in profit and leave the remainder of the position to run.

- Long entry if price action breaks out above $1.35600, ten pips above the intra-day high of the previous breakout that reversed into a breakdown. Place your stop loss level at 20 below your entry level. Adjust the stop loss to break even once the trade is 25 pips in profit. Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

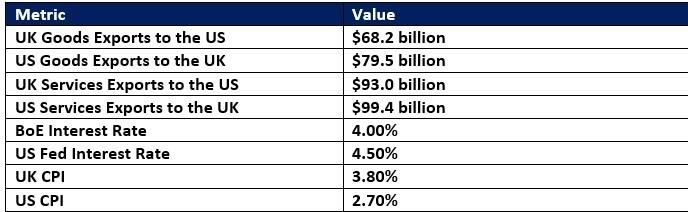

- Yesterday's UK August S&P Global Manufacturing PMI came in at 47.0, lower than the expected reading of 47.3, and below July's 48.0, confirming a deepening manufacturing slump. Economists predict today's US August S&P Global Manufacturing PMI to show a reversal from July's 49.8 to 53.3, suggesting an expansion. US July construction spending is predicted to show a contraction of 0.1%, following June's drop of 0.4%. The US August ISM Manufacturing PMI is expected to improve to 49.0 with the crucial Prices Paid component rising to 65.1, following July's readings of 48.0 and 64.8, respectively. Economists are upbeat about the US September IBD/TIPP Economic Optimism, expected to improve to 51.8 from August's 50.9.

I expect more downside, but Forex traders should brace for volatility, as bulls could make one final attempt to push higher. US economic data could exacerbate US Dollar strength versus the British Pound today. Forex traders should earn 50 to 75 pips from this short position.

EURUSD Chart by TradingViewGBP/USD Price Chart Ready to trade our free Forex signals? Here is our list of the best Forex brokers in the world worth checking out.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment