Hungarian Wage Data A Pleasant Surprise, But Is No Silver Bullet

| 9.7% |

Average wage growth (Jun)

ING Forecast 7.1% / Previous 7.8% |

| Better than expected |

After slowing significantly in May, wage growth accelerated sharply in June 2025. The Hungarian Central Statistical Office (HCSO) reported a 9.7% year-on-year increase in average wages, whereas the market consensus forecast was much lower. Thus, the data can be considered a strong positive surprise. These latest wage statistics add an interesting twist to the narrative of weak economic performance in the second quarter. Although wage growth exceeded expectations for the second quarter as a whole, it has yet to make its positive spillovers into the real economy.

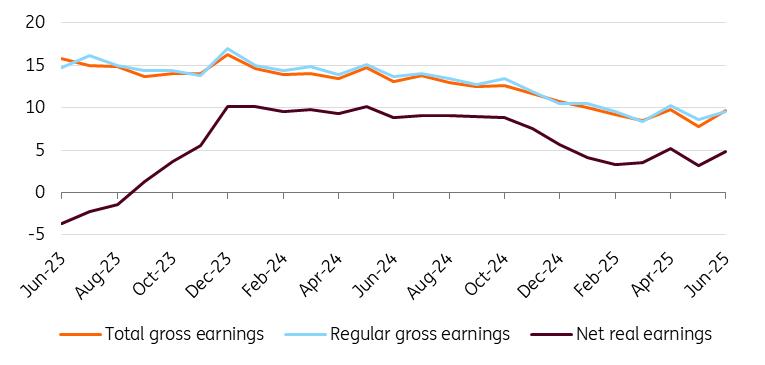

From the perspective of the real economy, trends are much more important than a single data point. In this regard, we can conclude that, following a slight slowdown in 2024 and a pronounced deceleration at the start of this year, wage growth has now stabilised at approximately 10%. However, this looks to be insufficient for rapid economic growth, as persistently high inflation keeps the real value of net average wages low. Nevertheless, the net real wage growth of 4.8% seen in June and 4.4% for the second quarter as a whole exceeds the historical average. So, at face value, the situation looks positive.

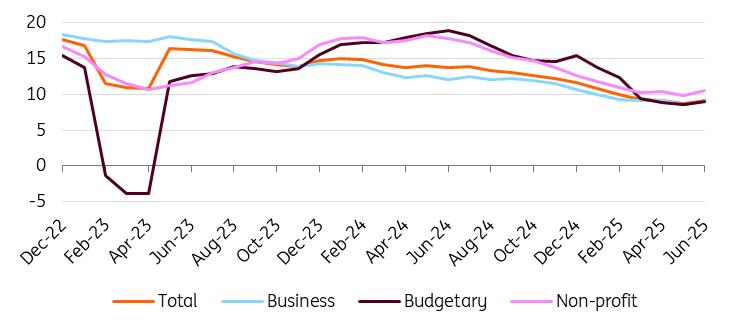

Wage dynamics (3-month moving average, % YoY)

Source: HCSO, ING

So, what could the problem be? In our view, the resulting change in real earnings from the combination of high inflation and high nominal wage growth is undesirable in the long term. Persistently high inflation expectations can fuel a price-wage spiral, making the economy more vulnerable. However, another 'soft' factor is at play: compared to the double-digit growth in purchasing power recorded between late 2023 and late 2024, the current 3-5% real wage growth feels like a deterioration in their financial situation to consumers.

Examining individual sectors reveals that wage dynamics accelerated in all major areas. In the corporate sector, the average wage increase of 9.7% was accompanied by a rather mixed picture. For example, wage growth slowed in the construction industry, while it remained close to double digits in manufacturing. The latter raises the question of composition effects, whereby dismissing the lowest earners may have pushed up the average wage level significantly. Institutional statistics show a 1.6% YoY reduction in manufacturing sector headcount, which may already demonstrate such an effect. We can also see significant increases in wage growth dynamics in most services. Based on these findings, it is clear that the higher-than-expected wage growth in June cannot be attributed to one specific area.

Nominal and real wage growth (% YoY)

Source: HCSO, ING

We expect average annual wage growth of around 8% for the economy as a whole in 2025. One of the downside risks is that business confidence remains weak and has started declining again. This could lead to labour cost rationalisation, and that could support a further slowdown in wage growth. An upside risk is the positive surprises in recent months, which could become a sustained, structural process.

Since we expect average inflation to be 4.6% this year, real wage growth is likely to slow to its historical average of 3.2% for the year. The main question remains whether consumer confidence can be restored in a situation where households compare the significant wage growth of the past one to two years with the current normalisation of dynamics, which paints a relatively worse picture for them. A strong improvement in confidence is essential for the Hungarian economy to return to a path of sustained growth. High wage growth alone is clearly not enough.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Poppy Seed Market Size, Share, In-Depth Insights, Opportunity And Forecast 2025-2033

- Daytrading Publishes New Study On The Dangers Of AI Tools Used By Traders

- Origin Summit Debuts In Seoul During KBW As Flagship Gathering On IP, AI, And The Next Era Of Blockchain-Enabled Real-World Assets

- Chicago Clearing Corporation And Taxtec Announce Strategic Partnership

- Bitmex And Tradingview Announce Trading Campaign, Offering 100,000 USDT In Rewards And More

- ROVR Releases Open Dataset To Power The Future Of Spatial AI, Robotics, And Autonomous Systems

Comments

No comment