From Rs 3,000 To Crores: Inside Kashmir's Half-Century Of Real Estate Growth

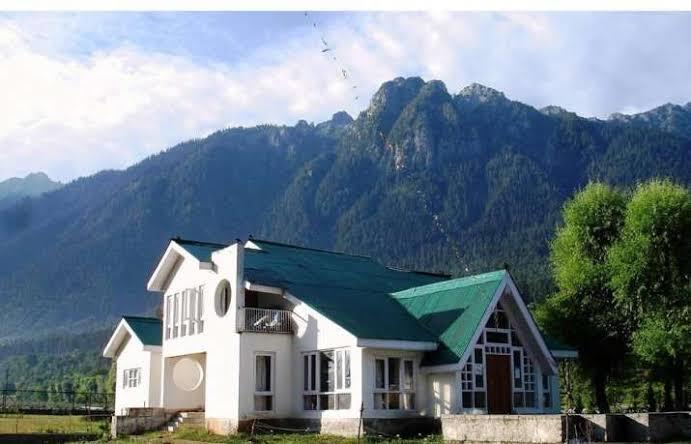

Representational Photo

In the early 1970s, a kanal of land in Hyderpora or Zakura might cost Rs 3,000. Roads were narrow, transport options scarce, and development seemed a distant hope.

Today, those same plots fetch Rs 2 crore or more.

Ahmad Nagar's 90-foot road, once a sleepy byway, now pulses with construction activity, shops, and new homes.

For early investors, this growth represents a staggering 12.6 percent average annual increase, translating into returns thousands of times the original investment.

Back then, these neighbourhoods were overlooked. Villages threaded with canals, orchards, and low-rise homes dotted the landscape.

Read Also Why J&K Landowners Are Turning to the Supreme Court Why Property Buyers in Kashmir Are at RiskUrbanization began reshaping the region slowly but inexorably. Roads replaced waterways, utilities expanded, and the demand for construction-ready land surged.

Those who recognized this shift and invested prudently saw their modest holdings turn into financial lifelines, supplementing incomes rooted in agriculture, horticulture, and Kashmiri handicrafts.

The transformation was more than monetary.

Families who bought land early witnessed the emergence of new schools, hospitals, and marketplaces, altering lifestyles and opportunities.

Real estate became a bridge from traditional livelihoods to modern economic stability, turning long-term vision into tangible wealth.

Today, the investment landscape has shifted. Prime land is scarce, and expectations of exponential returns have tempered. Investors now seek diversification.

Mutual funds, multi-asset portfolios, and systematic investment plans (SIPs) are emerging as tools to secure steady long-term growth.

Even modest monthly contributions can, over decades, accumulate into substantial wealth, demonstrating the power of disciplined, incremental investing.

Financial literacy emerges as the next frontier. Teaching younger generations about market dynamics, prudent spending, and the virtues of patience ensures that wealth is preserved and multiplied.

Impulse-driven decisions give way to careful planning, understanding risk, and responding to evolving economic realities.

Kashmir's real estate journey tells a story of foresight, patience, and strategic thinking. Early investors turned sparsely developed land into lasting legacies.

Future prosperity will depend on the ability to combine this historical wisdom with modern financial strategies, blending tangible assets with diversified portfolios and informed decision-making.

For Kashmiris, the lesson is clear: wealth is built over time, nurtured by knowledge, and preserved through careful, adaptable strategies.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment