Armored Vehicles Upgrade And Retrofit Market Size, Share And Growth Forecast By 2033

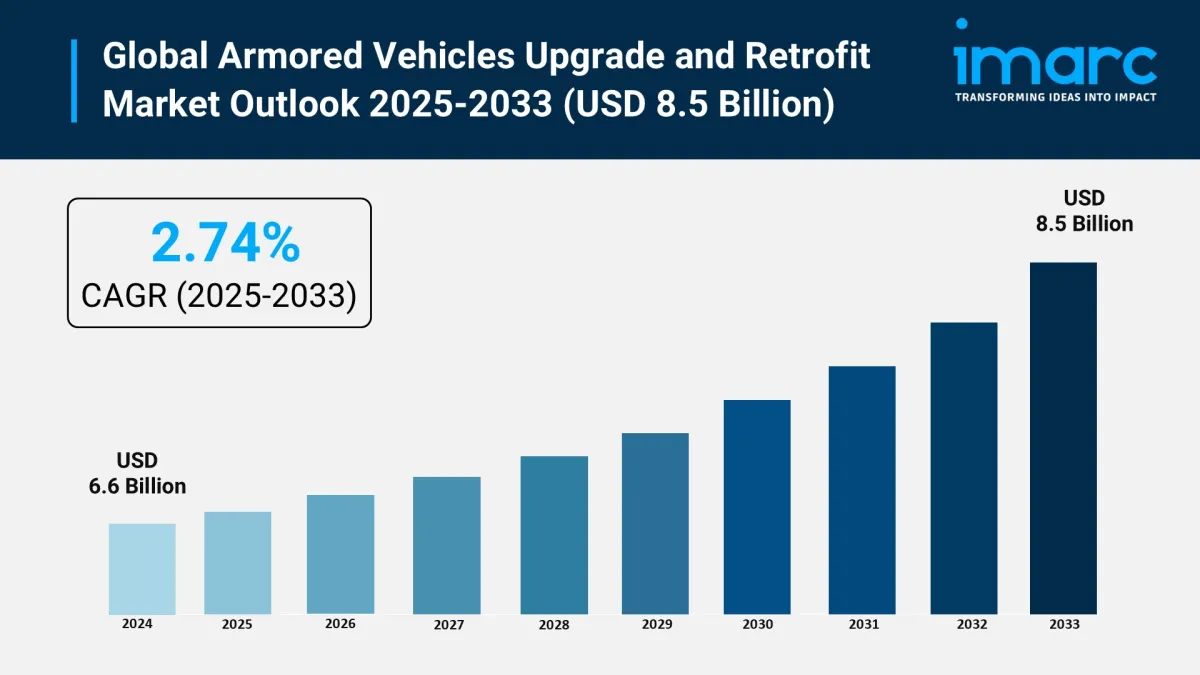

The armored vehicles upgrade and retrofit market is experiencing steady growth, driven by escalating geopolitical tensions, increasing terrorism threats, and the urgent need for military modernization across the globe. According to IMARC Group's latest research publication, “Armored Vehicles Upgrade and Retrofit Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033” , the global armored vehicles upgrade and retrofit market size reached USD 6.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.5 Billion by 2033, exhibiting a growth rate of 2.74% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/armoured-vechicles-upgrade-retrofit-market/requestsample

Our report includes:

-

Market Dynamics

Market Trends and Market Outlook

Competitive Analysis

Industry Segmentation

Strategic Recommendations

Growth Factors in the Armored Vehicles Upgrade and Retrofit Market

-

Rising Geopolitical Tensions and Border Security Threats

A major catalyst propelling the global armored vehicles upgrade and retrofit market is the intensification of geopolitical conflicts and border security challenges worldwide. Nations are increasingly investing in military modernization programs to maintain operational readiness against evolving threats. The United States allocated a defense budget of USD 916 billion in 2023, according to the Stockholm International Peace Research Institute (SIPRI), reflecting the growing emphasis on military capabilities and combat readiness. These substantial investments have enabled significant upgrades to existing armored vehicle fleets, as governments recognize that retrofitting older vehicles is far more cost-effective than purchasing entirely new platforms. Countries facing asymmetric warfare threats are particularly focused on upgrading their armored vehicles with enhanced protection systems, advanced electronics, and improved mobility solutions to counter modern battlefield challenges.

-

Cost-Effective Alternative to New Vehicle Procurement

The strong economic rationale behind upgrade and retrofit programs is another vital growth engine for the market. Military organizations worldwide are discovering that modernizing existing armored vehicles delivers exceptional value compared to acquiring new platforms. Upgrade programs typically cost 30-50% less than purchasing new vehicles while extending operational life by 10-15 years. This cost efficiency is especially attractive to defense agencies operating under tight budget constraints. For instance, the U.S. Army's Bradley Fighting Vehicle upgrade program demonstrates how retrofitting can transform aging platforms into modern, battle-ready systems at a fraction of new procurement costs. The process involves installing advanced armor packages, upgraded fire control systems, and modern communication equipment, essentially creating a new-generation vehicle from an existing platform.

-

Technological Advancement and Digital Integration

The rapid evolution of military technologies is driving unprecedented demand for vehicle upgrades that incorporate cutting-edge innovations. Modern warfare increasingly relies on digital integration, artificial intelligence, and advanced sensor systems. In 2024, the market saw increased demand for modular upgrade solutions, allowing for quick integration of new armor technologies and electronic warfare systems. AI-powered battlefield analytics were incorporated into upgraded vehicles, providing enhanced real-time decision-making capabilities. Defense contractors are developing sophisticated retrofit packages that include third-generation thermal imaging systems, automatic target trackers, and modernized fire control systems. Companies like BAE Systems, Rheinmetall, and General Dynamics are investing heavily in research and development to create upgrade solutions that transform legacy vehicles into technologically advanced platforms capable of operating in modern combat environments.

How AI is Reshaping the Future of Armored Vehicles Upgrade and Retrofit Market

Artificial intelligence is revolutionizing the armored vehicles upgrade and retrofit sector by introducing unprecedented levels of automation, precision, and battlefield awareness. AI-powered systems are being integrated into retrofit packages to enhance vehicle performance across multiple domains. Advanced machine learning algorithms now enable real-time threat detection and classification, allowing upgraded vehicles to automatically identify and prioritize targets while reducing human workload. Predictive maintenance systems powered by AI analyze vehicle performance data to forecast component failures before they occur, significantly reducing downtime and maintenance costs.

Modern upgrade programs incorporate AI-driven fire control systems that improve accuracy and reduce engagement times. These systems can process multiple sensor inputs simultaneously, providing crews with enhanced situational awareness and decision-making support. Electronic warfare capabilities have also been enhanced through AI integration, with upgraded vehicles now capable of automatically detecting, analyzing, and countering enemy electronic threats. Furthermore, AI is streamlining the upgrade process itself, with intelligent logistics systems optimizing parts inventory, scheduling maintenance windows, and coordinating complex retrofit operations across multiple vehicle platforms.

The integration of autonomous driving capabilities represents another frontier where AI is making significant impact. While full autonomy remains limited in military applications, AI-assisted navigation and obstacle avoidance systems are being incorporated into upgrade packages, reducing crew fatigue and improving operational efficiency in challenging terrain.

Key Trends in the Armored Vehicles upgrade and Retrofit Market

-

Modular Upgrade Architecture and Rapid Integration

One of the most significant trends transforming the armored vehicles upgrade sector is the shift toward modular upgrade architectures that enable rapid integration of new technologies. Rising geopolitical tensions and asymmetric warfare threats are driving governments to invest in modernizing their armored vehicle fleets to maintain operational readiness. In 2024, the market saw increased demand for modular upgrade solutions, allowing for quick integration of new armor technologies and electronic warfare systems. This modular approach allows military organizations to customize upgrade packages based on specific operational requirements and budget constraints. Manufacturers are designing standardized interfaces and plug-and-play systems that can be rapidly installed without extensive vehicle modifications. This trend is particularly valuable for countries with diverse vehicle fleets, as modular solutions can be adapted across multiple platform types, reducing training requirements and logistical complexity.

-

Advanced Armor Technology and Multi-Layered Protection

The evolution of armor technology represents a critical trend driving market growth, with manufacturers developing sophisticated protection systems that address modern battlefield threats. Traditional steel armor is being supplemented or replaced with advanced materials including ceramic composites, reactive armor tiles, and hybrid protection systems. These new armor technologies provide enhanced protection against kinetic energy penetrators, shaped charges, and improvised explosive devices while maintaining vehicle mobility. Active protection systems are increasingly being integrated into upgrade packages, using radar and computer-controlled countermeasures to intercept incoming projectiles before they reach the vehicle. The development of scalable armor solutions allows the same vehicle platform to be configured for different threat levels, from urban peacekeeping missions to high-intensity combat operations.

-

Enhanced Communication and Network-Centric Warfare Capabilities

The integration of advanced communication systems and network-centric warfare capabilities has become a standard component of modern upgrade programs. Military forces worldwide are recognizing the importance of real-time information sharing and coordinated operations in modern combat scenarios. Upgrade packages now routinely include sophisticated communication suites that enable seamless integration with command and control networks, providing crews with real-time intelligence, mapping data, and mission updates. Digital battlefield management systems allow individual vehicles to share sensor data, coordinate movements, and execute complex tactical maneuvers as part of larger formations. These communication upgrades also facilitate integration with unmanned systems, enabling armored vehicles to control and coordinate with drones and robotic platforms for enhanced reconnaissance and combat effectiveness.

Recent News and Developments

The armored vehicles upgrade and retrofit market has witnessed several significant developments that highlight the industry's dynamic nature and growing importance in modern defense strategies. Major defense contractors have announced substantial investments in upgrade capabilities, with companies expanding their retrofit facilities and developing next-generation upgrade packages.

Recent contract awards demonstrate the market's robust growth trajectory. The U.S. Army's ongoing Bradley Fighting Vehicle modernization program continues to drive substantial revenue for prime contractors, with multiple phases of upgrades planned through the next decade. European nations have also increased their focus on vehicle modernization, with several NATO countries launching comprehensive upgrade programs for their armored vehicle fleets in response to changing security environments.

Technological partnerships between traditional defense contractors and technology companies have accelerated innovation in the upgrade sector. These collaborations are producing breakthrough capabilities in areas such as artificial intelligence, advanced materials, and electronic warfare systems. The development of common upgrade standards across allied nations is facilitating international cooperation and reducing costs through economies of scale.

Manufacturing capacity expansion has become a priority for leading companies in the sector, with several firms announcing new production facilities dedicated to upgrade and retrofit operations. This expansion reflects confidence in sustained market growth and the need to meet increasing global demand for modernization services.

Ask analyst for customized report: https://www.imarcgroup.com/request?type=report&id=1304&flag=E

Leading Companies Operating in the Global Armored Vehicles Upgrade and Retrofit Market Industry:

-

AM General

BAE Systems

Diehl Defence

Elbit Systems

FNSS Savunma Sistemleri

General Dynamics

MKU

Oshkosh Defense

Palbam

Rheinmetall

Sabiex International

Thales Group

Armored Vehicles Upgrade and Retrofit Market Report Segmentation:

Breakup by Vehicle Type:

-

Main Battle Tanks

Infantry Fighting Vehicles

Armored Personnel Carriers

Mine-Resistant Ambush Protected (MRAP) Vehicles

Others

Breakup by Design:

-

Wheeled Armored Vehicles

Tracked Armored Vehicles

Regional Insights:

-

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91-120-433-0800

United States: +1-201-971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Origin Summit Debuts In Seoul During KBW As Flagship Gathering On IP, AI, And The Next Era Of Blockchain-Enabled Real-World Assets

- What Are The Latest Trends In The Europe Steel Market For 2025?

- United States AI Governance Market Size, Demand, Growth & Outlook 2033

- NOVA Collective Invest Showcases Intelligent Trading System7.0 Iterations Led By Brady Rodriguez

- North America Perms And Relaxants Market Size, Share And Growth Report 2025-2033

- Canada Real Estate Market Size, Share, Trends & Growth Opportunities 2033

Comments

No comment