Solid-State Battery Manufacturing Plant Report 2025: Feasibility Study And Profit Analysis

Setting up a solid-state battery manufacturing plant requires significant investment in advanced materials, precision equipment, and cleanroom facilities. Key considerations include securing raw materials, developing scalable production processes, ensuring quality control, and establishing partnerships for research and market adoption.

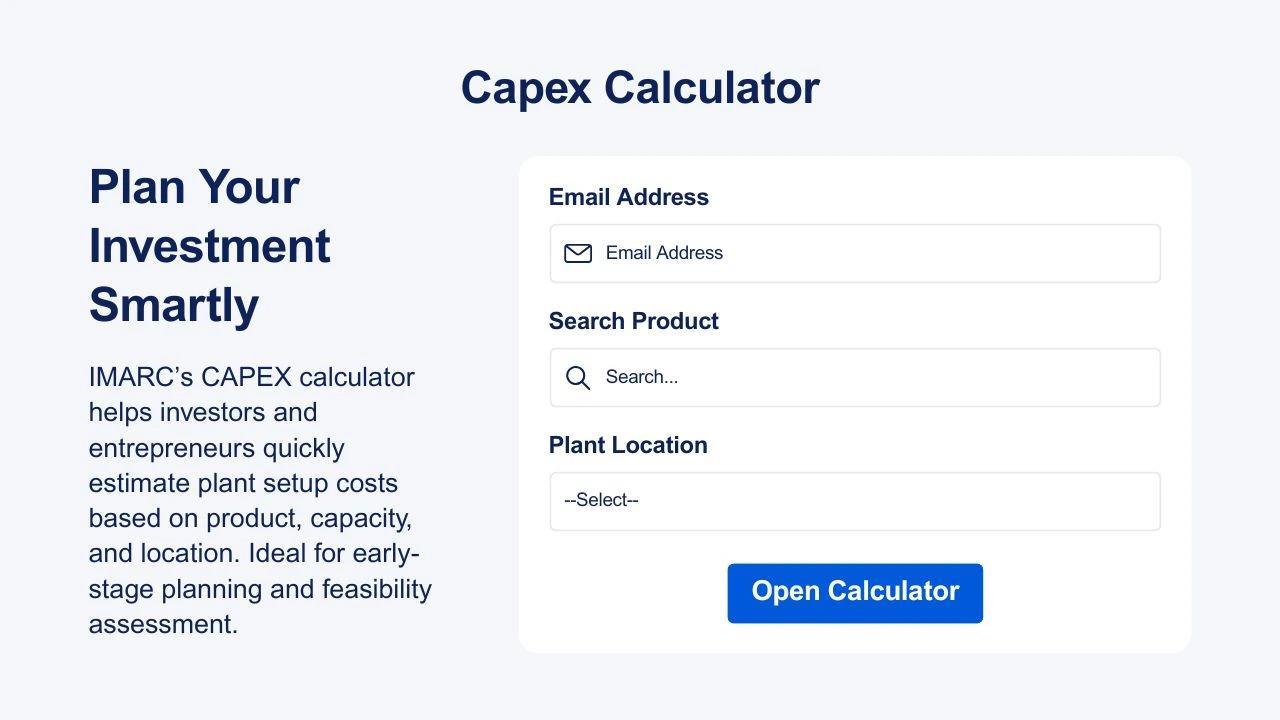

IMARC Group's report, titled “ Solid-State Battery Manufacturing Plant Project Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue,” provides a complete roadmap for setting up a solid-state battery manufacturing plant. It covers a comprehensive market overview to micro-level information such as unit operations involved, raw material requirements, utility requirements, infrastructure requirements, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, etc.

Request for a Sample Report : https://www.imarcgroup.com/solid-state-battery-manufacturing-plant-project-report/requestsample

Solid-State Battery Industry outlook 2025:

The solid-state battery industry outlook for 2025 is marked by rapid advancements in commercialization and strategic investments. With increasing demand from electric vehicles, consumer electronics, and renewable energy storage, the market is expected to accelerate due to its promise of higher energy density, faster charging, and enhanced safety compared to conventional lithium-ion batteries. Key players and startups are scaling pilot projects into mass production, supported by government incentives and R&D collaborations. However, challenges in manufacturing scalability and high material costs remain. Overall, 2025 is anticipated to be a pivotal year, moving the technology closer to mainstream adoption.

Key Insights for Solid-State Battery Manufacturing Plant Setup:

Detailed Process Flow:

-

Product Overview

Unit Operations Involved

Mass Balance and Raw Material Requirements

Quality Assurance Criteria

Technical Tests

Project Details, Requirements and Costs Involved:

-

Land, Location and Site Development

Plant Layout

Machinery Requirements and Costs

Raw Material Requirements and Costs

Packaging Requirements and Costs

Transportation Requirements and Costs

Utility Requirements and Costs

Human Resource Requirements and Costs

Capital Expenditure (CapEx) and Operational Expenditure (OpEx) Analysis:

Project Economics:

-

Capital Investments

Operating Costs

Expenditure Projections

Revenue Projections

Taxation and Depreciation

Profit Projections

Financial Analysis

Profitability Analysis:

-

Total Income

Total Expenditure

Gross Profit

Gross Margin

Net Profit

Net Margin

Key Cost Components of Setting Up a Solid-State Battery Plant :

-

Land and Infrastructure: Acquisition of industrial land, construction of production facilities, cleanrooms, and utilities.

Machinery and Equipment: High-precision coating machines, electrolyte fabrication units, cell assembly lines, and quality testing systems.

Raw Materials: Solid electrolytes, cathode and anode materials, separators, and specialty chemicals.

Research and Development: Costs for prototyping, process optimization, and continuous innovation.

Labor and Workforce Training: Skilled engineers, technicians, and operators with specialized training.

Quality Control and Safety Systems: Advanced testing labs and safety compliance infrastructure.

Operational Costs: Energy consumption, maintenance, logistics, and supply chain management.

Economic Trends Influencing Solid-State Battery Plant Setup Costs 2025 :

-

Raw Material Price Volatility: Rising costs of lithium, nickel, and advanced solid electrolytes directly impact capital requirements.

Technological Advancements: Improved manufacturing techniques are reducing per-unit production costs but require high initial investment.

Government Incentives: Subsidies, tax breaks, and green energy policies are lowering setup expenses in key regions.

Global Supply Chain Dynamics: Geopolitical tensions and trade restrictions are affecting equipment imports and material availability.

Energy Prices: Fluctuating energy costs influence plant operations and long-term profitability.

Market Demand Growth: Expanding EV and renewable sectors drive economies of scale, improving cost efficiency.

Speak to an Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=16552&flag=E

Challenges and Considerations for Investors in Solid-State Battery Plant Projects:

-

High Capital Expenditure: Significant upfront investment is required for advanced equipment, infrastructure, and R&D.

Scalability Issues: Transitioning from pilot-scale to mass production remains a technical and cost-intensive challenge.

Material Availability: Limited supply of solid electrolytes and high-purity raw materials can disrupt production plans.

Technological Uncertainty: Rapid innovation in battery chemistry may render current processes obsolete.

Regulatory Compliance: Meeting environmental, safety, and energy efficiency standards adds complexity and cost.

Market Adoption Risks: EV manufacturers and electronics companies may delay large-scale adoption until proven reliability and cost parity with lithium-ion batteries are achieved.

Conclusion:

The solid-state battery industry is positioned at a transformative stage, with 2025 expected to accelerate its path toward commercialization. Establishing a manufacturing plant presents significant opportunities, particularly in the electric vehicle and renewable energy sectors, where demand for safer, high-performance batteries is rapidly increasing. However, the journey requires careful navigation of high capital requirements, technological uncertainties, and raw material constraints. Strategic investments in R&D, supply chain security, and partnerships with automotive and energy companies will be critical for success. For investors, solid-state battery plants represent both a high-risk and high-reward opportunity in the future energy landscape.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excel in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment