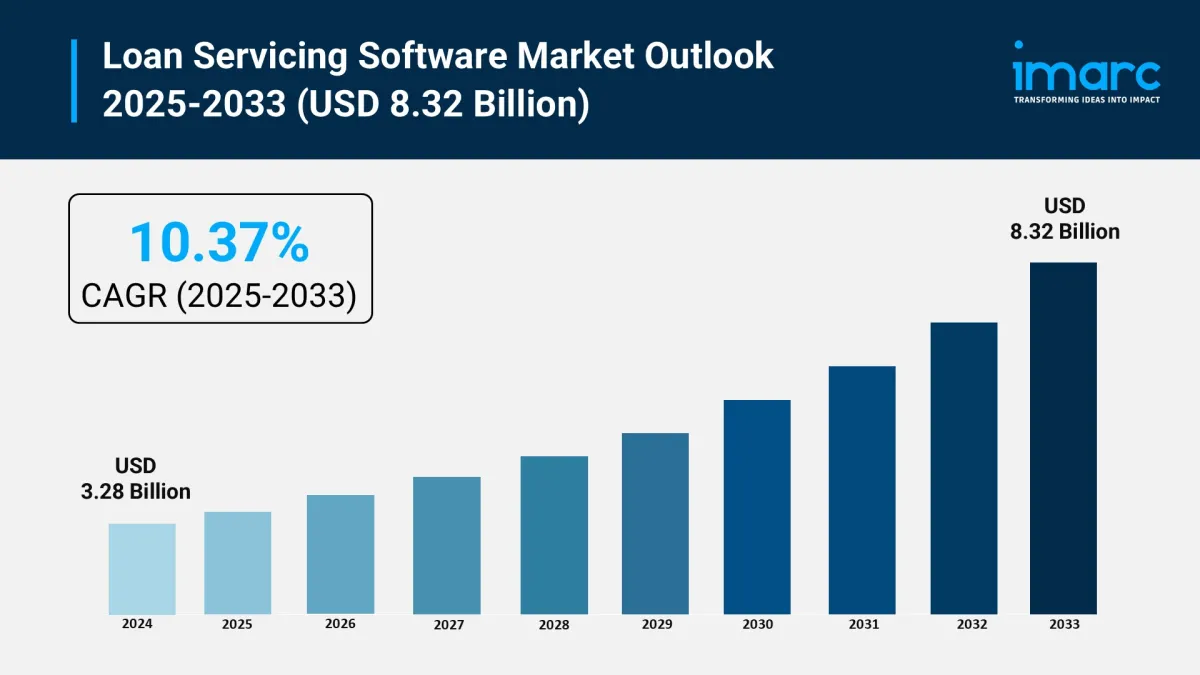

Loan Servicing Software Market Size To Surpass USD 8.32 Billion By 2033 With A 10.37% CAGR

The loan servicing software market is experiencing rapid growth, driven by demand for automation and efficiency, regulatory compliance and security spurring investment, and mobile-first experience and customer expectations. According to IMARC Group's latest research publication, “Loan Servicing Software Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, End User, and Region, 2025-2033”, the global loan servicing software market size was valued at USD 3.28 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.32 Billion by 2033, exhibiting a CAGR of 10.37% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Get Your Free“Loan Servicing Software Market” Sample PDF Report Now!

Our report includes:

-

Market Dynamics

Market Trends and Market Outlook

Competitive Analysis

Industry Segmentation

Strategic Recommendations

Growth Factors in the Loan Servicing Software Market

-

Demand for Automation and Efficiency

One of the biggest forces behind the surge in loan servicing software is the urgent need for automation and efficiency inside financial organizations. Today, banks and lenders are juggling more loan types and larger portfolios than ever, making manual processing unmanageable and error-prone. With a global market size of $3.28b, adoption of fully integrated digital platforms streamlines everything from payment tracking to compliance, cutting down operational costs. Cloud-based systems now cover about 70% of the market, letting institutions manage loans in real time, reduce processing errors, and free up staff for higher-value work rather than repetitive data entry. The positive impact? Turnaround times shrink, error rates drop, and even reporting to regulators becomes less daunting, giving organizations a clear competitive edge.

-

Regulatory Compliance and Security Spurring Investment

Tougher data privacy regulations and tighter government oversight are pushing financial companies to modernize with robust, secure servicing software. Newer solutions deliver real-time automated compliance monitoring-essential for navigating fast-changing data governance rules and providing audit trails that keep institutions in good standing. In North America, where 40.2% of the loan servicing software market is concentrated, regulatory frameworks demand these capabilities even more. Vendors are adding advanced encryption, user access controls, and automated reporting tools, making it possible for banks and fintechs to meet government mandates without a significant spike in overhead. Security isn't just a nice-to-have anymore; it's a must, and that's rapidly fueling market growth.

-

Mobile-First Experience and Customer Expectations

With 5.61 billion unique mobile users (69.4% of the global population), people expect fast, anywhere-anytime access to loan management. In response, lenders are rolling out mobile-first, user-friendly software allowing borrowers to make payments, check balances, and even get real-time alerts from a smartphone. As digital-savvy customers lean heavily into these features, institutions are driven to modernize their servicing tools or risk losing relevance. Not only does this boost satisfaction, but it also cuts the cost and volume of support calls, with the added benefit of widening access in emerging economies. Loan servicing is now as much about user experience as backend efficiency.

Key Trends in the Loan Servicing Software Market

-

Rise of AI, Analytics, and Automation

Artificial intelligence and machine learning are going from buzzwords to everyday essentials in loan servicing. Around 94% of organizations now leverage AI/ML for lending risk assessments, with automation like robotic process automation (RPA) slashing operational costs by nearly one-third. Analytics let lenders predict delinquencies or cash flow issues early. For example, lenders using AI-driven tools report faster threat responses and smarter, data-backed loan servicing. These platforms detect fraud, automate document checks, and help underwrite and monitor loans with minimal human intervention, saving time and tightening risk management.

-

Integration with Broader Digital Ecosystems

Loan servicing software is no longer standalone. Institutions integrate these platforms with everything from core banking to CRM and digital wallet tools, thanks to robust APIs. In the U.S., mergers like Rocket Mortgage acquiring Mr. Cooper (servicing 7 million mortgages) show that scale and ecosystem integration are essential. These converged platforms support cross-border lending, asset-backed securities, and personalized customer journeys-benefits that attract banks, SMEs, and fintechs alike. The end result is a richer digital experience for both lenders and borrowers.

-

Cloud Dominance and Subscription-Based Models

Seventy percent of the loan servicing software market now relies on the cloud, with providers offering scalable, subscription-based pricing. Cloud-native platforms are popular for their speed, flexibility, disaster recovery, and low upfront infrastructure costs. Leading the way are major banks and fintech startups, but even smaller lenders appreciate that cloud platforms automatically update with regulatory changes. This makes software upkeep effortless and affordable, pushing rapid adoption. Subscription pricing lowers barriers for new entrants and smaller organizations, driving competition and encouraging ongoing innovation in the loan servicing landscape.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=6773&flag=E

Leading Companies Operating in the Loan Servicing Software Industry:

-

Altisource

Applied Business Software

Bryt Software LCC

C-Loans Inc.

Emphasys Software (Constellation Software)

Financial Industry Computer Systems Inc.

Fiserv Inc.

GOLDPoint Systems Inc.

Graveco Software Inc.

LoanPro

Nortridge Software LLC

Q2 Software Inc. (Q2 Holdings Inc.)

Shaw Systems Associates LLC.

Loan Servicing Software Market Report Segmentation:

By Component :

-

Software

Services

The loan servicing software market is primarily composed of software and services, with software being the largest segment.

By Deployment Mode:

-

On-premises

Cloud-based

The market analysis reveals that cloud-based deployment holds the largest market share compared to on-premises solutions.

By Enterprise Size:

-

Large Enterprises

Small and Medium-sized Enterprises

Large enterprises dominate the loan servicing software market, as highlighted in the analysis of enterprise size.

By End User:

-

Banks

Credit Unions

Mortgage Lenders and Brokers

Others

Banks represent the largest segment among end users in the loan servicing software market, followed by credit unions and mortgage lenders.

Regional Insights:

-

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America, driven by growth in the BFSI sector and technology integration, is the largest market for loan servicing software, encompassing the United States and Canada, along with other global regions.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment