What Is The Brazil Construction Market Size And Forecast (20252033)?

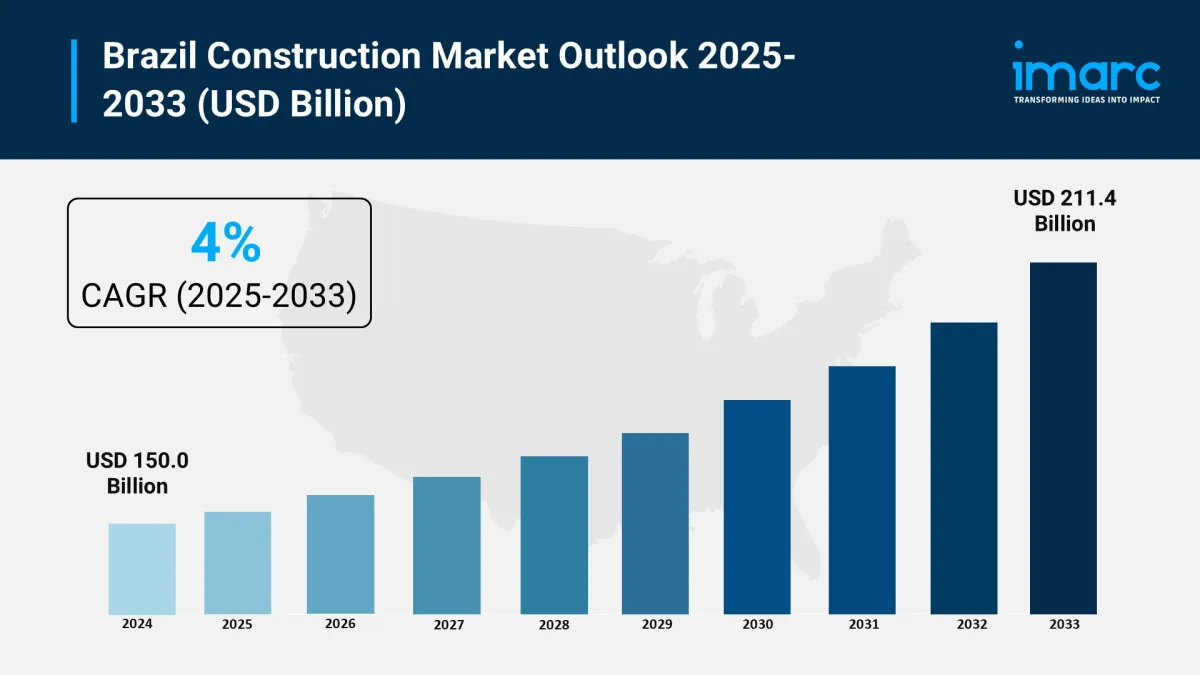

The Brazil construction market size hit USD 150.0 billion in 2024. IMARC Group predicts it will grow to USD 211.4 billion by 2033, with a 4% CAGR from 2025 to 2033. Key drivers include infrastructure development, urbanization, demand for properties, government initiatives, and tech advancements.

Key Highlights:

-

Market Size in 2024: USD 150.0 Billion

Market Forecast in 2033: USD 211.4 Billion

Market Growth Rate (2025-2033): 4%

Drivers of Growth:

-

Robust Infrastructure Investment: The Growth Acceleration Program (Novo PAC) and public-private partnerships are boosting spending on transportation, energy, and urban infrastructure.

Urbanization & Housing Demand: Rapid urban growth in cities like São Paulo and Rio de Janeiro, along with government housing programs, is increasing demand for affordable and mid-range homes.

Sustainability & Green Building Trends: More builders are adopting eco-friendly practices, including green materials and energy-efficient designs, driven by regulations and consumer preferences.

Technological Innovation Adoption: Digital tools like BIM (Building Information Modeling) and drones are enhancing efficiency and cost control.

Volumetric Construction Growth: The modular construction segment is expanding, with revenues rising from USD 183.8 million in 2024 to USD 289.8 million by 2030 , a CAGR of 7.9% .

Economic Setbacks & Recovery Expectations: The sector faced a –2.8% decline in 2024 due to inflation and weak demand but is expected to grow by ~3.2% annually from 2025 to 2028 .

Artificial Intelligence (AI) is transforming Brazil's construction market. It enhances project planning, resource optimization, and operational efficiency. AI tools analyze data to predict risks, reduce delays, and control costs. Technologies like machine learning and computer vision boost safety, automate tasks, and promote sustainable practices.

Key Points:

-

Predictive Analytics: AI predicts risks and timelines, improving planning.

Resource Optimization: Smart algorithms allocate materials and labor efficiently.

Enhanced Safety: Monitoring tools identify hazards and ensure safety compliance.

Automation of Tasks: Robotics and AI reduce manual labor, increasing productivity.

Sustainable Practices: AI supports eco-friendly designs and energy-efficient methods.

Improved Decision-Making: Real-time data analysis speeds up responses to challenges.

The Brazil construction market is growing due to rising infrastructure investments, urbanization, and government housing initiatives. Increased foreign direct investment (FDI) and public-private partnerships (PPPs) are accelerating highway, port, and renewable energy projects. Advanced technologies like BIM and prefabrication are enhancing efficiency and reducing costs. The demand for sustainable building solutions is also shaping the market.

Key Trends and Drivers:

-

Government Infrastructure Programs: More funding for roads, railways, and airports to drive growth.

Urbanization and Housing Demand: Population growth in cities is spurring residential projects.

Public-Private Partnerships (PPPs): Collaborations boost project execution.

Technological Adoption: BIM and automation improve efficiency.

Green Building Initiatives: Focus on sustainable materials and practices.

Foreign Direct Investment (FDI): Strong inflow supports large projects.

Renewable Energy Development: Rapid growth in solar and wind facilities.

Sector Insights:

For more information, Request Sample

-

Commercial Construction

Residential Construction

Industrial Construction

Infrastructure (Transportation) Construction

Energy and Utility Construction

The report details the market by sector, covering commercial, residential, industrial, infrastructure, and energy construction.

Regional Insights:

-

Southeast

South

Northeast

North

Central-West

The report analyzes major regional markets, including Southeast, South, Northeast, North, and Central-West.

Latest Developments in the Industry:-

June 2025: Brazil launched a USD 10 billion plan to fund over 120 roads, ports, and waterways, boosting contracts and attracting investments.

May 2025: Brazil partnered with Russia's Rosatom to build small modular nuclear reactors, enhancing energy infrastructure in the Amazon.

March 2025: Gerdau opened a new steel line in Minas Gerais, adding 230,000 tons of capacity and supporting local supply.

September 2024: Entrevias began constructing a 2.4 km bridge over the Tiete River, enhancing regional transport and creating jobs.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=14101&flag=C

About Us:

IMARC Group is a global management consulting firm that helps changemakers make a lasting impact. We offer market entry services, feasibility studies, regulatory navigation, and more.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment