How Fast Is The Brazil E-Commerce Market Expected To Grow By 2033?

Download a sample copy of the report: https://www.imarcgroup.com/brazil-e-commerce-market/requestsample

Key Highlights

-

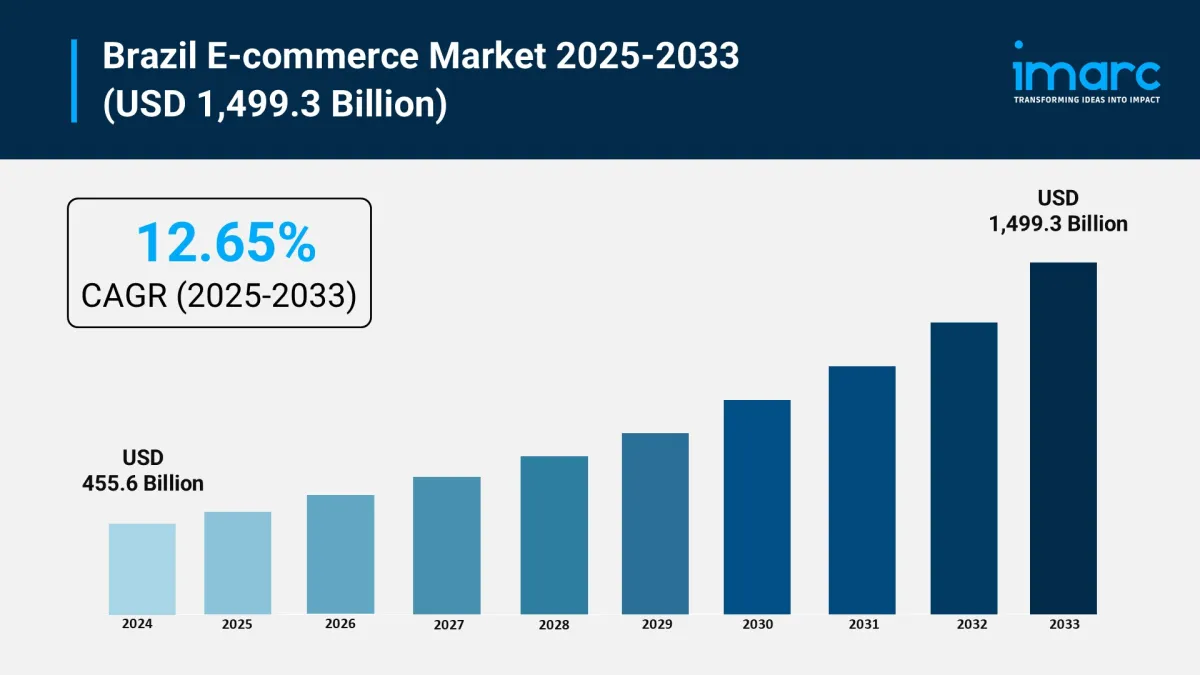

Market size (2024): USD 455.6 Billion

Forecast (2033): USD 1,499.3 Billion

CAGR (2025–2033): 12.65%

The Pix payment system is revolutionizing the market, accounting for nearly 30% of all e-commerce transactions.

A mobile-first shift, fueled by high smartphone penetration, is driving growth in m-commerce.

Key companies operating in the Brazilian e-commerce market include Amazon.com Inc., Apple Inc., KaBuM! (Magazine Luiza S.A.), MadeiraMadeira Comércio Eletrônico S/A, Magazine Luíza S.A., Shopee Pte. Ltd. (Sea Limited), etc.

How Is the Pix Payment System Transforming the E-commerce Market in Brazil?

The instant payment platform is being integrated into online retail to deliver:

-

Real-time transaction confirmation, eliminating the multi-day processing time of traditional 'boleto bancário' payments.

Greater financial inclusion allows millions of consumers without credit cards to participate seamlessly in the digital economy.

Reduced operational costs for merchants through zero or low-fee transactions, encouraging more small businesses to sell online.

An enhanced user experience, offering a simple, secure, and fast checkout process that boosts conversion rates, especially on mobile devices.

Key Market Trends and Drivers

-

Advancements in Digital Payments: The rapid and widespread adoption of Pix is making online payments more accessible, secure, and efficient, replacing older, slower methods.

Rising Smartphone & Internet Penetration: Increasing connectivity and high smartphone ownership are enabling more consumers, particularly outside major urban centers, to access online marketplaces.

Logistical Improvements: Significant investments in last-mile delivery, fulfillment centers, and logistics technology are reducing shipping times and improving the overall customer experience.

Growing Consumer Confidence: A growing preference for the convenience of online shopping, coupled with better security and service, is driving repeat purchases and market expansion.

Supportive Government Initiatives: Government efforts to improve digital infrastructure and formalize the digital economy are creating a favorable environment for e-commerce growth.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=14181&flag=C

Market Segmentation

The report has segmented the market into the following categories:

Breakup by Type:

-

B2C E-Commerce

-

Beauty and Personal Care

Consumer Electronics

Fashion and Apparel

Food and Beverage

Furniture and Home

Others

Breakup by Region:

-

Southeast

South

Northeast

North

Central-West

Brazil E-commerce Market News:

-

In April 2026, Mercado Livre announced a landmark investment plan for its Brazilian operations, allocating funds to build new hyper-local fulfillment centers and expand its dedicated cargo fleet to guarantee same-day delivery across 20 major cities.

At the Brazil E-commerce Summit in July 2026, the Central Bank of Brazil is expected to launch 'Pix Garantido,' a feature enabling installment payments via Pix, which is poised to challenge the long-standing dominance of credit cards for high-value online purchases.

The market continues to see intensified competition from cross-border platforms, with players like Shopee and Shein investing heavily in localizing their operations and logistics to capture a larger share of Brazil's burgeoning online consumer base.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment