India Toothpaste Market 2025: Size, Share, Growth, Top Brands, Demand And Forecast Report By 2033

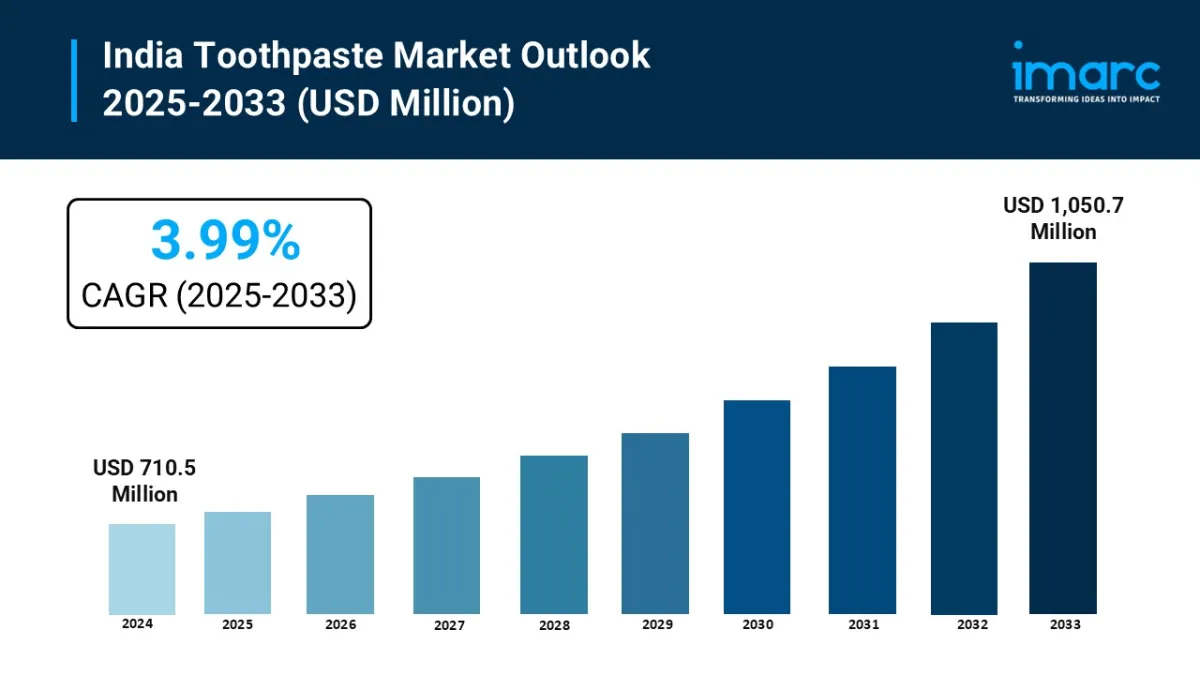

India's toothpaste market was valued at USD 710.5 million in 2024 and is forecast to reach USD 1,050.7 million by 2033 , reflecting a CAGR of 3.99% during 2025–2033 . Growth is supported by rising oral-hygiene awareness across urban and semi-urban consumers, continued product innovation (herbal/natural, sensitivity, whitening), and expanding e-commerce/modern retail that improves assortment and availability. Aggressive brand marketing and frequent new launches further catalyze category penetration and premiumization.

Key Highlights-

Market size (2024): USD 710.5 million .

Forecast (2033): USD 1,050.7 million .

CAGR (2025–2033): 3.99% .

Growth contributors:

-

Rising awareness of preventive dental care and treatment of sensitivity/whitening needs.

Strong innovation pipeline, including herbal/natural and multifunctional formulations.

Rapid e-commerce expansion improving access and price comparison.

Sustained mass-media advertising and celebrity-led campaigns boosting brand salience.

Get instant access to a free sample copy and explore in-depth analysis: https://www.imarcgroup.com/india-toothpaste-market/requestsample

How Is AI Transforming the Toothpaste Market in India?-

Demand forecasting & predictive analytics: AI tools analyze sales patterns and seasonal demand to optimize stock levels for different variants (herbal, whitening, sensitive) across regions.

Marketing optimization: Machine learning refines ad targeting, helping brands run high-ROI campaigns on TV, social media, and e-commerce platforms.

Smart retail integrations: AI-powered shelf tracking in modern trade ensures products remain in stock and supports dynamic pricing to boost sales.

Personalization: Online retailers use AI recommendation engines to suggest toothpaste variants based on past purchases and user concerns, improving conversion rates.

-

Preventive care focus: Consumers increasingly seek solutions for sensitivity, whitening, and gum protection, elevating demand for specialized SKUs.

Herbal/natural shift: Continued traction for neem/clove/charcoal and ayurvedic propositions within mass and premium segments.

E-commerce acceleration: Online platforms broaden reach, enable price discovery, and support rapid launches/limited editions.

Aggressive marketing cadence: Category growth supported by frequent celebrity-driven campaigns and thematic launches.

Product innovation: Multifunctional pastes (breath freshening + enamel/gum care) and kid-safe formulations expand use cases.

Regional tailoring: Premium/specialized demand skewing urban/North & South; value/economy formats sustaining rural uptake.

Explore the Full Report with Charts, Table of Contents, and List of Figures: https://www.imarcgroup.com/india-toothpaste-market/requestsample

Market SegmentationBy Type

By Distribution Channel

By End User

Regional Insights-

North India

West & Central India

South India

East & Northeast India

-

Colgate-Palmolive (India) launched Colgate Active Salt (April 2024), reinforcing its mass-premium proposition and salt-based functional positioning.

Dabur Herb'l rolled out a limited-edition Star Wars pack for its Activated Charcoal Toothpaste (May 2024), leveraging pop-culture IP to drive engagement and trial.

Patanjali Dant Kanti unveiled Fresh Active Gel with a high-visibility celebrity TVC (July 2024), underscoring the push toward natural/ayurvedic gels with freshness cues.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment