India Soap Market Size, Share, Trends, Industry Growth And Analysis Report 20252033

Key Highlights:

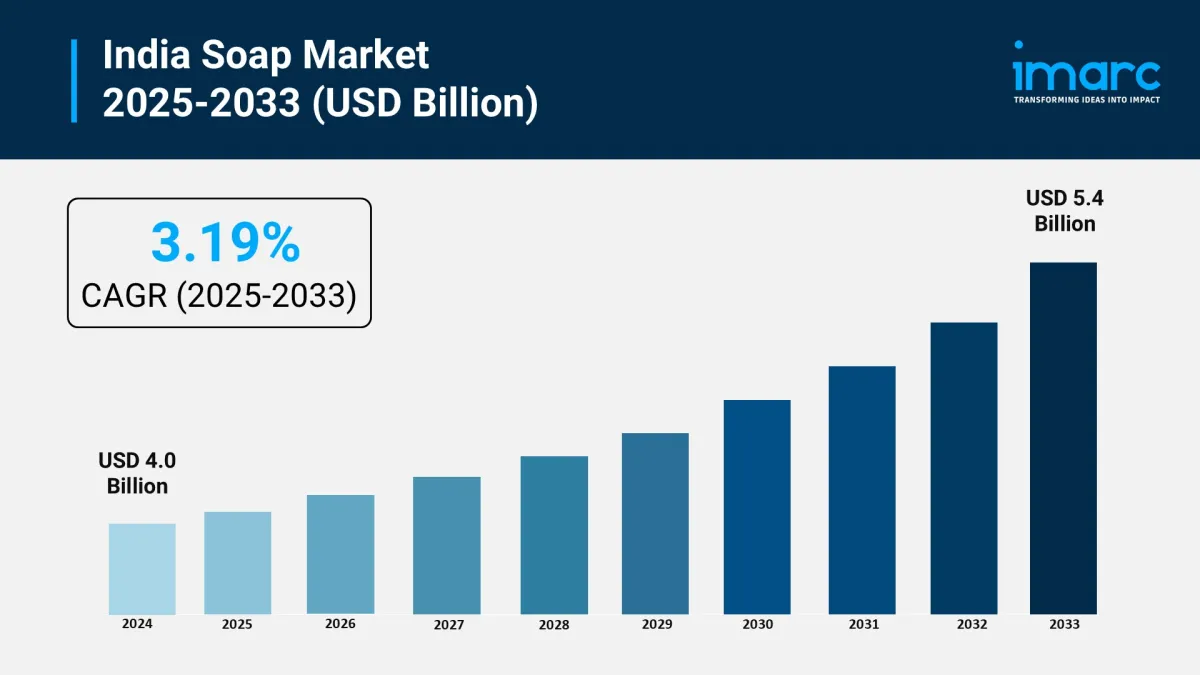

. 2024 Market Size: USD 4.0 Billion

. 2033 Forecast Size: USD 5.4 Billion

. CAGR (2025–2033): 3.19%

. Rising consumer preference for organic and natural ingredients in soaps

. Expansion of online and modern retail distribution channels

. Growing demand for specialized soaps catering to skin care and hygiene needs

. Continuous product innovation and aggressive marketing by major FMCG brands

Get Free Sample Report: https://www.imarcgroup.com/india-soap-market/requestsample

How Is AI Transforming the Market?

AI is supporting the soap market through demand forecasting, targeted advertising, and personalized product recommendations. Machine learning tools analyze consumer purchase patterns to guide product launches and optimize inventory. AI-driven formulation development is enabling the creation of soaps with tailored skin benefits, while AI-powered supply chain management is improving production efficiency and reducing waste.

Key Market Trends and Drivers:

. Increasing adoption of organic and chemical-free soap products

. Growth of premium bath and beauty soap segments

. Rising health and hygiene consciousness post-pandemic

. Expansion of rural market penetration through localized marketing strategies

. Surge in e-commerce and D2C (direct-to-consumer) sales for soap brands

Explore the Full Report with Charts, Table of Contents, and List of Figures: https://www.imarcgroup.com/india-soap-market

Market Segmentation:

By Type:

. Organic

. Conventional

By Form:

. Liquid

. Solid

. Others

By Product:

. Bath Soap

. Kitchen Soap

. Medicated Soap

. Laundry Soap

. Others

By Distribution Channel:

. Supermarkets and Hypermarkets

. Convenience Stores

. Pharmacies

. Online Stores

. Others

By Region:

. North India

. West and Central India

. South India

. East India

Competitive Landscape:

. Colgate Palmolive (India) Ltd.

. Godrej Consumer Products Limited

. Himalaya Wellness Company

. Hindustan Unilever Limited

. ITC Limited

. Jyothy Laboratories Ltd.

. Karnataka Soaps and Detergents Limited

. Patanjali Ayurved Limited

. Reckitt Benckiser (India) Ltd.

. Wipro Consumer Care & Lighting

Latest Developments:

. Leading FMCG companies expanding organic and herbal soap portfolios

. Strategic partnerships with e-commerce platforms for wider distribution

. Introduction of eco-friendly packaging solutions in soap products

. Increased investment in dermatologically tested and skin-specific soap formulations

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment