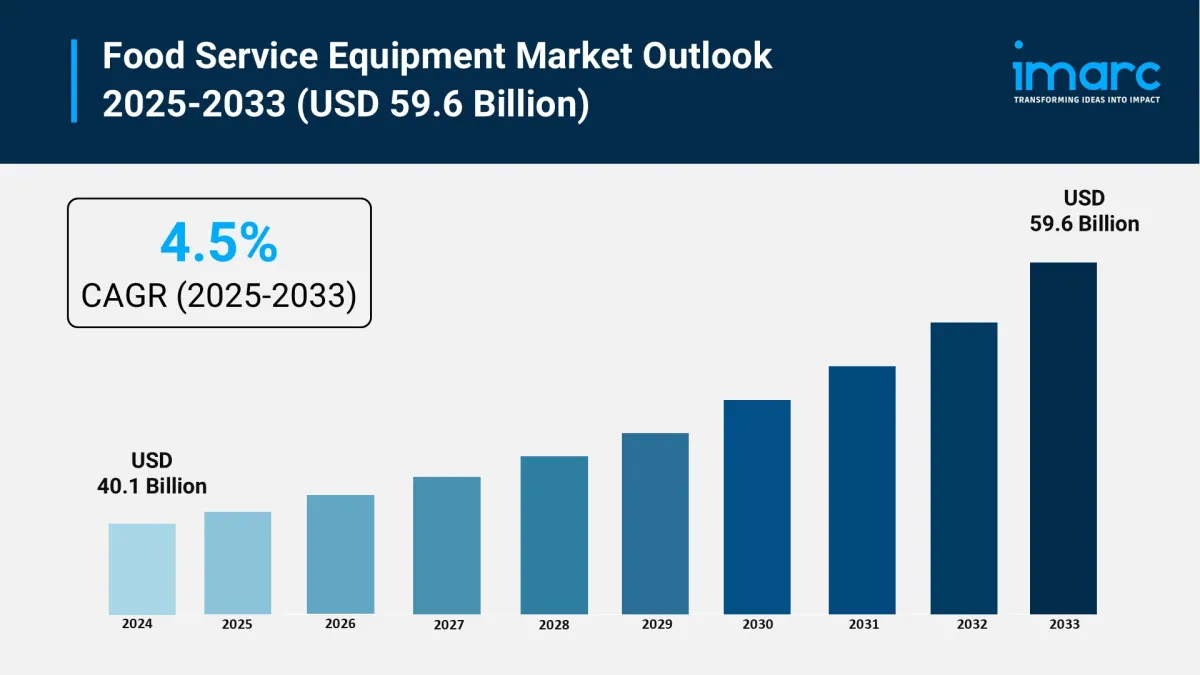

Food Service Equipment Market Size To Hit USD 59.6 Billion By 2033 With A 4.5% CAGR

The food service equipment market is experiencing rapid growth, driven by Booming Foodservice Industry, Focus on Energy Efficiency and Rise of Automation and Smart Technology. According to IMARC Group's latest research publication, “Food Service Equipment Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033” The global food service equipment market size reached USD 40.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 59.6 Billion by 2033, exhibiting a growth rate (CAGR) of 4.5% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/food-service-equipment-market/requestsample

Our report includes:

-

Market Dynamics

Market Trends And Market Outlook

Competitive Analysis

Industry Segmentation

Strategic Recommendations

Growth Factors in the Food Service Equipment Industry:

-

Booming Foodservice Industry

The foodservice sector is witnessing significant expansion, with global restaurant sales reaching USD 3.8 trillion. Quick-service restaurants, which constitute 42% of the market, depend on high-performance fryers and grills to cater to increasing customer demand. The recent acquisition of Welbilt by Middleby Corporation for USD 55 million enhances its offerings, now serving 32% of U.S. fast-food chains. Initiatives like India's PMFME scheme, allocating INR 12,000 crore, are empowering small food enterprises and driving equipment investments. With urban populations at 58%, there is a growing need for space-efficient, high-capacity equipment in restaurants and cafes, particularly in the Asia-Pacific region, which holds a 48% market share, propelling strong market growth.

-

Focus on Energy Efficiency

Restaurants and hotels are increasingly prioritizing energy-efficient appliances to reduce operating costs, with 65% of operators seeking ENERGY STAR-certified products. These appliances can lower energy consumption by 30%, translating to annual savings of USD 600 per unit. The EU's Ecodesign Directive mandates stringent energy standards, leading to increased adoption in Europe, which captures 32% of the market. Manitowoc's latest eco-friendly ice machines, utilized in 25% of global hotels, have been shown to reduce energy expenses by 18%. Government incentives, such as the U.S. EPA's USD 250 million fund for sustainable upgrades, are encouraging investments. As utility costs rise, energy-efficient ovens and refrigeration systems are becoming crucial, driving demand in commercial kitchens worldwide.

-

Rise of Automation and Smart Technology

Automation is revolutionizing the foodservice industry, with 55% of large chains implementing smart technologies for enhanced operational efficiency. Automated fryers and robotic food preparation systems can increase output by 35%, addressing labor shortages that affect 75% of U.S. restaurants. Ali Group's AI-driven combi ovens, found in 20% of European kitchens, enhance cooking accuracy and consistency. Government initiatives, such as China's USD 200 billion digital economy strategy, are facilitating smart technology adoption in 30% of Asia-Pacific restaurants. With 85% of operators emphasizing the importance of real-time data for inventory management and maintenance, smart equipment is becoming essential, driving market growth in bustling foodservice environments globally.

Key Trends in the Food Service Equipment Market:

-

Smart Kitchen Appliances

Smart kitchen technologies, now utilized by 55% of large restaurants, are transforming operations through real-time monitoring and analytics. Rational's iCombi Pro, employed in 25% of global fine-dining establishments, utilizes AI to optimize cooking processes, reducing energy usage by 12%. These systems are integrated with IoT for efficient inventory management, resulting in a 20% reduction in food waste. In the Asia-Pacific region, which holds a 48% market share, smart grills and ovens are enhancing operational efficiency for 35% of quick-service outlets. Government programs, such as Japan's USD 60 billion digital transformation initiative, are promoting the adoption of smart technology in 30% of urban cafes, further driving this trend.

-

Compact and Modular Equipment

Compact and modular equipment is increasingly popular, utilized by 45% of urban food establishments, as it fits seamlessly into limited spaces in densely populated areas. Electrolux's innovative modular prep stations, adopted by 20% of European cafes, optimize space and enhance output by 25%. With 58% of the global population residing in urban areas, the demand for adaptable fryers and grills is on the rise. The PMFME scheme in India, with a budget of INR 12,000 crore, is boosting equipment sales among small food businesses. These modular solutions allow for customization, reducing setup costs by 15% for food trucks and temporary dining setups, catering to the fast-paced urban market.

-

Sustainable and Eco-Friendly Designs

Sustainability remains a key focus, with 65% of operators opting for eco-friendly equipment. Hobart's green dishwashers, used in 30% of U.S. hotels, reduce water consumption by 35%, aligning with the EU's Ecodesign regulations. Restaurants can save USD 450 per unit annually on utility costs. Brazil's USD 120 million sustainability grants are encouraging adoption in 25% of Latin American kitchens. With 75% of consumers favoring environmentally friendly brands, eco-conscious refrigeration and cooking appliances are gaining popularity. This trend not only supports environmental initiatives but also contributes to cost savings, driving demand across the global foodservice sector.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=4280&flag=E

Leading Companies Operating in the Global Food Service Equipment Industry:

-

AB Electrolux

Ali group s.r.l. a socio unico

Alto-Shaam Inc.

Cambro Manufacturing

Comstock-Castle Stove Co. Inc

Dover Corporation

Duke Manufacturing

Illinois Tool Works Inc.

The Middleby Corporation

Welbilt

Food Service Equipment Market Report Segmentation:

Breakup By Product Type:

-

Cooking Equipment

Storage and Handling Equipment

Warewashing Equipment

Food and Beverage Preparation Equipment

Serving Equipment

Cooking equipment represents the largest segment due to the indispensable role of cooking in food service operations.

Breakup By Distribution Channel:

-

Online

Offline

Offline holds the biggest market share owing to its extensive reach, wide product selection, and competitive pricing.

Breakup By End Use:

-

Full-service Restaurants and Hotels

Quick-service Restaurants and Pubs

Catering

Full-service restaurants and hotels exhibit a clear dominance in the market, as these establishments cater to a broad spectrum of people, ranging from individuals seeking fine dining experiences to corporate clients hosting events or conferences.

Breakup By Region:

-

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America enjoys the leading position in the food service equipment market on account of a thriving foodservice industry characterized by a diverse array of restaurants, cafes, hotels, and other establishments.

Research Methodology:

The report employs a comprehensive research methodology , combinin g primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliabili t y.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment