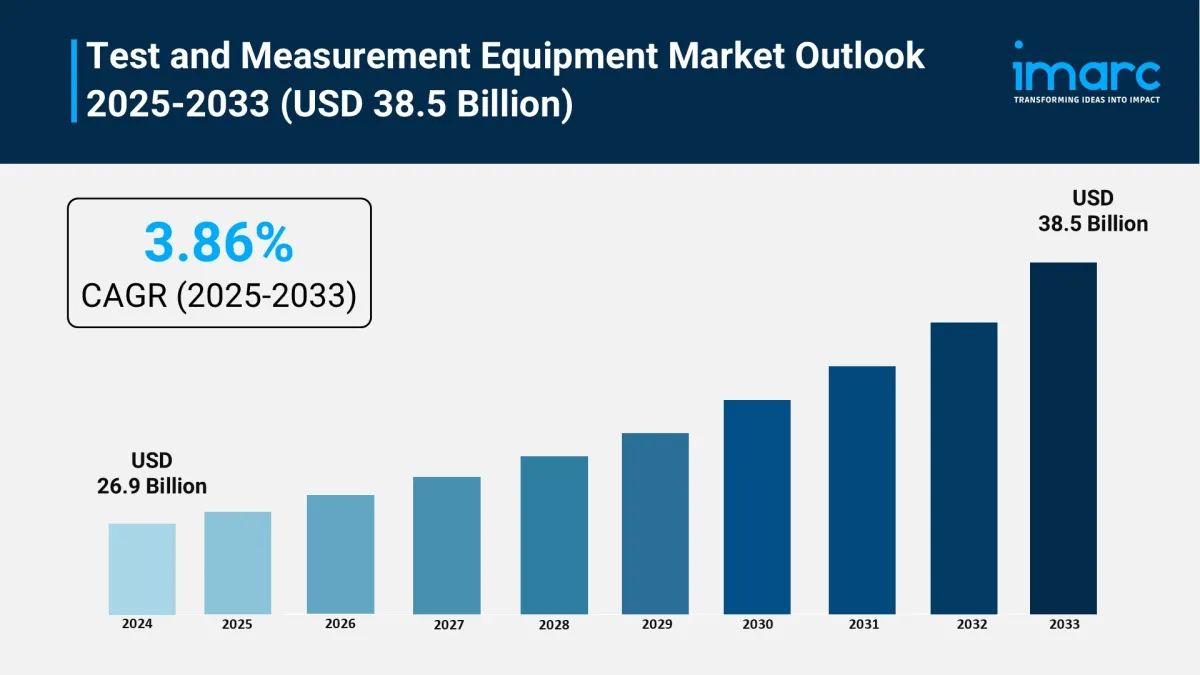

Test And Measurement Equipment Market Size To Surpass USD 38.5 Billion By 2033 Exhibiting CAGR Of 3.86%

The Test and Measurement Equipment Market is experiencing steady growth, driven by Rising Demand for Advanced Electronics Testing, Expansion of 5G Networks, and Increasing Adoption of IoT Devices. According to IMARC Group's latest research publication, “Test and Measurement Equipment Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033” The global test and measurement equipment market size reached USD 26.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 38.5 Billion by 2033, exhibiting a growth rate (CAGR) of 3.86% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/test-measurement-equipment-market/requestsample

Our Report Includes:

-

Market Dynamics

Market Trends and Market Outlook

Competitive Analysis

Industry Segmentation

Strategic Recommendations

Growth Factors in the Test and Measurement Equipment Industry:

-

Rising Demand for Advanced Electronics Testing

The increasing complexity of consumer electronics, automotive systems, and industrial automation is significantly driving the demand for advanced test and measurement solutions. Manufacturers are now relying on sophisticated instruments such as oscilloscopes, signal analyzers, and protocol analyzers to ensure product reliability, safety, and compliance with international standards. Enhanced testing capabilities also facilitate accelerated product development cycles, enabling companies to innovate while minimizing time-to-market. For example, high-speed testing equipment is critical in the creation of next-generation semiconductor components. This growing reliance on precise testing, fueled by trends in miniaturization and heightened performance expectations, positions test and measurement tools as essential enablers across various high-tech sectors.

-

Expansion of 5G Networks

The global deployment of 5G technology is generating substantial demand for high-precision test and measurement instruments. Telecom operators, device manufacturers, and network providers require specialized tools to validate 5G infrastructure, assess high-frequency signals, and ensure optimal low-latency performance. These testing systems are crucial for enhancing network coverage, maintaining service quality, and supporting new 5G-enabled applications such as smart cities and telemedicine. As 5G testing demands higher bandwidth and intricate signal analysis, equipment manufacturers are rapidly innovating to address these challenges. This trend is anticipated to accelerate as more regions expand their 5G networks in the coming years.

-

Increasing Adoption of IoT Devices

The rapid proliferation of IoT devices across smart homes, healthcare, manufacturing, and logistics sectors has escalated the need for testing at both device and network levels. IoT ecosystems require testing equipment capable of measuring connectivity performance, energy efficiency, signal integrity, and adherence to wireless communication standards. As IoT applications become increasingly critical-such as in telehealth or automated factories-precision and reliability in testing are essential. Manufacturers are investing in versatile testing solutions to streamline research and development as well as production processes, ensuring smooth integration of IoT devices into larger networks. This surge in IoT-related demand is a significant growth driver for the market.

Key Trends in the Test and Measurement Equipment Market:

-

Shift Toward Modular and Portable Testing Solutions

An increasing number of industries are adopting modular and portable testing equipment to lower costs, enhance flexibility, and facilitate on-site diagnostics. Modular systems enable organizations to customize configurations for specific tasks, while portable devices support field testing in telecommunications, aerospace, and energy sectors. This transition helps minimize downtime, speed up maintenance, and boost operational efficiency. Furthermore, advancements in wireless technology and cloud connectivity are allowing portable devices to transmit real-time testing data for remote analysis. This capability not only accelerates troubleshooting but also enables global teams to collaborate on complex projects without needing to be physically present, further enhancing productivity.

-

Integration of AI and Machine Learning in Testing

AI-driven analytics are increasingly being incorporated into test and measurement systems to facilitate real-time fault detection, predictive maintenance, and automated testing processes. This integration improves accuracy, reduces human error, and accelerates testing timelines, particularly in fields such as semiconductor production and telecommunications. Machine learning algorithms can detect performance anomalies that traditional testing methods may miss, ensuring greater product reliability. Additionally, AI-enhanced systems can self-adjust testing parameters based on historical data, minimizing the need for repetitive manual calibration. This results in quicker product validation cycles, reduced operational expenses, and enhanced consistency in meeting stringent quality standards across various industries.

-

Growth in Automotive Testing for EV and ADAS

The swift adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) is driving a significant demand for specialized testing solutions. These include high-voltage battery testers, radar signal analyzers, and simulation platforms for autonomous driving scenarios. As safety regulations for EVs and self-driving cars become more stringent, manufacturers and suppliers are heavily investing in advanced testing facilities and simulation environments. Additionally, vehicle-to-everything (V2X) communication testing is becoming increasingly important to ensure seamless interaction between vehicles and surrounding infrastructure. The growing complexity of in-vehicle electronics is also fueling demand for integrated testing platforms that can validate multiple systems concurrently, thus shortening development timelines and ensuring compliance with regulatory standards.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=2596&flag=E

Leading Companies Operating in the Global Test and Measurement Equipment Industry:

-

Advantest Corporation

Anritsu Corporation

EXFO Inc.

Fortive

Keysight Technologies, Inc.

National Instruments Corporation

Rohde & Schwarz GmbH & Co. KG

Teledyne Technologies Incorporated

Texas Instruments Incorporated

VIAVI Solutions Inc.

Yokogawa Electric Corporation.

Test and Measurement Equipment Market Report Segmentation:

Breakup By Product:

-

General Purpose Test Equipment (GPTE)

Oscilloscopes

Signal Generators

Multimeters

Logic Analyzers

Spectrum Analyzers

Bert (Bit Error Rate Test)

Network Analyzers

Others

Mechanical Test Equipment (MTE)

Non-Destructive Test Equipment

Machine Vision Inspection

Machine Condition Monitoring

General purpose test equipment (GPTE) account for the majority of shares as it performs a wide range of testing functions, accommodating diverse applications from electronics to telecommunications.

Breakup By Service Type:

-

Calibration Services

Repair Services/After-Sales Services

Repair services/after-sales services dominate the market due to the increasing complexity and sophistication of products in various industries.

Breakup By End Use Industry:

-

Automotive and Transportation

Aerospace and Defense

IT and Telecommunication

Education

Semiconductor and Electronics

Others

Automotive and transportation represent the majority of shares because of the rising need for efficient and sustainable transportation options.

Breakup By Region:

-

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America enjoys the leading position owing to a large market for test and measurement equipment driven by favorable government initiatives.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment