J&K Bank Holds Camp Under 'Saturation Campaign For Financial Inclusion'

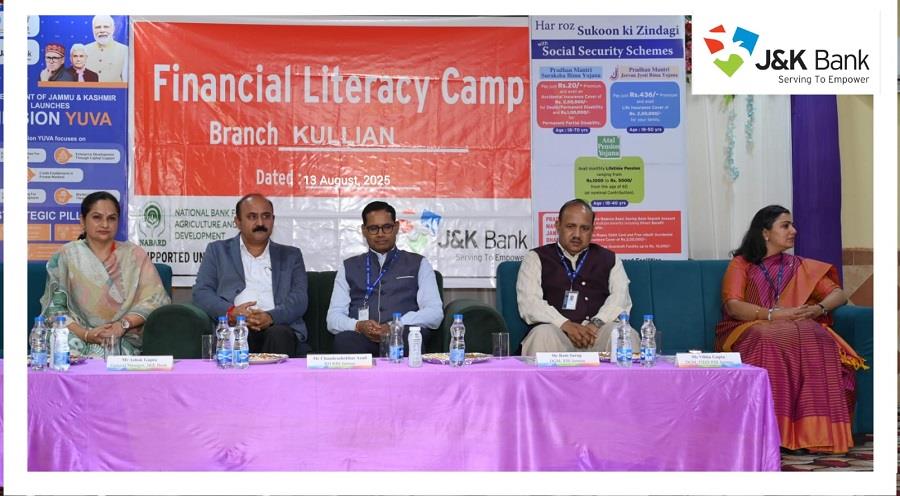

Regional Director (RBI – Jammu) Chandrashekhar Azad was the Chief Guest, while General Manager & Divisional Head (Jammu) Ashok Gupta presided over the function that was attended by DGM FIDD (RBI-Jammu) Vibha Gupta, Zonal Head (Jammu) Anita Nehru, DGM (RBI Jammu) Ram Sarup, senior officials from the Bank and the RBI besides a large number of people from the area.

Addressing the participants, Regional Director Chandrashekhar Azad appreciated the Bank's sustained efforts. He emphasized the importance of completing Re-KYC in a timely manner to ensure uninterrupted access to banking services - one of the key objectives of the ongoing campaign. He also cautioned the public against falling prey to digital frauds and urged them to adopt safe banking habits.

While highlighting the grievance redressal mechanisms available for prompt resolution of banking issues, he said that financial inclusion is about ensuring continued and safe access to banking services, for which timely completion of Re-KYC, alertness against fraud and proper use of grievance redressal channels are very important.

Later, the Regional Director visited stalls set up by various banks and financial institutions, interacting with beneficiaries and urging the public to take maximum advantage of the services and facilities available under the campaign.

Read Also J&K Bank Opens Centralised Processing Centre In Srinagar For Customer Ease J&K Bank MD Inaugurates Centralized Processing Centre at Zonal Office DelhiEarlier, welcoming the participants, Divisional Head Ashok Gupta reiterated the Bank's commitment to driving financial inclusion across its operational geographies. He said,“At J&K Bank, financial inclusion is not just about opening accounts – it is a mission of empowering people with access to the entire range of banking services that can improve their livelihoods and secure their future. Through such camps, we aim to bridge the gap between banking services and the people, ensuring that every individual, household, and enterprise has access to formal finance.”

“We are fully committed to complementing RBI's vision by reaching every household with our inclusive and customer-friendly offerings”, he added.

On the occasion, Chief Manager Suresh Gupta presented a brief overview of various Financial Inclusion schemes, while AGM (RBI Jammu) Rajnesh Mahotra shared RBI's perspective on financial inclusion and its role in improving economic conditions of people at the grass root level.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment