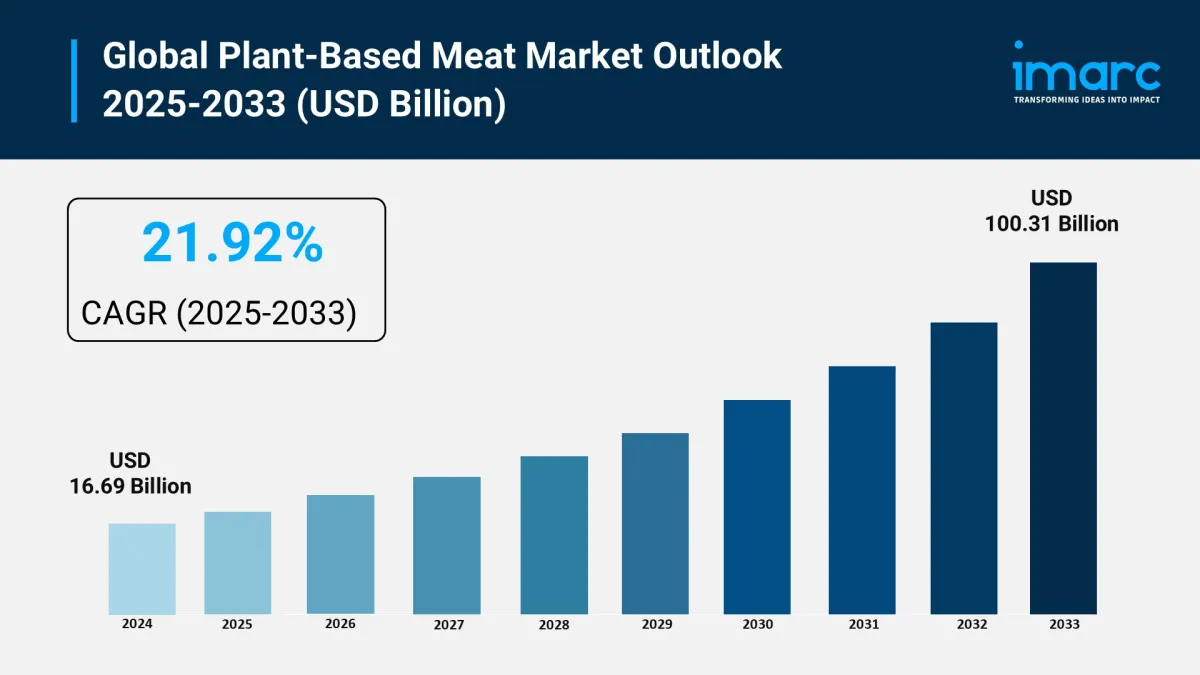

Global Plant-Based Meat Market Report 2025: Size Projected USD 100.31 Billion, CAGR Of 21.92% By 2033.

The global plant-based meat market was valued at USD 16.69 Billion in 2024 and is projected to reach USD 100.31 Billion by 2033 , expanding at a remarkable CAGR of 21.92% during 2025–2033 , according to IMARC Group. This exceptional growth is driven by increasing health-consciousness, rising demand for sustainable protein alternatives, and rapid advancements in food technology. The market is gaining momentum as consumers embrace flexitarian and vegan diets, and as major foodservice chains integrate plant-based options into their menus. Enhanced taste, texture, and nutritional profiles of plant-based meat products are making them a mainstream choice across global markets.

Request Free Sample Report– https://www.imarcgroup.com/plant-based-meat-market/requestsample

Key Stats

-

Market Value (2024): USD 16.69 Billion

Projected Value (2033): USD 100.31 Billion

CAGR (2025–2033): 21.92%

Leading Segment (2025): Burger patties anticipated to dominate due to strong demand in retail and quick-service restaurants

Key Regions: North America (largest), Asia Pacific (fastest-growing)

Top Companies: Beyond Meat, Impossible Foods, Amy's Kitchen, Maple Leaf Foods, Quorn Foods, MorningStar Farms, The Vegetarian Butcher, Vbites, and others

Growth Drivers

Health and Wellness Trends – Rising awareness of the health risks linked to high red meat consumption, such as cardiovascular diseases and obesity, is boosting demand for plant-based proteins. Clean-label, non-GMO, and fortified plant-based products are attracting health-conscious consumers. Sustainability and Ethical Consumption – Plant-based meat offers a significantly lower carbon footprint compared to traditional meat. Growing consumer concern over climate change, deforestation, and animal welfare is accelerating adoption. Technological Advancements – Innovations such as high-moisture extrusion, fermentation technology, and AI-driven ingredient optimization are enabling products that closely mimic traditional meat in flavor, texture, and nutrition. Retail and Foodservice Expansion – Increased shelf space in supermarkets, partnerships with fast-food giants, and the growing role of e-commerce channels are boosting accessibility and visibility.AI and Technology Impact

Artificial intelligence and data analytics are revolutionizing product development in the plant-based meat sector. Companies are using AI to:

-

Optimize ingredient combinations for better flavor, texture, and nutritional value.

Enhance processing efficiency with automation in extrusion and fermentation methods.

Personalize product offerings by analyzing consumer feedback and dietary trends.

In addition, sustainable protein innovations such as mycoprotein, mung bean protein, and pea protein are gaining momentum, supported by improved packaging technologies to extend shelf life without preservatives.

Contact Out Analysts for Brochure Requests, Customization, and Inquiries Before Purchase: https://www.imarcgroup.com/request?type=report&id=2198&flag=C

Segmental Analysis

By Product Type:

-

Burger Patties – Expected to lead due to popularity in both retail and restaurant channels.

Sausages – Growing demand in European and North American markets.

Nuggets & Strips – Strong adoption among younger consumers.

Ground Meat, Meatballs, Others – Expanding product portfolios catering to global cuisines.

By Meat Type:

-

Chicken Alternatives – Leading segment due to high versatility.

Beef Alternatives – Driven by environmental concerns and culinary diversity.

Pork and Others – Gaining traction in Asian markets.

By Source:

-

Soy – Dominates due to protein quality and functional versatility.

Peas – Fastest-growing source driven by allergen-free demand.

Wheat and Others – Expanding for specialized diets.

By Distribution Channel:

-

Supermarkets & Hypermarkets – Largest share due to product variety and accessibility.

Restaurants & Catering – Rapidly expanding with QSR partnerships.

Online Retail – Fastest growth due to direct-to-consumer strategies.

Convenience & Specialty Stores – Catering to niche and premium consumers.

Regional Insights

-

North America: Largest market, fueled by strong retail presence, high consumer awareness, and leading food tech innovations.

Asia Pacific: Fastest-growing region, driven by urbanization, dietary shifts, and government sustainability initiatives in China, India, and Australia.

Europe: Mature market with strong demand for premium and organic plant-based products.

Latin America: Rising adoption supported by health awareness campaigns and growing vegetarian communities.

Middle East & Africa: Emerging opportunities due to increased plant-based menu offerings in hospitality and tourism sectors.

Market Dynamics

Drivers:

-

Shift toward plant-based diets for health and environmental benefits

Expansion of product availability across retail and foodservice

Technological advancements enhancing taste and texture

Restraints:

-

Higher production costs compared to conventional meat

Limited consumer awareness in developing economies

Key Trends:

-

Hybrid products combining plant-based and cultivated meat

Premiumization with gourmet-style plant-based offerings

Direct-to-consumer sales and subscription models

Strategic partnerships between food tech brands and global QSR chains

Leading Companies

Beyond Meat – Pioneer in plant-based burger patties and sausages. Impossible Foods – Known for heme-based beef alternatives with realistic flavor. Amy's Kitchen – Organic and non-GMO plant-based meal products. Maple Leaf Foods – Canadian food giant with multiple plant-based brands. Quorn Foods – Leader in mycoprotein-based meat alternatives. MorningStar Farms – Established plant-based brand under Kellogg's. The Vegetarian Butcher – Offers gourmet-style plant-based meats. Vbites Food Limited – UK-based innovator in vegan food solutions. Garden Protein International (Conagra Brands) – Known for Gardein plant-based products. Boca Foods Company – Kraft Foods' plant-based product line. Lightlife Foods – Focuses on clean-label, minimally processed plant-based meats. Field Roast – Specializes in artisanal plant-based sausages and deli slices.Recent Developments

-

2024: Beyond Meat launched new high-protein, clean-label burger patties with improved texture.

2024: Impossible Foods expanded its plant-based chicken nuggets into Asian markets.

2023: Maple Leaf Foods invested in new production facilities to scale plant-based operations.

2023: Quorn partnered with KFC in Europe to expand vegan chicken options.

2023: MorningStar Farms introduced gourmet-style plant-based steak strips for retail.

2023: The Vegetarian Butcher collaborated with Burger King to expand plant-based Whopper availability.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment