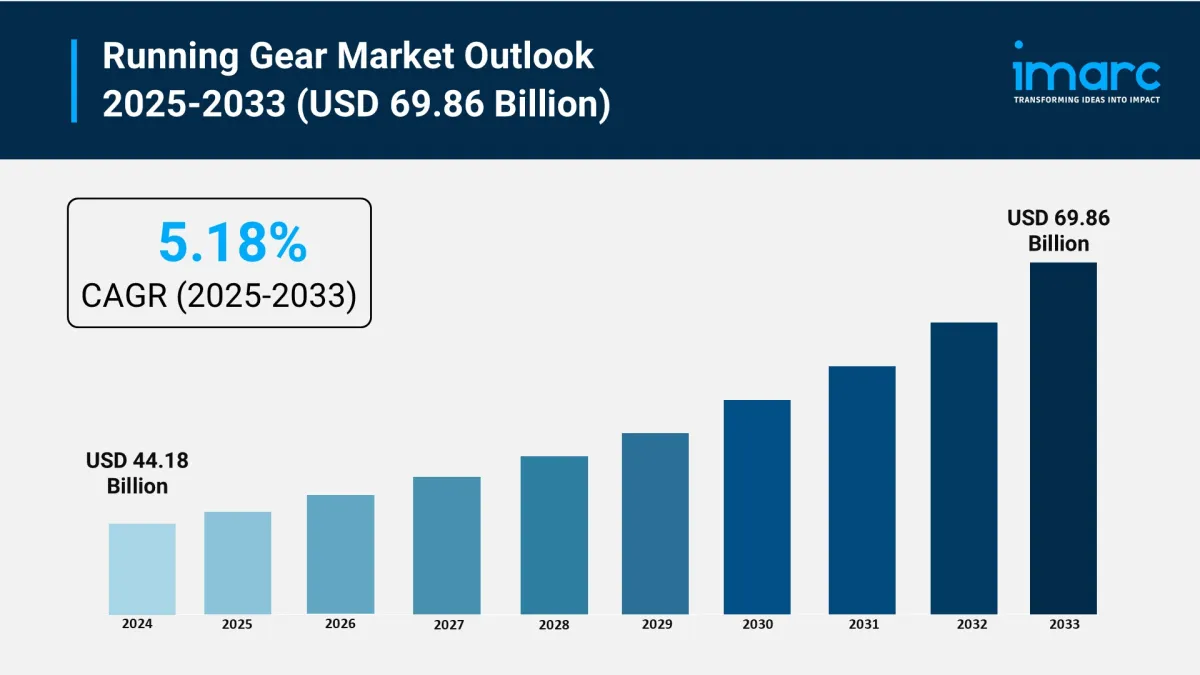

Running Gear Market Predicted To Exceed USD 69.86 Billion By 2033, Rising At A CAGR Of 5.18%

The running gear market is experiencing rapid growth, driven by surge in health and fitness awareness, boom in running events, and advancements in technology. According to IMARC Group's latest research publication,“ Running Gear Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033 “ , The global running gear market size was valued at USD 44.18 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 69.86 Billion by 2033, exhibiting a CAGR of 5.18% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Receive Your“Running Gear Market” Sample PDF – Don't Miss Out!

Our report includes:

-

Market Dynamics

Market Trends And Market Outlook

Competitive Analysis

Industry Segmentation

Strategic Recommendations

Growth Factors in the Running Gear Market

-

Surge in Health and Fitness Awareness:

People are getting more serious about staying fit, and running is one of the easiest ways to do it. This growing focus on health is a big driver for the running gear industry. For example, in the U.S., over 164 million people aged six and up took part in outdoor activities in a recent year, with running being a top choice. This has spiked demand for gear like cushioned shoes, breathable apparel, and fitness trackers. Social media and fitness influencers are also fueling this trend, encouraging folks to invest in quality gear for better performance and comfort. Government campaigns pushing active lifestyles, like public fitness programs, are making running even more popular, driving sales of specialized gear that helps runners stay safe and comfortable.

-

Boom in Running Events:

The popularity of running events, from marathons to charity 5Ks, is skyrocketing, and it's boosting the running gear market big time. Over 30 million people in the U.S. alone participate in endurance events like marathons, needing gear like moisture-wicking clothes, supportive shoes, and GPS watches to perform their best. These events create a sense of community and competition, pushing runners to buy high-quality gear for comfort and injury prevention. Companies like Nike and ASICS are cashing in, launching event-specific products, like Nike's Alphafly shoes designed for marathon speed. Government-backed initiatives, such as city-sponsored races, also play a role by promoting fitness and encouraging more people to join, which means more demand for gear tailored to race-day needs.

-

Advancements in Technology:

Tech is changing the game for running gear, making it more appealing to runners who want performance and data. About 21% of Americans use smartwatches or fitness trackers, which track stats like distance and heart rate, helping runners optimize their workouts. Brands are rolling out innovative products, like Hoka's Cielo X1 shoes with advanced cushioning for elite runners, or smart apparel with built-in sensors. These upgrades improve comfort and functionality, driving sales. Companies are also investing heavily in R&D-ASICS reported exceeding 10 billion yen in profit from performance gear recently, showing how tech-focused products are paying off. Government grants for wearable tech research are supporting these innovations, making running gear smarter and more attractive to tech-savvy consumers.

Key Trends in the Running Gear Market

-

Rise of Athleisure:

Athleisure is taking over, with running gear doubling as stylish everyday wear. People want clothes that work for both workouts and casual outings, and brands are delivering. For instance, New Balance's RC Short uses moisture-wicking fabric that's comfy for running but sleek enough for daily wear. This trend is huge, with running footwear holding a 50.3% market share because of its versatility. Companies are teaming up with celebrities and designers to create trendy, limited-edition collections, boosting appeal. The direct-to-consumer model, like Puma's online styling recommendations, is also growing, letting brands connect directly with shoppers. This blend of fashion and function is making running gear a go-to choice for people who value both style and performance.

-

Focus on Sustainability:

Sustainability is a hot topic in the running gear world, as eco-conscious runners demand greener products. Brands like Puma are stepping up, using recycled plastic in their collections through partnerships like the one with First Mile. Their RE:FIBRE program turns used textiles into new gear, cutting waste. Meanwhile, Hoka's upcycled line supports reforestation efforts, tying purchases to environmental causes. About 43.8% of running gear sales happen in specialty sports shops, where eco-friendly products are heavily promoted. This trend is driven by consumer demand for biodegradable materials like organic cotton and hemp, which offer breathability and comfort. Brands adopting low-carbon manufacturing and eco-packaging are gaining loyalty, as runners align their purchases with their values.

-

Growth of Customization:

Runners are loving personalized gear, and brands are jumping on the trend. Custom shoes tailored to foot shape or running style are gaining traction-Nike's Air Zoom Pegasus lets customers tweak designs, colors, and even add text. This trend is big, with 54.1% of the market driven by male runners who often seek custom performance gear. Companies like On are innovating too, with their“LightSpray” process creating laceless, sock-like marathon shoes for a perfect fit. Subscription services like StrideBox deliver curated gear based on runners' preferences, adding convenience. This focus on personalization boosts engagement, as runners feel their gear is made just for them, enhancing both performance and brand loyalty in a competitive market.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=1348&flag=E

Leading Companies Operating in the Global Running Gear Industry:

-

Adidas AG

ASICS

New Balance

Nike

Skechers USA, Inc.

Amer Sports

British Knights

Columbia Sportswear Company

Fitbit

Garmin

Kering (Puma)

Newton Running

The Rockport Group

Under Armour

VF Corporation

Wolverine World Wide

Running Gear Market Report Segmentation:

Breakup by Product:

-

Running Footwear

Running Apparel

Running Accessories

Fitness Trackers

Running footwear dominates the market as runners prioritize the selection of appropriate shoes, tailored to their gait, running style, and terrain preferences.

Breakup by Gender:

-

Male

Female

Unisex

Males dominates the market owing to their higher participation rates in running and related sports. This segment seeks specialized running apparel, footwear, and accessories tailored to their performance and comfort needs.

Breakup by Distribution Channel:

-

Specialty and Sports Shops

Supermarkets and Hypermarkets

Department and Discount Stores

Online

Others

Specialty and sports shops represent the largest distribution channel in the running gear market as it offers a comprehensive range of specialized products tailored to the needs of runners.

Regional Insights:

-

North America: (United States, Canada)

Asia Pacific: (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe: (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America: (Brazil, Mexico, Others)

Middle East and Africa

In North America, the presence of iconic sportswear brands like Nike, Under Armour, and New Balance spurs innovation and product development in the running gear sector.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment