Bromine Market Outlook 20252033: Innovations In Flame Retardants, Water Treatment & Cleantech

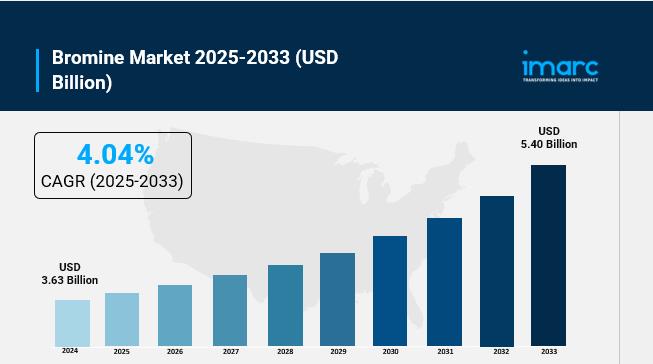

The global bromine market was valued at USD 3.63 billion in 2024 and is expected to reach USD 5.40 billion by 2033 , expanding at a compound annual growth rate (CAGR) of 4.04% during 2025–2033. This growth is primarily driven by rising demand in flame retardants, water treatment, pharmaceuticals, agricultural chemicals, and electronics. Technological advancements in brominated compounds and growing safety regulations are significantly shaping the market's upward trajectory, especially across rapidly industrializing economies.

Key Stats

-

Market Size (2024): USD 3.63 Billion

Projected Market Size (2033): USD 5.40 Billion

CAGR (2025–2033): 4.04%

Leading Region (2024): Asia Pacific (37%+ market share)

Top Applications: Flame retardants, water treatment, agricultural chemicals

Major Companies: Albemarle Corporation, ICL Group Ltd., Lanxess AG, Tata Chemicals Limited, Tosoh Corporation, and others

Growth Drivers

Technological Advancements in Flame Retardants

New innovations, such as halogen-free, bromine-based polypropylene compounds launched by Sirmax North America in 2024, are revolutionizing flame retardant materials. Certified with UL Yellow Card (V0/5VA) for electrical safety, these materials meet stringent fire safety regulations in sectors such as electronics, automotive, textiles, and construction. Such advancements are fostering demand for high-performance, regulation-compliant bromine derivatives globally.

Regulatory Influence & Safety Mandates

Global regulatory frameworks continue to drive demand for brominated flame retardants across construction, electronics, textiles, and furniture industries. Simultaneously, environmental and health-related rules around agrochemicals and pharmaceuticals are pushing for cleaner, more sustainable bromine-based solutions-creating fertile ground for continuous product innovation.

Rising Demand Across End Users

Bromine plays a critical role in agriculture, serving as a fumigant and pest control agent , and in water treatment systems for microbial control. With public initiatives like India's clean water mission , and the expansion of electronics, oil & gas, and pharmaceutical sectors in developing nations, bromine consumption is experiencing significant acceleration.

Segmental Analysis

By Derivative:

-

Hydrogen Bromide

Organobromine Compounds

Bromine Fluids

Others

By Application:

-

Flame Retardants (FR)

Biocides

Bromine-Based Batteries

Clear Brine Fluids (CBF)

Others

By End User:

-

Chemicals

Oil and Gas

Pharmaceuticals

Agriculture

Textiles

Electronics

Others

Each segment represents a strategic avenue for market expansion, with flame retardants and biocides driving the highest share of demand.

Regional Insights

The Asia Pacific region leads the global bromine market, accounting for over 37% share in 2024 , primarily driven by robust industrial growth in China, India, and South Korea . Demand across electronics, agriculture , and downstream manufacturing continues to boost regional consumption.

Other key regions include:

-

North America: Driven by pharmaceutical, oil & gas, and electronics demand

Europe: Focused on regulatory compliance and eco-friendly solutions

Latin America: Emerging applications in agriculture and textiles

Middle East & Africa: Increasing bromine demand in oil exploration and water treatment

Market Dynamics

Drivers:

-

Advancements in brominated flame retardants

Regulatory push for fire safety and clean water solutions

Growing demand from electronics, textiles, and agricultural sectors

Restraints:

-

Environmental concerns regarding bromine toxicity

Shifting focus toward halogen-free alternatives in developed markets

Key Trends:

-

Rise in halogen-free bromine innovations

Expanding use of bromine in battery technologies

Strategic investments in sustainable water treatment solutions

Leading Companies

The bromine market is moderately consolidated with major players investing heavily in R&D, partnerships, and sustainable product lines. Key companies include:

Albemarle Corporation Chemada Industries Ltd. Gulf Resources Inc. Hindustan Salts Limited Honeywell International Inc. ICL Group Ltd. Jordan Bromine Company Limited Lanxess AG Solaris Chemtech Industries Limited (Agrocel Industries Pvt. Ltd.) Tata Chemicals Limited TETRA Technologies Inc. Tosoh CorporationRecent Developments

-

2024: Sirmax North America launched halogen-free, bromine-based polypropylene compounds for electronics and automotive sectors.

2023–2024: Surge in eco-friendly flame retardant R&D across North America and Europe to meet green building codes.

2024: Growing use of bromine-based fumigants in Asia to enhance food security and storage infrastructure.

2023: Increased adoption of bromine compounds in water treatment aligned with global sustainability initiatives.

2024: Expansion of bromine production capacity by ICL Group and Tata Chemicals to meet rising global demand.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=460&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email:

Tel No: (+1-201971-6302 )

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment