India Tyre Market 2025: Size, Industry Share, Top Companies, Growth Analysis And Forecast Report 2033

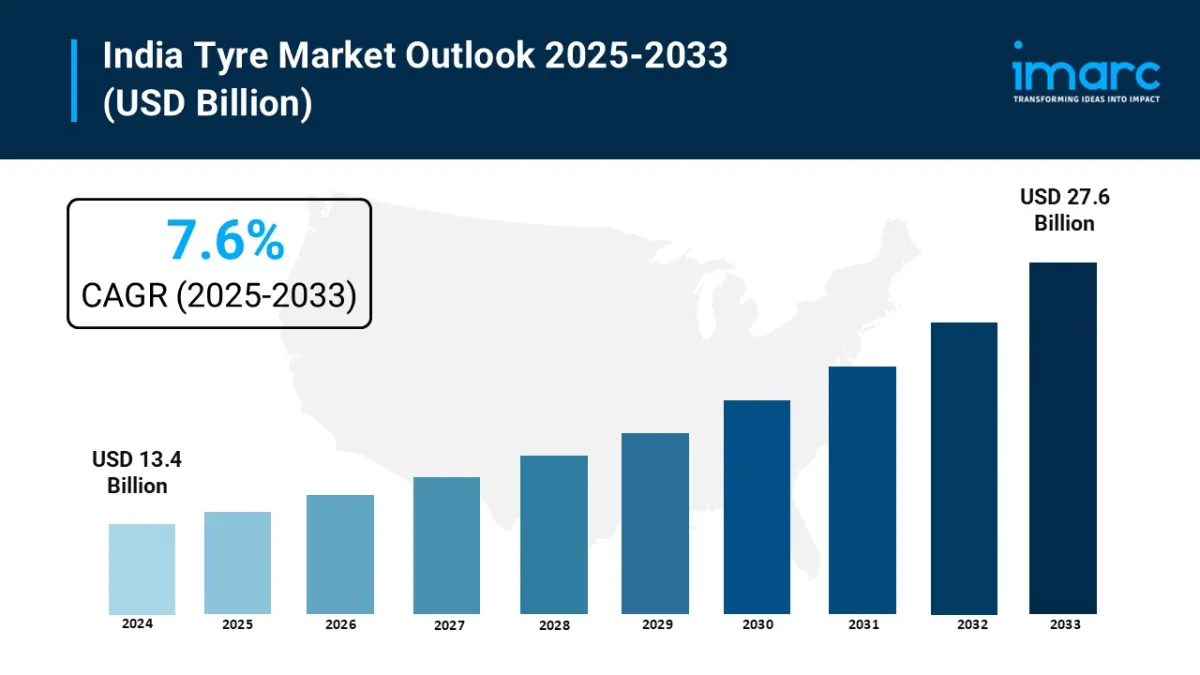

The tyre industry in india valued at approximately USD 13.4 Billion in 2024, is on a significant growth trajectory, with a projected market value of USD 27.6 Billion by 2033. This expansion is forecasted to occur at a notable Compound Annual Growth Rate (CAGR) of 7.6% from 2025 to 2033. The key drivers fueling this growth include India's robust economic development, a booming automotive sector, increasing vehicle ownership driven by a rising middle-class population, and government initiatives promoting domestic manufacturing and infrastructure development. The growing demand for radial and tubeless tyres, along with the burgeoning electric vehicle (EV) market, are also major contributors to the market's dynamic landscape.

Key Highlights-

Market Size (2024): USD 13.4 Billion

Forecast (2033): USD 27.6 Billion

CAGR (2025–2033): 7.6%

The market is primarily driven by the replacement segment, which accounts for over 60% of the total volume, fueled by the country's large and aging vehicle fleet.

The“Make in India” initiative and a strong focus on domestic production have led to major investments and capacity expansions by both local and international players.

The ongoing radialization of tyres, particularly in the commercial vehicle segment, is a key trend as fleet operators seek enhanced fuel efficiency and durability.

Key companies operating in the market include MRF, Apollo Tyres, CEAT, JK Tyre & Industries.

For an in-depth analysis, you can refer free sample copy of the report: https://www.imarcgroup.com/india-tyre-market/requestsample

How Is AI Transforming the Tyre Market in India?Artificial Intelligence is being increasingly integrated into the Indian tyre industry, revolutionizing processes from manufacturing to sales and beyond.

-

Manufacturing Automation and Quality Control: AI-powered systems are used for real-time defect detection during the manufacturing process, employing advanced image processing to identify even the smallest imperfections. This reduces human error, ensures product reliability, and minimizes waste.

Predictive Maintenance: AI algorithms analyze data from manufacturing equipment to predict potential failures, allowing for proactive maintenance. This reduces unplanned downtime, increases operational efficiency, and extends the lifespan of machinery.

Demand Forecasting and Supply Chain Optimization: By analyzing vast datasets of sales trends, seasonal patterns, and economic indicators, AI algorithms provide highly accurate demand forecasts. This helps manufacturers optimize inventory levels, streamline distribution, and reduce supply chain disruptions.

Smart Tyre Technology: The future of the market lies in smart tyres embedded with IoT sensors. These sensors, combined with AI, can monitor tyre pressure, temperature, and tread wear in real time, providing drivers with crucial data to enhance safety and fuel efficiency.

-

Government Initiatives and Policies: Government initiatives like the“Make in India” program, along with import restrictions and the new Production Linked Incentive (PLI) scheme for the auto components sector, are encouraging domestic manufacturing and attracting foreign investment.

Infrastructure Development: Massive government investment in road infrastructure through projects like the Bharatmala Pariyojana is enhancing connectivity and leading to a surge in commercial vehicle sales, directly boosting demand for commercial vehicle tyres.

Rise of the Electric Vehicle (EV) Sector: The rapid adoption of EVs, driven by government subsidies and a focus on sustainability, is creating a new segment of demand for specialized tyres. These tyres are designed to handle the extra weight of batteries and provide low rolling resistance to maximize battery range.

Shift to Radial and Tubeless Tyres: There is a pronounced market shift away from traditional bias tyres towards radial and tubeless tyres, particularly in the commercial and passenger vehicle segments. This is driven by their superior performance, longer life, and greater fuel efficiency.

E-commerce and Organized Retail Growth: The emergence of online tyre sales platforms and the expansion of organized retail chains into Tier II and Tier III cities are making tyres more accessible to a wider consumer base and offering greater price transparency.

The India tyre market can be segmented to highlight the varied demand across different categories:

Analysis by Vehicle Type:

-

Two Wheelers

Three Wheelers

Passenger Cars

Light Commercial Vehicles

Medium and Heavy Commercial Vehicles

Off the Road

Analysis by OEM and Replacement:

-

OEM Tyres

Replacement Tyres

Analysis by Domestic Production and Imports:

-

Domestic Production

Imports

Analysis by Radial and Bias Tyres:

-

Bias Tyres

Radial Tyres

Analysis by Tube and Tubeless Tyres:

-

Tube Tyres

Tubeless Tyres

Analysis by Tyre Size:

-

Small

Medium

Large

Analysis by Price Segment:

-

Low

Medium

High

Regional Analysis:

-

North India

East India

West and Central India

South India

-

Continental India's Strategic Shift: In a strategic decision announced in June 2025, Continental India halted the production of truck and bus radial (TBR) tyres at its Modipuram plant to focus on the more lucrative passenger vehicle and light truck tyre (PLT) segment. This move aligns with the company's global strategy and the growing demand for passenger vehicle tyres in India, as the country's economic goals under programs like Vision 2030 prioritize individual mobility and urban development.

JK Tyre's Sustainable Manufacturing: In May 2025, JK Tyre & Industries commenced the production of passenger car tyres using ISCC PLUS certified materials at its Chennai plant. This initiative is a first in the domestic market, marking a significant step toward achieving sustainability goals and reducing the carbon footprint of tyre manufacturing. This development is in line with India's broader national commitment to energy transition and environmental responsibility.

CEAT's Capacity Expansion: To cater to the booming demand in the passenger car and utility vehicle (PCUV) segment, CEAT announced its plan to expand its production capacity at its Chennai plant by approximately 35%. This expansion, which will increase annual PCUV capacity to 9.45 million tyres, demonstrates the industry's confidence in the sustained growth of India's automotive sector and the effectiveness of policies designed to boost domestic manufacturing.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment