Will AI Data Centers Crash The US Economy?

AI technology is advancing fast, threatening (promising?) to upend many sectors of the economy. Nobody knows yet exactly who will profit from this boom, but one thing that's certain is that it's going to take a lot of computing power (or“compute”, as they say).

AI models take a lot of compute to train, but nowadays they also take a lot of compute to do inference - i.e., to“think about” and answer each question you ask. Inference compute now represents most of the cost of running advanced AI models, and increases in inference compute are responsible for many of the ongoing performance gains . So compute needs are probably only going to grow as AI keeps getting better.

Whoever provides this compute is going to make a huge amount of revenue. Whether that means they'll make a lot of profit is another question, but let's table that for right now; you can't make profit if you don't make revenue. So right now, tech companies have the choice to either sit out of the boom entirely, or spend big and hope they can figure out how to make a profit.

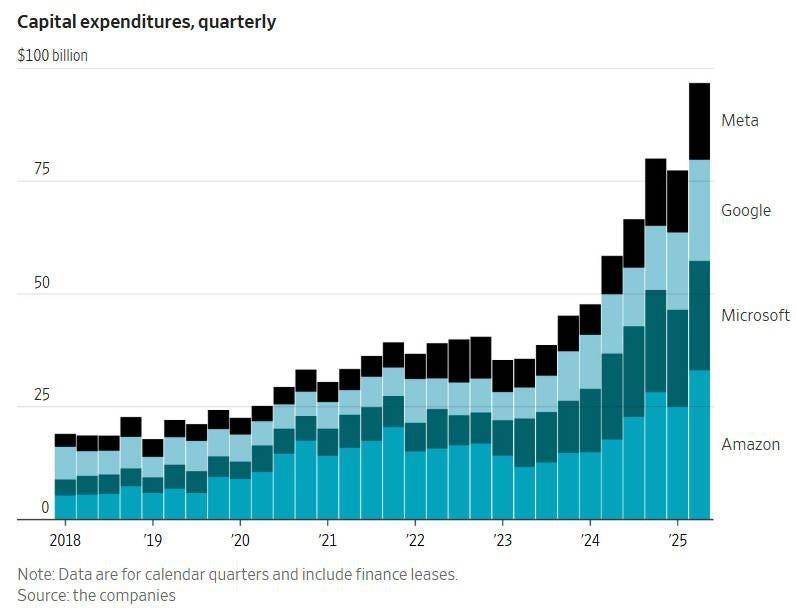

Roughly speaking, Apple is choosing the former , while the big software companies - Google, Meta, Microsoft and Amazon - are choosing the latter. These spending numbers are pretty incredible:

Source: Chris Mims

For Microsoft and Meta, this capital expenditure is now more than a third of their total sales.

Here's Chris Mims of the WSJ :

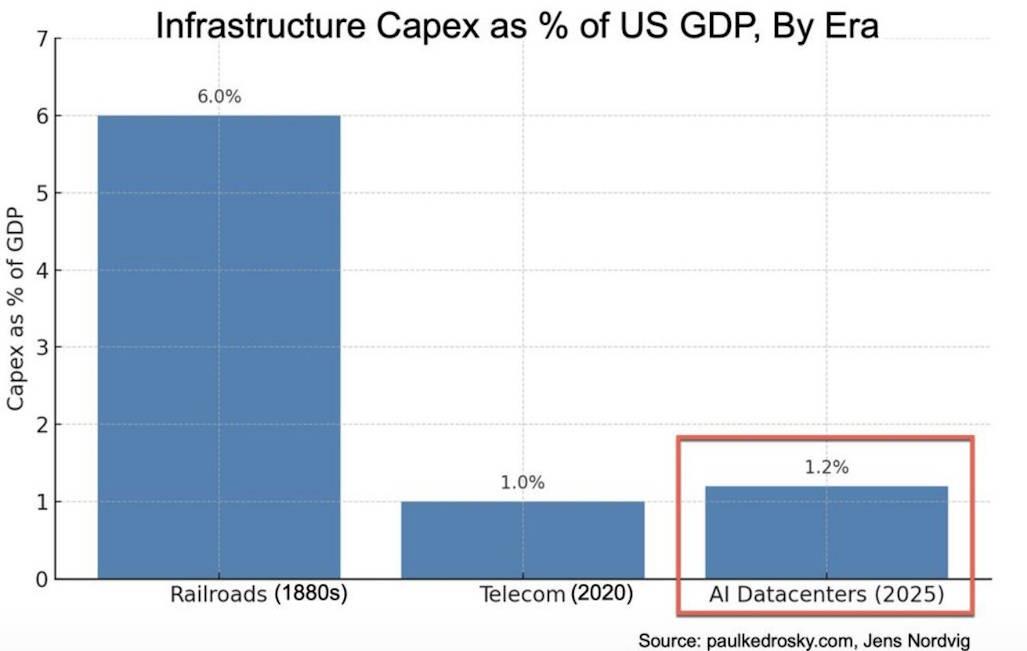

Here's that chart from Kedrosky, who has been doing an excellent job following this story as it unfolds:

Source: Paul Kedrosky

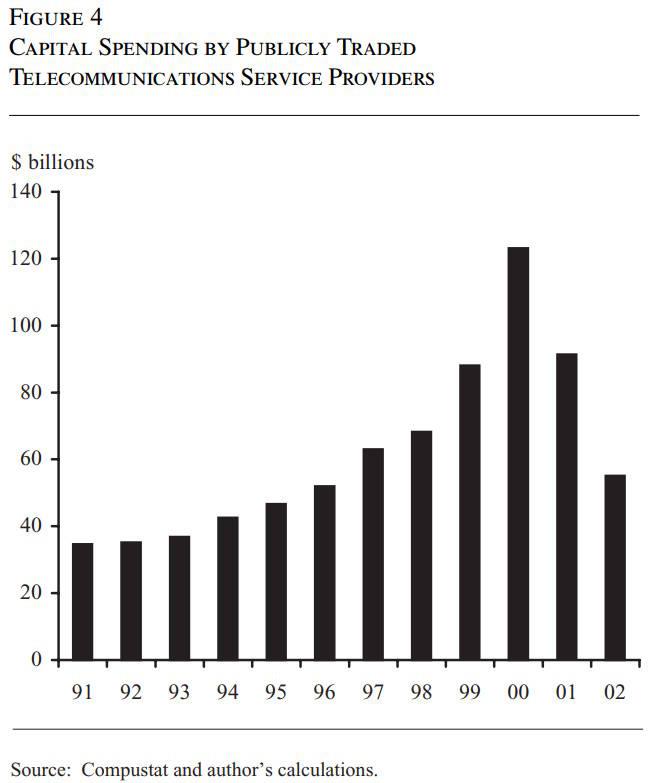

Side note: I'm actually not sure Kedrosky is right about the height of the telecom boom. His chart shows the level of capex for 2020, when 5G and fiber infrastructure was being built out. But Doms (2004) shows US telecom capex reaching $120 billion in 2000:

Source: Doms (2004)

That would have been around 1.2% of US GDP at the time - about where the data center boom is now. But the data center boom is still ramping up, and there's no obvious reason to think 2025 is the peak, so Kedrosky's point still stands.

I think it's important to look at the telecom boom of the 1990s rather than the one in the 2010s, because the former led to a gigantic crash . The railroad boom led to a gigantic crash too , in 1873 (before the investment peak on Kedrosky's chart).

In both cases, companies built too much infrastructure, outrunning growth in demand for that infrastructure, and suffered a devastating bust as expectations reset and loans couldn't be paid back.

In both cases, though, the big capex spenders weren't wrong; they were just early. Eventually, we ended up using all of those railroads and all of those telecom fibers, and much more.

This has led a lot of people to speculate that big investment bubbles might actually be beneficial to the economy , since manias leave behind a surplus of cheap infrastructure that can be used to power future technological advances and new business models.

But for anyone who gets caught up in the crash, the future benefits to society are of cold comfort. So a lot of people are worrying that there's going to be a crash in the AI data center industry, and thus in Big Tech in general, if AI industry revenue doesn't grow fast enough to keep up with the capex boom over the next few years.1

A data center bust would mean that Big Tech shareholders would lose a lot of money, like dot-com shareholders in 2000. It would also slow the economy directly, because Big Tech companies would stop investing. But the scariest possibility is that it would cause a financial crisis.

Financial crises tend to involve bank debt. When a financial bubble and crash is mostly a fall in the value of stocks and bonds, everyone takes losses and then just sort of walks away, a bit poorer - like in 2000.

Jorda, Schularick, and Taylor (2015) survey the history of bubbles and crashes, and they find that debt (also called“credit” and“leverage”) is a key predictor of whether a bubble ends up hurting the real economy. They write:

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment