Abrasilver Substantially Increases Total Diablillos Mineral Resources To 199 Million Ounces Contained Silver And 1.7 Million Ounces Contained Gold (350 Moz Ageq) In M&I

| Zone | Category | Tonnes (000 t) | Ag (g/t) | Au (g/t) | AgEq (g/t) | Contained Ag (000 Oz Ag) | Contained Au (000 Oz Ag) | Contained AgEq (000 Oz Ag) | |

| Tank Leach | Oxides | Measured | 26,545 | 119 | 0.71 | 183 | 101,564 | 604 | 156,487 |

| Indicated | 46,584 | 56 | 0.63 | 114 | 84,430 | 948 | 170,592 | ||

| Measured & | 73,129 | 79 | 0.66 | 139 | 185,994 | 1,553 | 327,078 | ||

| Indicated | |||||||||

| Inferred | 9,693 | 34 | 0.57 | 86 | 10,616 | 176 | 26,647 | ||

| Heap Leach | Oxides | Measured | 6,673 | 16 | 0.14 | 25 | 3,486 | 30 | 5,342 |

| Indicated | 24,102 | 12 | 0.17 | 23 | 9,163 | 133 | 17,506 | ||

| Measured & | 30,774 | 13 | 0.16 | 23 | 12,649 | 162 | 22,848 | ||

| Indicated | | | | | | | | ||

| Inferred | 10,024 | 9 | 0.20 | 21 | 2,811 | 64 | 6,850 | ||

| Total | Oxides | Measured | 33,218 | 98 | 0.59 | 152 | 105,050 | 634 | 161,829 |

| Indicated | 70,686 | 41 | 0.48 | 83 | 93,593 | 1,081 | 188,098 | ||

| Measured & | 103,904 | 59 | 0.51 | 105 | 198,643 | 1,715 | 349,927 | ||

| Indicated | | | | | | | | ||

| Inferred | 19,628 | 21 | 0.38 | 53 | 13,427 | 241 | 33,496 | ||

| Refer to footnotes in Tables 2 and 4 |

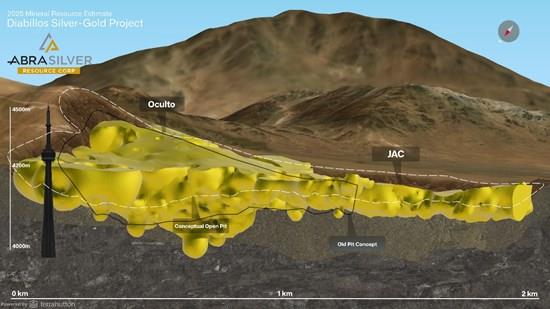

Figure 1 - Visualization of Oculto and JAC Mineral Resource Estimate

To view an enhanced version of this graphic, please visit:

Table 2 - Diablillos Mineral Resource Estimate by Deposit (Tank Leach Material Only) - As of July 21, 2025.

| Deposit | Zone | Category | Tonnes (000 t) | Ag (g/t) | Au (g/t) | AgEq (g/t) | Contained Ag (000 Oz) | Contained Au (000 Oz) | Contained AgEq (000 Oz) |

| Oculto | Oxides | Measured | 20,485 | 107 | 0.89 | 188 | 70,193 | 588 | 123,611 |

| Indicated | 36,898 | 45 | 0.77 | 115 | 53,128 | 917 | 136,439 | ||

| Measured & Indicated | 57,382 | 67 | 0.82 | 141 | 123,321 | 1,505 | 260,051 | ||

| Inferred | 8,026 | 27 | 0.67 | 88 | 6,898 | 173 | 22,663 | ||

| JAC | Oxides | Measured | 6,061 | 161 | 0.08 | 169 | 31,371 | 17 | 32,875 |

| Indicated | 7,073 | 119 | 0.05 | 124 | 27,121 | 11 | 28,090 | ||

| Measured & | 13,134 | 139 | 0.06 | 144 | 58,492 | 27 | 60,965 | ||

| Indicated | |||||||||

| Inferred | 1,036 | 77 | 0.01 | 78 | 2,558 | 0 | 2,602 | ||

| Fantasma | Oxides | Measured | - | - | - | - | - | - | - |

| Indicated | 1,049 | 72 | 0.01 | 73 | 2,436 | 0 | 2,455 | ||

| Measured & Indicated | 1,049 | 72 | 0.01 | 73 | 2,436 | 0 | 2,455 | ||

| Inferred | 475 | 64 | 0.01 | 65 | 978 | 0 | 986 | ||

| Laderas | Oxides | Measured | - | - | - | - | - | - | - |

| Indicated | 806 | 17 | 0.67 | 78 | 428 | 17 | 2,014 | ||

| Measured & Indicated | 806 | 17 | 0.67 | 78 | 428 | 17 | 2,014 | ||

| Inferred | 104 | 15 | 0.68 | 77 | 51 | 2 | 259 | ||

| Sombra | Oxides | Measured | - | - | - | - | - | - | - |

| Indicated | 758 | 54 | 0.12 | 65 | 1,317 | 3 | 1,594 | ||

| Measured & Indicated | 758 | 54 | 0.12 | 65 | 1,317 | 3 | 1,594 | ||

| Inferred | 51 | 80 | 0.04 | 84 | 131 | 0 | 137 | ||

| Total (tank leach) | Oxides | Measured | 26,545 | 119 | 0.71 | 183 | 101,564 | 604 | 156,487 |

| Indicated | 46,584 | 56 | 0.63 | 114 | 84,430 | 948 | 170,592 | ||

| Measured & Indicated | 73,129 | 79 | 0.66 | 139 | 185,994 | 1,553 | 327,078 | ||

| Inferred | 9,693 | 34 | 0.57 | 79 | 10,616 | 176 | 26,647 | ||

| Mineral Resources are not Mineral Reserves and have not demonstrated economic viability. The formula for calculating AgEq is as follows: Silver Eq Oz = Silver Oz + Gold Oz x (Gold Price/Silver Price) x (Gold Recovery/Silver Recovery). The Mineral Resource model was populated using Ordinary Kriging grade estimation within a three-dimensional block model and mineralized zones defined by wireframed solids, which are a combination of lithology and alteration domains. The 1m composite grades were capped where appropriate. The Mineral Resource is reported inside a conceptual Whittle open pit shell derived using US$ 27.50/oz Ag price, US $2,400/oz Au price, 83% process recovery for Ag, and 87% process recovery for Au. The constraining open pit optimization parameters used were US $1.94/t mining cost, US $22.96/t processing cost, US $3.32/t G&A cost, and average 51-degree open pit slopes. The MRE has been categorized in accordance with the CIM Definition Standards (CIM, 2014). A Net Value per block [NVB] calculation was used to constrain the Mineral Resource, determine the "Benefits = Income-Cost", where, Income = [(Au Selling Price (US$/oz) - Au Selling Cost (USD/Oz)) x (Au grade (g/t)/31.1035)) x Au Recovery (%)] + [(Ag Selling Price (US$/oz) - Ag Selling Cost (USD/Oz)) x (Ag grade (g/t)/31.1035)) x Ag Recovery (%)] and Cost = Mining Cost (US$/t) + Process Cost (US$/t) + Transport Cost (US$/t) + G&A Cost (US$/t) + [Royalty Cost (%) x Income] The Mineral Resource is sub-horizontal with sub-vertical feeders and a reasonable prospect for eventual economic extraction by open pit and tank leach processing methods. In-situ bulk density were assigned to each model domain, according to samples averages for each lithology domain, separated by alteration zones and subset by oxidation. All tonnages reported are dry metric tonnes and ounces of contained gold are troy ounces. Mining recovery and dilution factors have not been applied to the Mineral Resource estimates. The Mineral Resource was estimated by Luis Rodrigo Peralta, B.Sc., FAusIMM CP (Geo), Independent Qualified Person under NI 43-101. Mr. Peralta is not aware of any environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues that could materially affect the potential development of the Mineral Resource. All figures are rounded to reflect the relative accuracy of the estimates. Minor discrepancies may occur due to rounding to appropriate significant figures. |

Updated Tank Leach Mineral Resource Estimate Highlights Significant Growth at JAC and Oculto

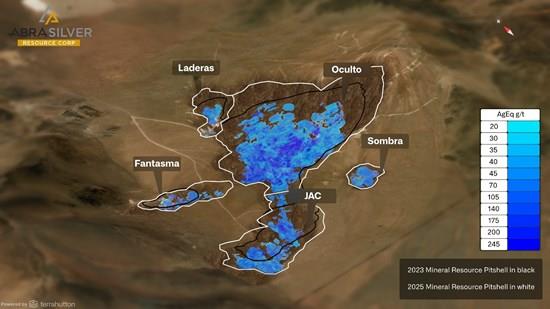

The largest gains in the updated tank leach MRE stem from significant extensions at the JAC and Oculto deposits. These expansions underscore the high-grade continuity of mineralization at both deposits and their central role in supporting the upcoming mine plan. In total, the Diablillos project is now comprised of five deposits (Oculto, JAC, Fantasma, Laderas and Sombra) containing defined Mineral Resources.

- At Oculto , M&I tonnage increased by 23% , with contained silver up 11% and gold up 14%. The growth is primarily driven by strong drill results from holes DDH-24-011, DDH-24-021, DDH-24-027, DDH-24-031, DDH-24-034, DDH-24-043, DDH-24-049, DDH-24-051, DDH-24-052, DDH-25-011 and DDH-25-024, which extended both the Silver Enrichment and Deep Gold zones to the northeast.

At JAC , M&I Mineral Resources increased by 148% in tonnage , with contained silver rising 70% and contained gold up 23% . This substantial increase reflects the success of the Phase IV drilling campaign, which focused on extending the orebody to the southwest and expanding the margins, further highlighting the potential of high-grade, near-surface silver mineralization in this area. At Fantasma, M&I Mineral Resources grew by 54% in tonnage and 6% in contained silver. The increase in metal price assumptions has upgraded material previously classified as waste into lower grade mineralization, enhancing the size of the Mineral Resource in this area.

At Laderas, M&I tonnage rose by 74% , with contained silver up 79% and gold up 21%. As with Fantasma, higher metal price assumptions have led to the reclassification of material previously categorized as waste into lower grade silver and gold mineralization. At Sombra, the initial M&I Mineral Resource is supported by 11 initial drill holes in this newly discovered area . Drill holes DDH-24-069, DDH-24-062, DDH-24-036, DDH-25-019 and DDH-25-026 confirm the potential of this zone. Although still at an early stage, Sombra shows significant potential as the mineralization lies beneath only 35 metres of easily mineable unconsolidated colluvial cover.

Table 3 - Comparison of the July 2025 M&I MRE (tank leach) to the Prior Estimate (November 2023).

| Deposit | | Category | Tonnes (000 t) | Ag (g/t) | Au (g/t) | Contained Ag (k oz Ag) | Contained Au (k oz Au) |

| Oculto | Current Resource | Measured & Indicated | 57,382 | 67 | 0.82 | 123,321 | 1,505 |

| Prior Resource | Measured & Indicated | 46,824 | 74 | 0.88 | 111,401 | 1,325 | |

| Variance (%) | 23% | -9% | -7% | 11% | 14% | ||

| | Current Resource | Measured & Indicated | 13,134 | 139 | 0.06 | 58,492 | 27 |

| JAC | Prior Resource | Measured & Indicated | 5,286 | 202 | 0.13 | 34,329 | 22 |

| | Variance (%) | 148% | -31% | -54% | 70% | 23% | |

| Fantasma | Current Resource | Measured & Indicated | 1,049 | 72 | - | 2,436 | - |

| | Prior Resource | Measured & Indicated | 683 | 105 | - | 2,306 | - |

| | Variance (%) | 54% | -31% | - | 6% | - | |

| Laderas | Current Resource | Measured & Indicated | 806 | 17 | 0.67 | 428 | 17 |

| | Prior Resource | Measured & Indicated | 464 | 16 | 0.91 | 239 | 14 |

| | Variance (%) | 74% | 6% | -26% | 79% | 21% | |

| Sombra | Current Resource | Measured & Indicated | 758 | 54 | 0.12 | 1,317 | 3 |

| Prior Resource | Measured & Indicated | - | - | - | - | - | |

| Variance (%) | n/a | n/a | n/a | n/a | n/a | ||

| All deposits (tank leach only) | Current Resource | Measured & Indicated | 73,129 | 79 | 0.66 | 185,994 | 1,553 |

| Prior Resource | Measured & Indicated | 53,257 | 87 | 0.79 | 148,275 | 1,360 | |

| Variance (%) | 37% | -9% | -16% | 25% | 14% |

Notes to Mineral Comparison Table

- Key Assumptions in July 2025 MRE:

- Ag price: $ 27.50/oz & Au price: $2,400/oz

Average recovery rates (tank leach): 82.6% Ag and 86.5% Au Cut-off grade: based on Net Value per Block, with an average cut-off grade equivalent to ~39 g/t AgEq

Open pit optimization parameters: Mining cost; $1.94/t; Processing cost; $22.97/t; G&A cost $3.32/t

- Ag price: $ 24.00/oz & Au price: $1,850/oz

Average recovery rates (tank leach): 82.6% Ag and 86.5% Au Cut-off grade: based on Net Value per Block, with an average cut-off grade equivalent to ~45 g/t AgEq

Open pit optimization parameters: Mining cost; $1.94/t; Processing cost; $22.97/t; G&A cost $3.32/t For additional details, please refer to "NI 43-101 Technical Report, Mineral Resource Estimate, Diablillos Project" with an effective date of November 22, 2023 and available on the Company's profile on .

Heap Leach Mineral Resource Estimate

The inclusion of a maiden heap leach Mineral Resource estimate marks an important milestone for Diablillos. This additional M&I tonnage of 30.8 Mt of lower-grade material is contained within the same constraining Whittle open pit as described above for the tank leach MRE. The vast majority of this tonnage, which is sourced from the Oculto deposit, was previously classified as waste and now provides the opportunity to reduce the strip ratio and further enhance overall Project economics. Preliminary metallurgical testwork has demonstrated that the heap leach material offers a potential incremental, cost-effective processing route that complements the primary tank leach circuit. A Preliminary Economic Assessment ("PEA") evaluating the additional heap leach potential is planned for completion in H1 2026.

Table 4 - Diablillos Mineral Resource Estimate (Heap Leach Material Only) - As of July 21, 2025.

| Deposit | Zone | Category | Tonnes (000 t) | Ag (g/t) | Au (g/t) | AgEq (g/t) | Contained Ag (000 Oz Ag) | Contained Au (000 Oz Ag) | Contained AgEq (000 Oz Ag) |

| Total | Oxides | Measured | 6,673 | 16 | 0.14 | 25 | 3,486 | 30 | 5,342 |

| Indicated | 24,102 | 12 | 0.17 | 23 | 9,163 | 133 | 17,506 | ||

| Measured & | 30,774 | 13 | 0.16 | 23 | 12,649 | 162 | 22,848 | ||

| Indicated | |||||||||

| Inferred | 10,024 | 9 | 0.20 | 27 | 2,811 | 64 | 6,850 | ||

| The formula for calculating AgEq is as follows: Silver Eq Oz = Silver Oz + Gold Oz x (Gold Price/Silver Price) x (Gold Recovery/Silver Recovery). The Mineral Resource model was populated using Ordinary Kriging grade estimation within a three-dimensional block model and mineralized zones defined by wireframed solids, which are a combination of lithology and alteration domains. The 1m composite grades were capped where appropriate. The Mineral Resource is reported inside a conceptual Whittle open pit shell derived using US$ 27.50/oz Ag price, US $2,400/oz Au price, 80% process recovery for Ag, and 58% process recovery for Au. The constraining open pit optimization parameters used and overall operational cost of US $11.31/t. The MRE has been categorized in accordance with the CIM Definition Standards (CIM, 2014). A Net Value per block [NVB] calculation was used to constrain the Mineral Resource, determine the "Benefits = Income-Cost", where, Income = [(Au Selling Price (US$/oz) - Au Selling Cost (USD/Oz)) x (Au grade (g/t)/31.1035)) x Au Recovery (%)] + [(Ag Selling Price (US$/oz) - Ag Selling Cost (USD/Oz)) x (Ag grade (g/t)/31.1035)) x Ag Recovery (%)] and Cost = Mining Cost (US$/t) + Process Cost (US$/t) + Transport Cost (US$/t) + G&A Cost (US$/t) + [Royalty Cost (%) x Income] In-situ bulk density were assigned to each model domain, according to samples averages for each lithology domain, separated by alteration zones and subset by oxidation. All tonnages reported are dry metric tonnes and ounces of contained gold are troy ounces. Mining recovery and dilution factors have not been applied to the Mineral Resource estimates. The Mineral Resource was estimated by Mr. Peralta, B.Sc., FAusIMM CP (Geo), Independent Qualified Person under NI 43-101. Mr. Peralta is not aware of any environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues that could materially affect the potential development of the Mineral Resource. All figures are rounded to reflect the relative accuracy of the estimates. Minor discrepancies may occur due to rounding to appropriate significant figures. |

Figure 2 - Plan View of Mineral Resource Estimate

To view an enhanced version of this graphic, please visit:

Significant Exploration Upside Potential

There remains substantial potential to further expand the Diablillos Mineral Resource estimate within the existing deposits, particularly at Oculto East. Ongoing and planned drilling is aimed at both step-out exploration and defining new high-grade zones to extend the current Mineral Resources. The Company is advancing its fully-funded Phase V drill program, which includes an additional 20,000 metres of drilling scheduled for completion by early 2026.

Existing Deposits:

- Oculto: Ongoing exploration is focused on extending known zones of mineralization, particularly towards the northeast, where Oculto East represents a key growth opportunity. Results from recently announced hole DDH 25-024, with 31m @ 9.96g/t Au and 16.2g/t Ag, show the very high-grade gold potential of the Oculto East area, and follow up drilling is underway with three rigs. Geological interpretation has identified several structures in the area with high-grade gold potential.

JAC: Upcoming drilling will test the margins of the conceptual constraining open pit where mineralization remains open. Sombra: An initial Mineral Resource has now been established, and additional drilling is planned to expand this new discovery. The mineralized zone is very shallow, covered by unconsolidated colluvium, and is open along strike. Drilling was postponed here following the high-grade gold intercept at Oculto East, which became the priority exploration area.

Diablillos Porphyry Complex:

- Cerro Viejo: The shallow intercept of 36.0m at 1.91 g/t gold in hole DDH 24-056 in the root zone of epithermal mineralization at Cerro Viejo is scheduled for follow-up drilling later this year. Mapping has shown that gold mineralized silicified zones extend significantly towards the west of hole DDH 24-056.

Cerro Blanco: This is the highest priority area for porphyry style mineralization based on shallow historical Reverse Circulation ("RC") drill results and surface rock chip sampling of a mineralized breccia zone. The area has been mapped in detail and surface sampling completed in preparation for a deeper drilling program expected to commence before the end of August 2025.

Mineral Resource Estimate Methodology

- The tank leach open pit constrained MRE for Diablillos is based on a Net Value per Block methodology that results in an approximate cut-off grade of approximately 39 g/t AgEq, derived from assumptions regarding specified metal prices and estimated operating costs for mining, processing and G&A.

The updated processing assumptions now incorporate a secondary lower cost heap leaching metal recovery process for lower-grade material, complementing the primary tank leaching. The heap leach MRE has also employed a Net Value per Block method that results in a cut-off grade of approximately 22 g/t AgEq. The updated MRE was prepared by Luis Rodrigo Peralta, B.Sc., FAusIMM CP (Geo), Independent Consultant, in accordance with Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards incorporated, by reference, and in compliance with National Instrument NI 43-101 - Standards of Disclosure for Mineral Projects (" NI 43-101 ") and has been reviewed internally by AbraSilver.

The MRE incorporates approximately 157,211 metres of drilling from 733 drill holes (both historical and current). The MRE is based on the Oculto, JAC, Fantasma, Laderas and Sombra deposits within the broader Diablillos property, reported within a constraining Whittle open pit shell. The cut-off grade was determined using a Net Value per Block calculation, factoring in the economic parameters outlined in the Supporting Technical Disclosure section below.

Gold and silver grades were estimated into the block model using RC and Diamond Drill Holes (DDH), including drilling completed up to March 30, 2025. Industry-standard estimation methodologies were applied, including Ordinary Kriging (OK) and validation against an Inverse Distance squared estimate (ID2). Drill hole intervals were composited to a length of 1 metre, which is the average sampling length for core sampling. Grade capping was applied to composited grade intervals on a case-by-case basis for each estimation domain. Domains were defined by a combination of lithology, alteration, and oxide / sulphide state, resulting in a total of 24 estimation domains for gold and silver.

Supporting Technical Disclosure

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

The MRE incorporates geological and structural constraints and is constrained by an optimized Whittle open pit containing a total of 103.9 Mt of M&I Mineral Resources and 514 Mt of waste. Individual metals are reported at 100% of in-situ grades.

The effective date of the MRE is July 21, 2025 and is based on drilling through March 30, 2025. There are no known legal, political, environmental, or other risks that could materially affect the potential development of the Mineral Resource.

Key Assumptions are outlined below (all figures are in US dollars unless otherwise noted):

- Commodity prices used were US$ 27.50/oz Ag price and US $2,400/oz Au price

Note: Commodity price assumptions were guided by the NI 43-101 requirement for the Mineral Resource to have 'reasonable prospects' of eventual economic extraction.

Metallurgical recoveries: heap leach metallurgical recoveries were obtained from a preliminary bottle roll test work campaign on the lower grade mineralization. Recovery assumptions of 58% for gold and 80% for silver were used. Operating cost estimations: mining costs of $1.94/t; tank leach processing costs of $22.96/t and G&A costs of $3.32/t. As for the heap leach an overall processing cost of $11.31/t respectively.

Open pit slopes: Open pit shell slope angles applied are based on 2022 geotechnical drilling and modelling. Six geotechnical sectors have been defined. The average overall angle assumed for open pit shell optimization was 51 degrees. A Net Value per block [NVB] calculation was used to constrain the Mineral Resource, determine the "Benefits = Income-Cost", where, Income = [(Au Selling Price (US$/oz) - Au Selling Cost (USD/Oz)) x (Au grade (g/t)/31.1035)) x Au Recovery (%)] + [(Ag Selling Price (US$/oz) - Ag Selling Cost (USD/Oz)) x (Ag grade (g/t)/31.1035)) x Ag Recovery (%)] and Cost = Mining Cost (US$/t) + Process Cost (US$/t) + Transport Cost (US$/t) + G&A Cost (US$/t) + [Royalty Cost (%) x Income].

The formula for calculating AgEq is as follows: Silver Eq Oz = Silver Oz + Gold Oz x (Gold Price/Silver Price) x (Gold Recovery/Silver Recovery). For additional information in respect of the Company's drill results referenced herein, please refer to the Company's news releases dated August 19, 2024, September 30, 2024, October 23, 2024, December 11, 2024, February 19, 2025, March 11, 2025, May 20, 2025 and July 15, 2025.

QA/QC and Core Sampling Protocols

AbraSilver applies industry standard exploration methodologies and techniques, and all drill core samples are collected under the supervision of the Company's geologists in accordance with industry best practices. Drill core is transported from the drill platform to the logging facility where drill data is compared and verified with the core in the trays. Thereafter, it is logged, photographed, and split by diamond saw prior to being sampled. Samples are then bagged, and quality control materials are inserted at regular intervals at site; these include blanks and certified reference materials as well as duplicate core samples which are collected in order to assess sampling precision and reproducibility. Groups of samples are then placed in large bags which are sealed with numbered tags in order to maintain a chain-of-custody during the transport of the samples from the project site to the laboratory.

All samples are received by the ASA (Alex Stewart Argentina) preparation laboratory in Salta, where they are prepared, then the pulp sachet is directly dispatched to its facility in Mendoza, Argentina, where they are analyzed. All samples are analyzed using a multi-element technique consisting of a four-acid digestion followed by ICP/AES detection, and gold is analyzed by 50g Fire Assay with an AAS finish. Silver results greater than 100g/t are re-analyzed using four acid digestion with an ore grade AAS finish.

Qualified Persons and Technical Information

The site visit, review of various geological aspects including sampling techniques, drill core, logging, assay laboratory, secondary laboratory check samples and Mineral Resource estimate were done by Mr. Luis Rodrigo Peralta, B.Sc., FAusIMM CP (Geo). Mr. Peralta is an independent Qualified Person as defined by the NI 43-101. Mr. Peralta has reviewed and approved the technical content of this news release.

The full Technical Report in respect of the Mineral Resource estimate is being prepared in accordance with NI 43-101 and will be available on SEDAR+ () under the Company's issuer profile within 45 days from this news release. The effective date of the Mineral Resource estimate is July 21, 2025.

About AbraSilver

AbraSilver is an advanced-stage exploration company focused on rapidly advancing its 100%-owned Diablillos silver-gold project in the mining-friendly Salta province of Argentina. The current Measured and Indicated Mineral Resource estimate for Diablillos consists of 73.1 Mt grading 79 g/t Ag and 0.66 g/t Au, containing approximately 186Moz silver and 1.6Moz gold, with significant further upside potential based on recent exploration drilling. The Company is led by an experienced management team and has long-term supportive shareholders including Mr. Eric Sprott. In addition, AbraSilver owns a portfolio of earlier-stage copper-gold projects including the La Coipita copper-gold project in the San Juan province of Argentina. AbraSilver is listed on the TSX under the symbol "ABRA" and in the U.S on the OTCQX under the symbol "ABBRF".

For further information please visit the AbraSilver Resource website at , our LinkedIn page at AbraSilver Resource Corp. , and follow us on X at

Alternatively, please contact:

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment