Dollar General (DG) Stock Signal 22/07: (Chart)

(MENAFN- Daily Forex) Short Trade IdeaEnter your short position between 106.08 (the intra-day low of a previous price gap higher) and 110.28 (yesterday's intra-day high).Market Index Analysis

- Dollar General (DG) is a member of the S&P 500. This index remains near record highs, but bearish trading volumes are rising. The Bull Bear Power Indicator of the S&P 500 shows a negative divergence.

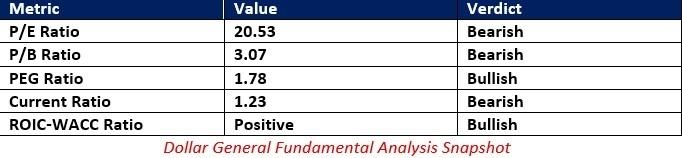

- The DG D1 chart shows a breakdown below a horizontal resistance zone. It also shows price action at its 38.2% Fibonacci Retracement Fan level with massive bearish momentum. The Bull Bear Power Indicator is bearish and has been contracting for weeks. Trading volumes are higher during selloffs than during rallies. DG corrected as the S&P 500 rallied to fresh highs, a significant bearish development.

- DG Entry Level: Between 106.08 and 110.28 DG Take Profit: Between 86.25 and 92.11 DG Stop Loss: Between 114.18 and 116.30 Risk/Reward Ratio: 2.45

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Japan Skin Care Products Market Size Worth USD 11.6 Billion By 2033 CAGR: 4.18%

- Permissionless Data Hub Baselight Taps Walrus To Activate Data Value Onchain

- Chaingpt Pad Unveils Buzz System: Turning Social Hype Into Token Allocation

- Newcastle United Announce Multi-Year Partnership With Bydfi

- PLPC-DBTM: Non-Cellular Oncology Immunotherapy With STIPNAM Traceability, Entering A Global Acquisition Window.

- Origin Summit Unveils Second Wave Of Global Icons Ahead Of Debut During KBW

Comments

No comment