$TAC Token Debuts In TVL As TAC Mainnet Goes Live With Leading Defi Protocols

-

$TAC token is now listed on leading exchanges including Bybit, Bitget, and Kraken. The token is also now live on trading platforms such as Wallet in Telegram and Binance Alpha.

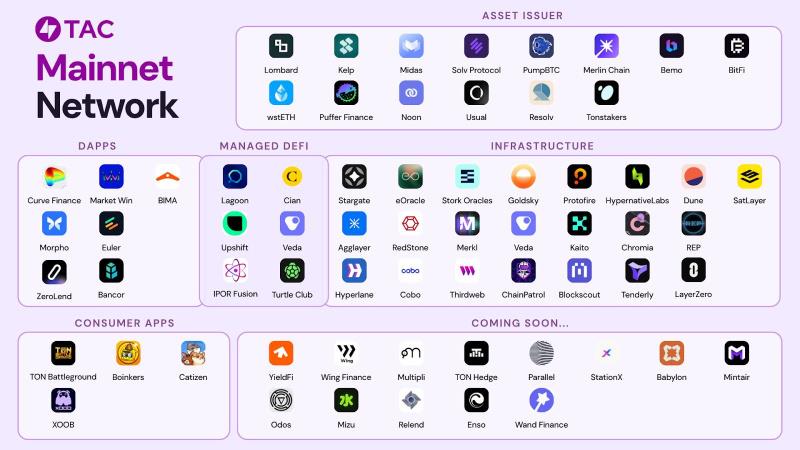

TAC's public mainnet is now live. Leading DeFi protocols, including Morpho, Curve, Bancor, Euler, ZeroLend, IPOR Fusion, and Market.win are now deployed on the public mainnet.

The TAC Summoning Liquidity Campaign reached $800M in TVL. This liquidity will power the DeFi dApps on TAC.

TAC , a purpose-built blockchain enabling EVM dApps to access TON and Telegram's growing blockchain-based economy, has launched its public mainnet and unveiled its native token, $TAC. $TAC token is now listed on leading exchanges including Bybit, Bitget, and Kraken. The token is also now live on trading platforms such as Wallet in Telegram and Binance Alpha. The token release

Alongside the token launch, TAC's public mainnet is now live. Leading DeFi protocols, including Morpho, Curve, Bancor, Euler, ZeroLend, IPOR Fusion, and are now deployed on the public mainnet. The campaign, a liquidity bootstrapping campaign launched in collaboration with Turtle Club, a liquidity distribution protocol, accumulated over $800 million in TVL. The liquidity that this has bootstrapped will ensure robust markets from day one, solving the cold-start problem that typically affects new DeFi ecosystems.

$TAC Token Utility and Role in the Network

$TAC serves three indispensable roles. First, it is the exclusive gas token on TAC EVM, including back-end logic that converts TON-denominated fees into $TAC, creating continuous buy-pressure as network activity scales. Secondly, it enhances network security through a delegated proof-of-stake (DPoS) mechanism, where validators are required to bond $TAC to participate in block production. Token holders may also delegate their $TAC to validators, with current protocol estimates indicating potential annualized returns in the range of 8–10%. Third, $TAC unlocks on-chain governance, allowing stakers to direct upgrades, incentive programs, and the community treasury. TAC token is launching in a live and vibrant ecosystem with $800mn TVL, with a variety of high-quality assets, blue-chip dApps, and DeFi use cases.

With the public listing, TAC will distribute validator grants, activate liquidity incentives on partner DEXs, and open proposals for its first community-led growth programs.

Built to Scale with Major Infrastructure Partnerships

TAC is a layer 1 blockchain built using a CosmosEVM architecture, ensuring seamless compatibility with Ethereum's Cancun hard fork. It is secured through a Tendermint-based Delegated Proof-of-stake (DPoS) consensus mechanism and the native $TAC token, enabling about 2-second block finality and allowing users to delegate their tokens to trusted validators.

Security is further strengthened by TAC's integration with Babylon, which introduces Bitcoin staking to enhance consensus validation.

TAC has also established partnerships with leading infrastructure providers, including LayerZero, RedStone, Blockscout, Dune, and Thirdweb, laying the groundwork for a powerful, scalable, and developer-friendly ecosystem.

TAC's mainnet launch comes after the company

About TAC

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment