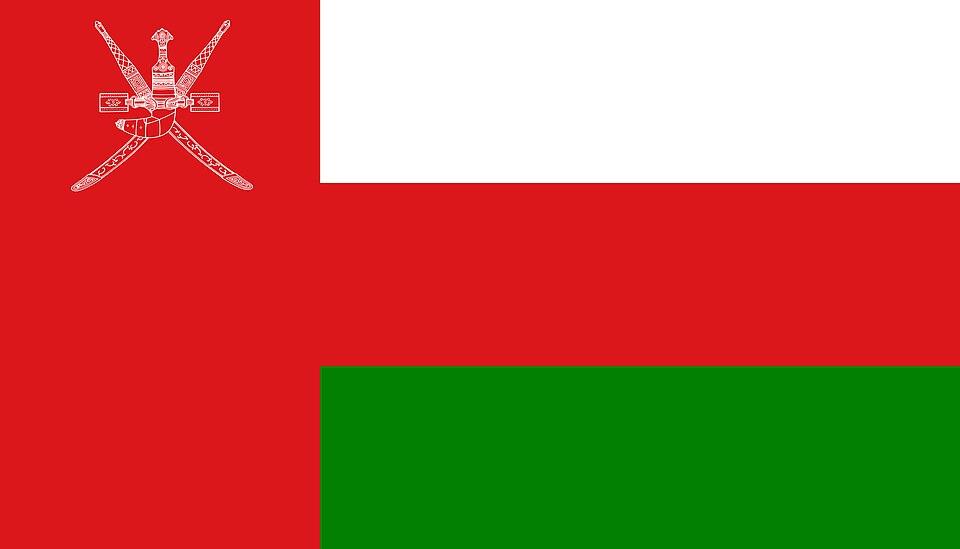

Oman's Landmark Move To Tax High Earners

Oman has become the first Gulf Cooperation Council nation to legislate a personal income tax, with a royal decree introducing a flat 5% levy on residents earning above OMR 42,000 per year. The law takes effect on 1 January 2028 and is expected to impact roughly the top 1% of earners.

The decree, Royal Decree No. 56/2025 issued by His Majesty Sultan Haitham bin Tariq, forms part of Oman's broader Vision 2040 strategy aimed at reducing reliance on oil revenues, which can constitute up to 85% of public income. With this move, Oman joins corporate tax, VAT, excise duties, and customs duties as pillars of its expanding fiscal framework.

Officials emphasise that most residents will be unaffected. A high exemption threshold ensures that 99% of the population falls below the taxable income bracket. Exemptions and deductions for education, healthcare, housing, inheritance, charitable donations, and zakat are included to align the law with social welfare objectives.

Early adoption of a personal income tax signals a shift in fiscal policy, likely to trigger regional analysis. Tax experts suggest that expatriates and high-net-worth individuals may reassess their residency choices, although the modest 5% rate is not expected to drive widespread departures.

Implementation will require the introduction of executive regulations within a year of the law's publication, which is scheduled following its official gazette release. Employers will need to enhance payroll infrastructure to accommodate withholding requirements, while both businesses and individuals must review contracts and compensation strategies ahead of the shift.

The International Monetary Fund and regional analysts have long advised GCC states to broaden revenue sources; Oman's measure aligns with this guidance. For neighbouring countries like Saudi Arabia and the UAE, which have implemented VAT and corporate taxes but not personal income levies, Oman's precedent may prompt fresh deliberations.

See also Stock market information for NVIDIA CorpWith execution set three years ahead, stakeholders have a window to adjust. Observers note that while Oman's strategy is socially oriented-protecting most citizens-it heralds a transformation in Gulf tax policy that merits close attention from both regional governments and international investors.

Notice an issue? Arabian Post strives to deliver the most accurate and reliable information to its readers. If you believe you have identified an error or inconsistency in this article, please don't hesitate to contact our editorial team at editor[at]thearabianpost[dot]com . We are committed to promptly addressing any concerns and ensuring the highest level of journalistic integrity. Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- VUBE Exchange Announces Unified Account Integration Across VUBE Pro, VUBE Plus, And VUBE Max

- Fitell Corporation Launches Solana (SOL) Digital Asset Treasury With $100M Financing Facility, With Focus On Yield And On-Chain Defi Innovation

- Meanwhile, Bitcoin Life Insurer, Secures $82M To Meet Soaring Demand For Inflation-Proof Savings

- Edgen Launches Multi‐Agent Intelligence Upgrade To Unify Crypto And Equity Analysis

- The Bitcoin Way Launches Panama Discovery Trip - A Premium 3-Day Plan B Experience

- Seoul Exchange, One Of Only Two Licensed Platforms For Unlisted Securities, Will Exclusively Use Story To Settle Tokenized Rwas

Comments

No comment