403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Meta Platforms (META) Stock Signal 01/07: (Chart)

(MENAFN- Daily Forex) Market Index Analysis

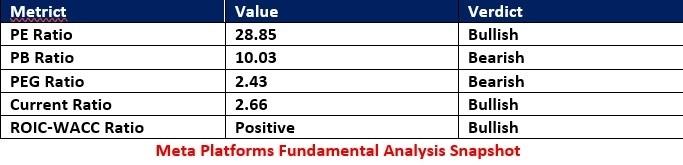

- Meta Platforms (META) is a member of the NASDAQ 100 , the S&P 100, and the S&P 500. All three indices are at or near record highs, but underlying technical factors suggest volatility ahead with cracks in the strength of the uptrend. The Bull Bear Power Indicator of the NASDAQ 100 shows a negative divergence, which is a bearish sign that could lead to a bearish correction within a bull trend.

- The META D1 chart shows price action climbing the Fibonacci Retracement Fan. It also shows a bearish chart pattern, but support levels should limit downside risk. The Bull Bear Power Indicator shows a negative divergence, but an uptick this week confirms the most recent push higher. Trading volumes over the past week were higher during risk-on sessions. META ranks among the market leaders in the current uptrend.

- META Entry Level: Between 708.87 and 738.09 META Take Profit: Between 861.92 and 887.78 META Stop Loss: Between 638.58 and 665.03 Risk/Reward Ratio: 2.18

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- CEA Industries ($BNC) Announces BNB Holdings Of 480,000 Tokens, And Total Crypto And Cash Holdings Of $663 Million

- Whale.Io Launches Battlepass Season 3, Featuring $77,000 In Crypto Casino Rewards

- Kucoin Appeals FINTRAC Decision, Reaffirms Commitment To Compliance

- Daytrading Publishes New Study Showing 70% Of Viral Finance Tiktoks Are Misleading

- Bitmex Launches Uptober Carnival Featuring A $1,000,000 Prize Pool

- PU Prime Launches Halloween Giveaway: Iphones, Watches & Cash Await

Comments

No comment