Canadian Credit Market Reaches $2.5 Trillion In Outstanding Balances, With Gen Z Canadians Accounting For 10% Of Credit Growth

| Risk Tier | Avg. Non-Mortgage Balances per Consumer | YoY Change in Non-Mortgage Balances | YoY Change in Consumer Card Balances | YoY Change in Consumer Personal Loan Balances | |||

| Super Prime | $26,355 | 0.10% | -0.30% | 4.50% | |||

| Prime Plus | $26,301 | 0.10% | 1.10% | 4.50% | |||

| Prime | $24,983 | 3.30% | 6.20% | 4.90% | |||

| Near Prime | $29,681 | 3.80% | 5.90% | 4.70% | |||

| Subprime | $23,638 | 6.30% | 5.50% | 6.70% |

The YoY growth in average balances among below prime consumers may be due to these consumers utilizing more credit to augment disposable income in the face of elevated prices. This trend was seen particularly with the growth in credit card and personal loan balances, as these are traditionally the products used by consumers for liquidity. Below prime consumer average balances across these products grew at a faster rate than overall borrower balance growth during this period.

Additionally, the data shows regional disparities in the YoY growth rates of non-mortgage debt, although province rankings did not change from the previous quarter. P.E.I. and Newfoundland had the highest average debt per borrower, while Quebec and Manitoba had the lowest. While the gap between the highest and lowest average debt balances across provinces may not appear substantial, even modest differences in average debt per consumer can significantly influence delinquency rates. Consumers in provinces with higher average debt levels may be more susceptible to increases in interest rates as well as higher everyday living costs, making them more vulnerable to financial strain and increasing the likelihood of delinquency, particularly during economic downturns.

“The rise in balances from higher-risk and more vulnerable credit consumers signals a critical moment for lenders to reassess risk strategies and engagement models. Proactive credit monitoring, tailored financial support and early intervention tools can mitigate potential delinquencies while still maintaining consumer access to credit,” said Fabian.“At the same time, consumers should continue to build financial resilience by understanding their credit profiles, seeking guidance when needed and using credit responsibly. Empowered, informed borrowers are key to a healthier credit ecosystem.”

| Ranking Average Consumer Non-Mortgage Debt Balance by Province | ||||

| Q1 2024 | Q1 2025 | YoY Change | ||

| Canada | $25,786 | $26,415 | 2.44% | |

| PEI | $27,696 | $29,364 | 6.02% | |

| NL | $27,876 | $28,775 | 3.23% | |

| BC | $27,656 | $28,585 | 3.36% | |

| AB | $28,304 | $28,403 | 0.35% | |

| ON | $26,880 | $27,544 | 2.47% | |

| SK | $26,683 | $26,972 | 1.08% | |

| NS | $24,266 | $24,929 | 2.73% | |

| NB | $23,675 | $24,497 | 3.47% | |

| QC | $22,152 | $22,756 | 2.72% | |

| MB | $20,268 | $20,802 | 2.63% |

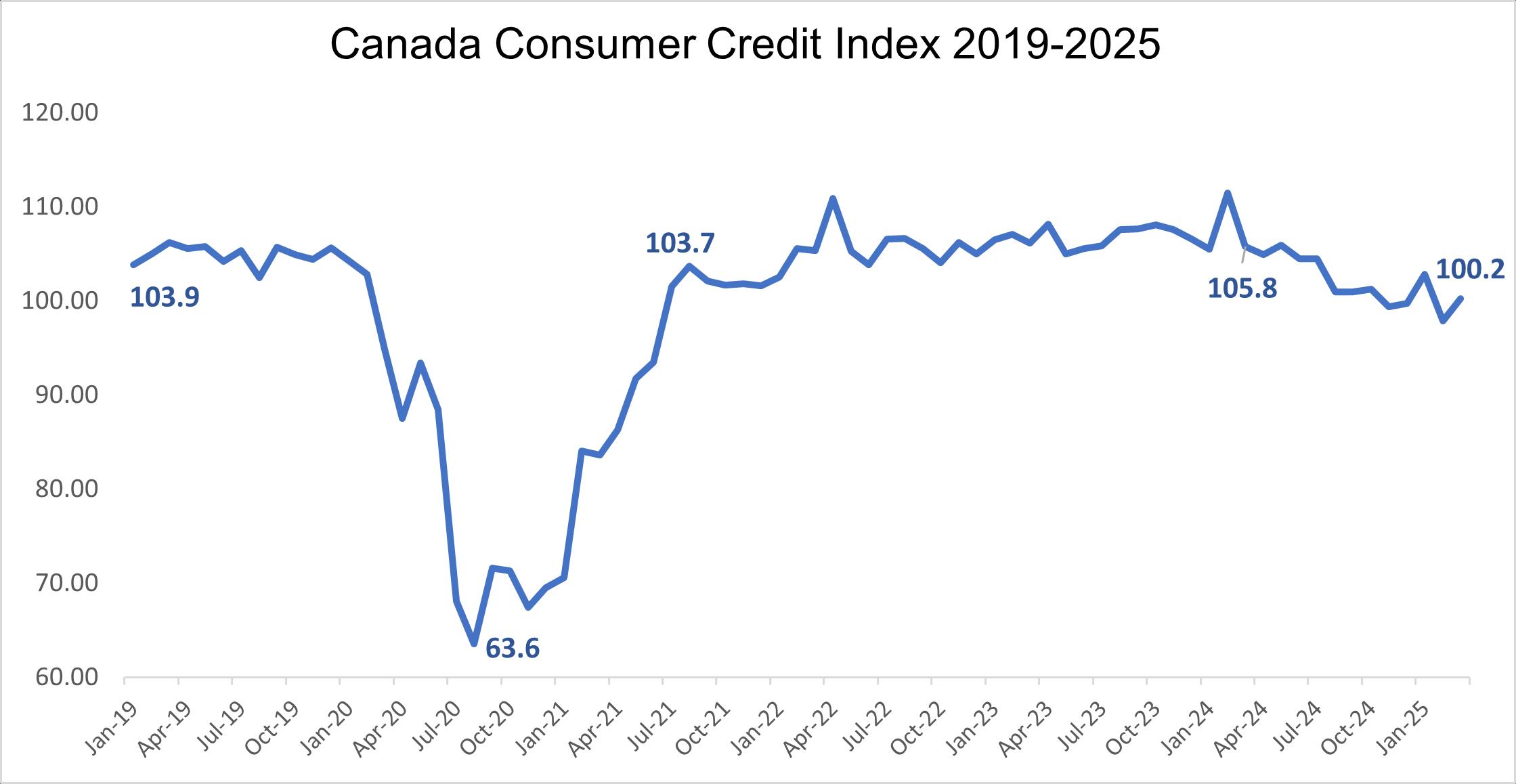

Lower Canada Consumer Credit Index Reflects Weakening Market Conditions

Economic uncertainty has recently muted credit demand while supply remains strong. Additionally, uncertainty has shifted some credit behaviours as consumers balances have increased while credit performance has remained relatively stable from prior year, driving the Canada Consumer Credit Index to 100.3, down almost 6 points from the prior year.

Differing Impact of Economic Volatility Across Risk Tiers

A widening financial divide is emerging among credit consumers across Canada. While recent improvements in inflation and interest rates have provided relief for some, enabling them to reduce debt and strengthen their financial positions, others continue to face significant challenges. These consumers are still grappling with the prolonged effects of past economic volatility, highlighting an uneven recovery and growing disparity in financial resilience.

Overall consumer-level serious delinquency (consumers 60 days or more delinquent on any credit product) was up 11 basis points YoY to 2.71% in Q1 2025. This increase was driven in part by the recent growth in new-to-credit consumers, who generally carry higher risk in their early years due to their limited credit experience. Even with the recent increase, the current levels of delinquency are similar to those seen prior to the pandemic.

Subprime consumers have become more likely to experience delinquency soon after opening a new product, with the delinquency rate within the first six months of opening a new credit account doubling between 2020 and 2024. This is particularly evident for below prime credit card and personal loans, where consumers may be more sensitive to interest rates. Subprime consumers that opened a credit card in 2023 or 2024 were 1.7x–2.0x as likely to go delinquent within the first 12 months of holding that card than those who opened a card in 2020. These findings further demonstrate the increased vulnerability that subprime borrowers have to macroeconomic factors such as higher interest rates and increased cost of living.

| Delinquency (90+ DPD) in the First 12 Months on Subprime Card Originations | |||||

| Q1 2020 | Q1 2021 | Q1 2022 | Q1 2023 | Q1 2024 | |

| 12 Months on Book | 6.46% | 9.18% | 11.86% | 12.68% | 10.76% |

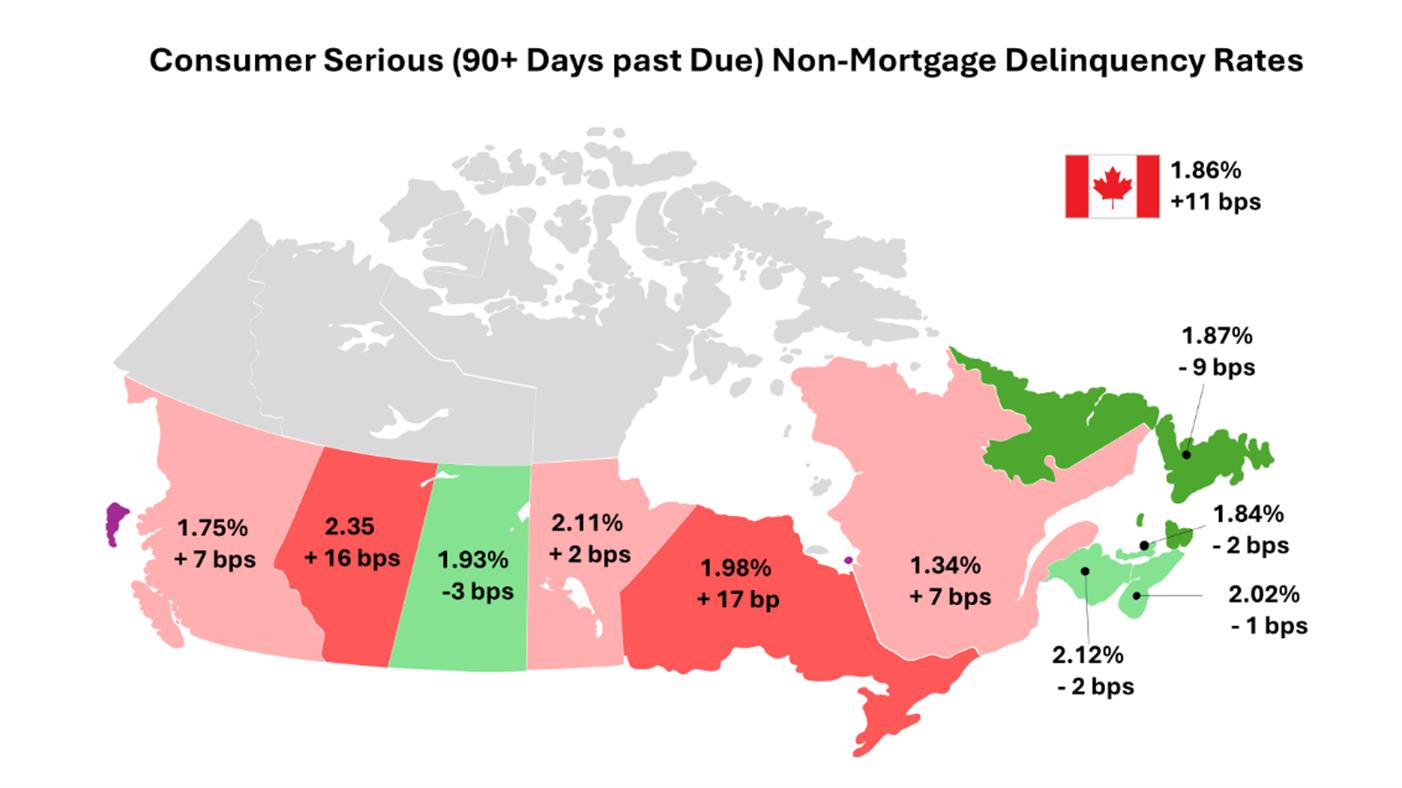

Geography is also playing a role in the vulnerability or resilience of consumers. A 16 basis point YoY increase in serious consumer delinquencies led to Alberta continuing to have the highest rate across all provinces in Q1 2025, driven by the volatility in oil and gas prices that play a large role in Alberta's economy. While Quebec remained the province with the lowest rate of delinquencies, it had a seven basis point increase YoY.

“We've seen volatility in delinquency rates attributed to a mix of regional economic pressures and demographic factors. Regional variations in both cost of living as well as wage growth, along with pressure from macro-economic cycles, disproportionately impact specific regions, and hence some provinces have had more volatile consumer credit performance,” Fabian said.“These findings underscore the importance of regionally tailored lending policies and support systems to address the unique challenges faced by those households. Additionally, consumers in more vulnerable areas should stay vigilant in keeping current on payments, monitoring credit and building emergency savings.”

About TransUnion (NYSE: TRU)

TransUnion is a global information and insights company with over 13,000 associates operating in more than 30 countries, including Canada, where we're the credit bureau of choice for the financial services ecosystem and most of Canada's largest banks. We make trust possible by ensuring each person is reliably represented in the marketplace. We do this by providing an actionable view of consumers, stewarded with care.

Through our acquisitions and technology investments we have developed innovative solutions that extend beyond our strong foundation in core credit into areas such as marketing, fraud, risk and advanced analytics. As a result, consumers and businesses can transact with confidence and achieve great things. We call this Information for Good® - and it leads to economic opportunity, great experiences and personal empowerment for millions of people around the world.

For more information visit:

For more information or to request an interview, contact:

Contact: Katie Duffy

E-mail: ...

Telephone: +1 647-772-0969

Photos accompanying this announcement are available at

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- FLOKI Funds Clean Water Wells In Africa Through Partnership With WWFA

- Solo Leveling Levels Up: Korean Billion-Dollar Megafranchise Goes Onchain With Story

- Cregis At FOREX Expo 2025: Connecting Forex With Crypto Payment

- Luminadata Unveils GAAP & SOX-Trained AI Agents Achieving 99.8% Reconciliation Accuracy

- Tradesta Becomes The First Perpetuals Exchange To Launch Equities On Avalanche

- BC.GAME News Backs Deccan Gladiators As Title Sponsor In 2025 Abu Dhabi T10 League

Comments

No comment