Asia Week Ahead: All Eyes On Trump's Reciprocal Tariffs

The main focus next week is new tariff developments. On top of President Trump's“Liberation Day” announcement of reciprocal tariffs, we should know results of the US investigation into China's imports under the Phase One Trade Agreement. The deadline for the probe is April Fool's Day; the results could be released on the day or soon after. While China is not necessarily a major focus of reciprocal tariffs, the results of the investigation could lead to additional actions.

Trump's moratorium on the TikTok ban is set to end on 5 April. This could make next week a key hinge point on the issue. Trump says that he would consider reducing China tariffs to get a TikTok deal done.

On the data front, next week's highlight is purchasing managers' index data. China's official PMI is out on Monday. We look for a small uptick in manufacturing to 50.4 from 50.2. The Caixin PMI follows on Wednesday. Markets are looking for a slight slowdown to 50.6 from 50.8. If this trend bears out, it would signal a more challenging environment for Chinese exporters.

Taiwan: Potential to avoid the worst-case scenarioTaiwan watchers will be eyeing 2 April closely to see how the island fares once the reciprocal tariffs are announced. Our view is that Taiwan could avoid the worst of Trump's reciprocal tariffs thanks to the announcement of high-profile investments in the US and the nature of its key exports to the US. The data schedule is reasonably light in the week ahead. On Tuesday, markets will pay close attention to whether Taiwan's manufacturing sector expands for a 12th consecutive month.

Australia: RBA likely to leave its policy rate unchangedWe expect the Reserve Bank of Australia to leave the cash rate unchanged on 1 April. Despite a weaker-than-expected consumer price index (CPI) reading for February, we estimate both the headline and trimmed CPI for the first quarter edged higher on a quarter-on-quarter basis. Still, elevated inflation readings and tariff risks will likely deter the RBA from delivering back-to-back rate cuts.

We expect industrial production to rebound thanks to increased auto production. Before reciprocal tariffs take effect, manufacturers might have revamped their production. Amid intensifying tariff threats, the Tankan survey of large manufacturing companies is expected to drop. However, the non-manufacturing survey is likely to advance amid strong wage growth. Meanwhile, consumption-related data should be on the soft side thanks to high food prices, especially Japan's main staple, rice. Retail sales and household spending should decline in February.

South Korea: Exports expected to pick up, but outlook remains cloudyBased on weak February exports, we expect industrial production to stay unchanged compared to January. Auto output may have increased, but with gains offset by declines in IT output. However, we expect exports to recover in March thanks to solid gains in both semiconductor and car exports. Manufacturers are expected to send out shipments before the reciprocal tariffs become effective. However, local surveys suggest a cloudy outlook for manufacturers due to US trade policies. As such, the manufacturing PMI is likely to decline further. Meanwhile, inflation is expected to ease a bit. Manufactured food prices are likely to rise, yet recent drops in gasoline prices may partly offset increases.

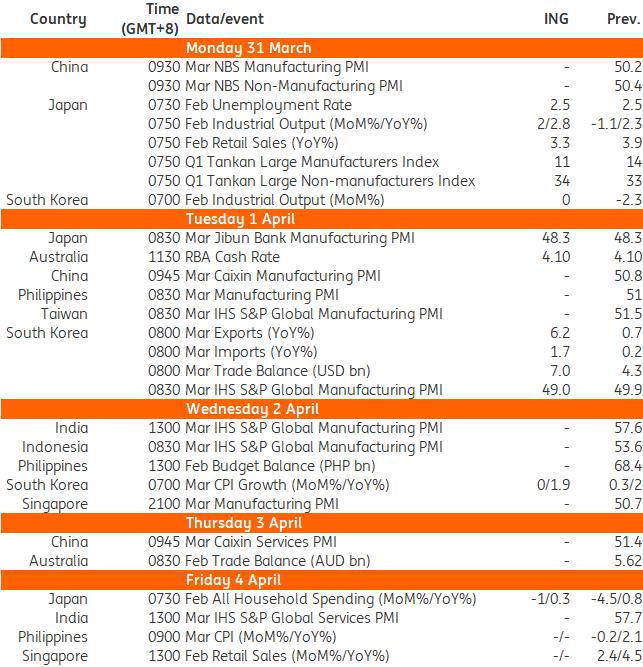

Key events in Asia next week

Source: Refinitiv, ING

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment