TOKYO GAS Co., Ltd.: Action Policy Toward Continuous Corporate Value Enhancement

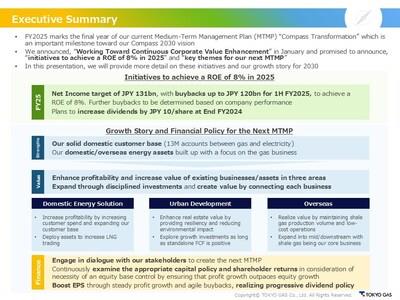

Since the announcement of current MTMP, we have accelerated our efforts to enhance corporate value. On January 31, we clearly committed to achieving a ROE of 8% in FY25 and demonstrated our willingness to aim for an ROE exceeding 10% around FY30. Capital efficiency is the core financial metric that our team uses and we believe shareholders should also use to evaluate our financial performance over time. We promised to present our key themes for the next MTMP by the end of March, and we are committed to prioritizing dialogue with stakeholders as we formulate our next MTMP.

Achieving high ROE targets is not an easy task for a company like ours, which is required to hold a significant amount of assets to be able to provide stable infrastructure services. However, we believe we can achieve these targets by leveraging our solid domestic customer base and assets to enhance the profitability and asset value of our existing businesses. Additionally, we believe expanding into adjacent and interconnecting our businesses to create new value will better position us to achieve our targets. Domestically, we aim to increase corporate value by cross-selling gas, electricity, and solutions to our customer base, further strengthening the customer base itself, and converting existing real estate assets in our urban development business, integrating building and energy system development/operation. Internationally, we will focus on ensuring profitability in our shale gas business while expanding into mid/downstream operations in the U.S. and LNG trading. Furthermore, strengthening resilience of existing infrastructure and working towards carbon neutrality are also crucial missions that support these efforts.

Growth investments are essential for continuous value creation, and we are strengthening our investment discipline and elevating our investment strategies. For example, in the shale gas business, we learned from past experiences to invest in a US shale company with management familiar with local operations, strengthen governance, and gradually acquire a majority stake. This has allowed us to execute advanced area strategies and expansion investments. As a result, our shale gas business is expected to become a major profit pillar in FY25.

Under the current MTMP, our financial strategy, which is instrumental for our growth, includes a highly flexible capital return policy. This policy includes a baseline target total return ratio of 40%, with room for opportunistic increases beyond that target as appropriate. To maintain capital efficiency, we are conducting significant share buybacks in FY25, as we did in FY24, to reverse the increase in equity from strong performance over the past two years to appropriate levels. We aim to enhance corporate value through this dual approach of steady growth investments and appropriate capital policies.

With this announcement, we hope to convey our plan to deliver continuous corporate value enhancement, earning the trust of our multiple stakeholders and securing your support over the medium- to long-term.

Media Contacts

Kekst CNC

In Tokyo:

Ai Saito

[email protected]

In New York:

Nick Capuano

[email protected]

SOURCE TOKYO GAS Co., Ltd.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment