UAE Gold Prices Hit Record High: Why Yellow Metal Will Rise Further Past $3,000

Gold prices are expected to scale new record highs due to the US tariffs row and geopolitical developments around the world pushing investors to safe-haven metal, say analysts.

The yellow metal hit a record high of $3,000 per ounce on Friday as investors shifted to safe-haven assets to cover from economic uncertainty sparked by US President Donald Trump's tariff war.

Khaleej Times reported in October last year that gold prices could touch $3,000 in the first quarter of 2025 due to geopolitical tensions, interest rate cuts and central banks' buying.

Stay up to date with the latest news. Follow KT on WhatsApp Channels.

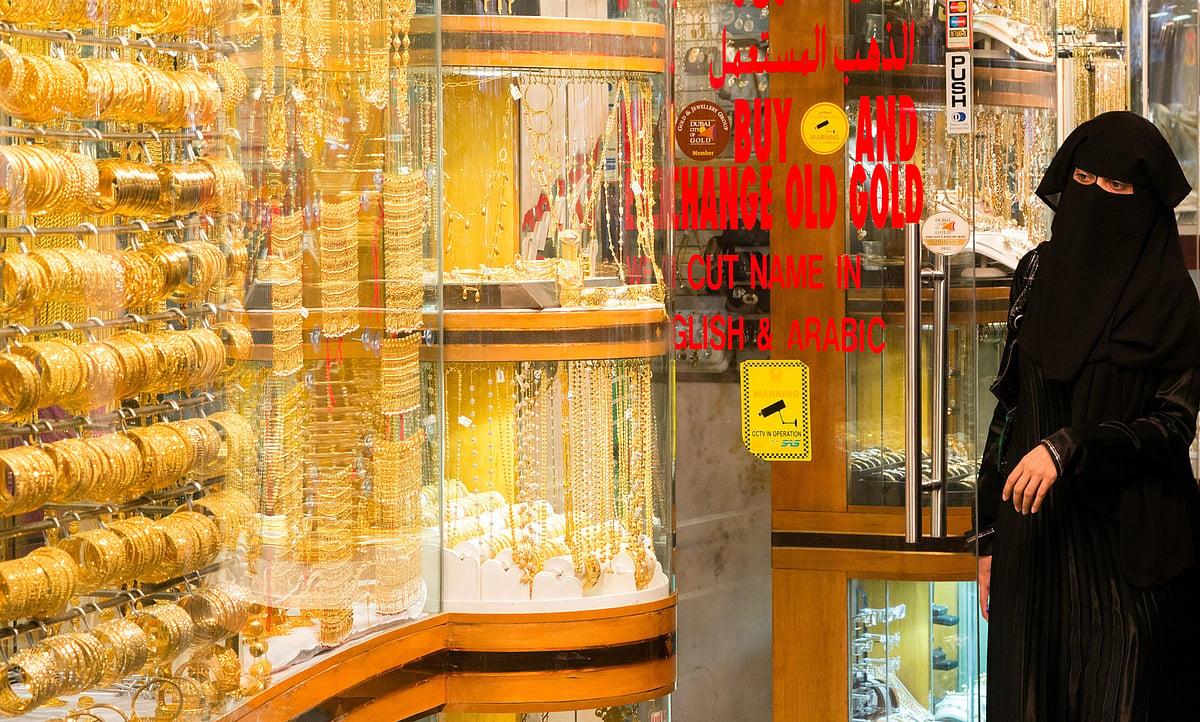

Gold closed at $2,986.65 per ounce over the weekend, up 0.23 per cent. In Dubai, gold prices hit an all-time high on Friday with 24K at Dh360.75, 22K at Dh335.75 per gram, 21K at Dh322.0 and 18K at Dh276.0 per gram. Gold prices closed the week slightly lower, with 24K at Dh359.5, 22K at Dh334.5, 21K at Dh320.75 and 18K at Dh275.0 per gram.

“Concerns over the stability of the US economy could further boost the appeal of gold. A cooling labour market and slowing inflation could push the Federal Reserve toward a more dovish stance at its next meeting, potentially driving gold prices to new records,” said Joseph Dahrieh, managing principal at Tickmill.

In the latest tariff war, Trump threatened a 200 per cent tariff on European Union-imported alcohol like champagne and wine.

“After several back-and-forths on tariffs this week, market uncertainty surged following President Trump's announcement of a 200 per cent tariff on alcoholic imports from the EU, fueling risk aversion and boosting demand for safe-haven assets like gold,” said Dahrieh.

Ahmad Assiri, research strategist at Pepperstone, said recent tariff threats play a significant role in the precious metal rally, particularly with the White House hinting at imposing tariffs that could reach up to 200 per cent on certain European products in the event of an escalation, in addition to anticipated tariffs on April 2 on both Canada and Mexico as well as reciprocal tariffs.

“This increases the uncertainty surrounding both the US and global economic growth prospects, pushing investors toward gold as a reliable hedging tool. Alongside trade tensions, gold receives strong support from the weakening of the US dollar, which stems from a shaking image of US exceptionalism and growing concerns about economic growth prospects. With the dollar trading below the 104 level, gold gains further momentum, making it attractive to international investors,” said Assiri

However, Joseph Dahrieh of Tickmill cautioned that a cautious US Fed tone, driven by inflation concerns over ongoing trade tensions, could limit the precious metal rally.

“Geopolitical developments also play a crucial role in shaping market sentiment. A ceasefire between Ukraine and Russia could improve investor sentiment, potentially weakening gold's bullish trend. However, the agreement remains to be seen, with Russian President Vladimir Putin leaving room for renewed uncertainty that may bolster gold prices once again,” said Dahrieh.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment