Asia Morning Bites

-

Global Markets: The Trump trade began to unwind yesterday on reports that Kamala Harris was leading in Iowa, a state which neither party have made a battleground, and which could be a bellwether for nearby swing states. 2Y Treasury yields fell 4.6 basis points, and 10Y yields were down 9.9bp to 4.285%. Voting starts later today, but it could be Thursday / Friday Asia time before we have more of an idea of who will likely emerge as the winner of this very tightly contested election. Markets are likely to be volatile in the meantime. EURUSD had risen sharply at yesterday's open and traded above 1.0910 briefly before settling lower at around 1.0880. The pattern of sharp early gains followed by some subsidence was reflected in most G-10 currencies. Asian FX was mostly stronger on Monday. The THB led the charge with a 0.56% gain, followed by the SGD and CNY. USDCNY is now 7.1009. The PHP bucked the trend, rising to 58.3450. US equities were softer yesterday, probably as rising prospects for a Harris win dampened thoughts of corporate tax cuts.

G-7 Macro: OK, sure, there is some US macro data today, but let's not pretend anyone will watch the service sector ISM data today while the final stages of this US election rage. The same goes for the smattering of European service PMI and production data. Today is all about US politics.

Australia: The RBA will meet today to consider their monetary stance. We see nothing in the recent data to shift them from their position of leaving rates at 4.35% for as long as it takes to ensure that inflation sustainably comes within their target. 100% of the Bloomberg consensus seems to agree. The statement text will be worth a look to see if the position is shifting at all, though we don't expect any significant semantic changes.

Indonesia: 3Q GDP is due around midday today. This figure implausibly hugs 5% so tightly in most quarters, that no one looks at it very much anymore. Deviations to two decimal places are irrelevant. The consensus is for exactly 5.0%. Why not?Philippines: October CPI inflation is released at 0900 SGT/HKT, and is expected to edge higher to 2.3% YoY, though still well within BSP's target. What happens next with policy rates will depend not just on Philippine inflation but on how Asian currencies like the PHP respond to the US Presidential election result. A period of uncertainty lies ahead until we have more clarity.

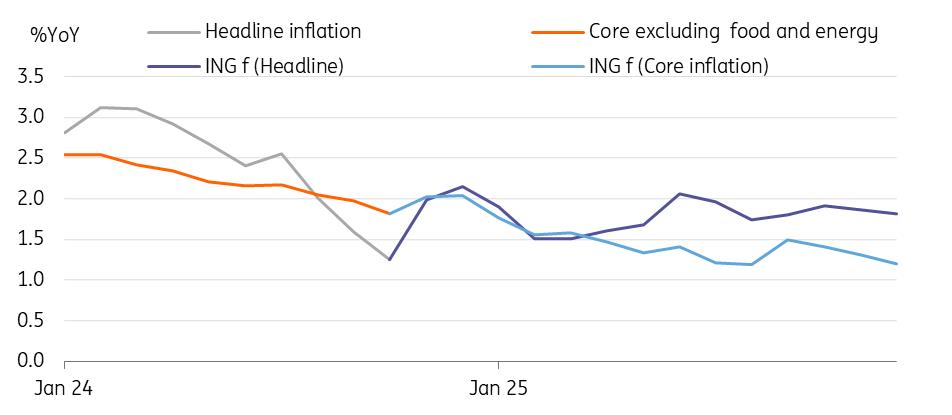

South Korea: Consumer price inflation eased to 1.3% YoY in October from 1.6% in September, below the market consensus of 1.4%. The fall in food and energy prices (-0.7%) was the main reason for the moderation, but core inflation excluding food and energy also slowed slightly to 1.7% from 1.8% in the previous month (vs 1.8% market consensus). Last year's high base also contributed to the slowdown.The gradual phasing out of fuel tax cuts in November and December is likely to push inflation temporarily back up to close to or above 2%. In addition, the increase in industrial electricity prices last month may continue to push up some goods prices with a time lag. Nevertheless, we continue to expect inflation to remain below 2% for most of next year, but the cumulative pressure of price hikes in utilities and public service fees will spike inflation from time to time.

We don't think today's lower-than-expected inflation will prompt the Bank of Korea to cut interest rates at its November meeting. Although inflation is clearly trending slower, we believe that the Bank of Korea's interest rate cuts will be limited given the imbalances in financial markets. The BoK would like to monitor the impact of its earlier cut on the housing market. However, the three-month forward guidance could change in a dovish direction. At the last meeting, one board member expressed that further easing should be considered in three months. Our baseline scenario is for an April cut, which is quite hawkish compared to the market consensus, but we acknowledge that the probability of an earlier cut than our current forecast is increasing.

What to look out for: Australia RBA target cash rate, South Korea CPI, Indonesia 3Q24 GDP, US election!

November 5th

Australia: November RBA target cash rate

China: October Caixin China composite PMI

Indonesia: 3Q GDP

Japan: October monetary base

Philippines: October CPI

Singapore: September retail sales

S Korea: October CPI, foreign reserves

Taiwan: October foreign reserves

US: September trade balance, October ISM services

November 6th

Philippines: September imports, exports, trade balance, unemployment rate

Taiwan: October CPI

November 7th

Australia: September imports, exports, trade balance, October foreign reserves

China: October imports, exports, trade balance, foreign reserves

Indonesia: October foreign reserves

Japan: September labour cash earnings, real cash earnings

Philippines:3Q GDP, October foreign reserves

Singapore: October foreign reserves

S Korea: September BoP current account balance, goods balance

November 8th

China: 3Q BoP current account balance

India: November foreign exchange reserves

Japan: September leading index CI

Taiwan: October imports, exports, trade balance

US: November FOMC rate decision, U. of Mich sentiment

China: October PPI, CPI (November 9th)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment