Lubricating Oil Additives Market Size To Reach USD 25.66 Billion By 2032 Adoption Of Synthetic Lubricants Drive Market Growth |Research By SNS Insider

| Report Attributes | Details |

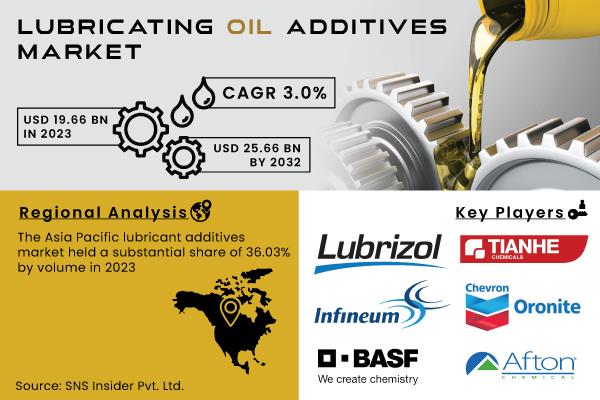

| Market Size in 2023 | US$ 19.66 Billion |

| Market Size by 2032 | US$ 25.66 Billion |

| CAGR | CAGR of 3.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | . By Type (Viscosity Index Improvers, Dispersants, Detergent, Anti-oxidants, Anti-wear Agent, Rust & Corrosion Inhibitors, Friction Modifiers, Extreme Pressure Additives, Pour Point Depressants, Others) . By Application (Engine Oil, Hydraulic Fluid, Gear Oil, Metal Working Fluids, Transmission Fluid, Grease, Compressor Oil, Others) . By Sector (Automotive, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Lubrizol Corporation, Tianhe Chemicals, Infineum International Limited, Chevron Oronite Company LLC, Lanxess, Evonik Industries AG, BRB International BV, Croda International PLC, BASF SE, Afton Chemical, Krystal Lubetech Private Limited and other players. |

| DRIVERS | . Demand from the automobile industry is growing driving the market growth. . Demand for Industrial Lubricants with Better Quality |

If You Need Any Customization on Lubricating Oil Additives Market Report, Enquire Now @

Segmentation Analysis

By Type

The viscosity index segment held the largest market share around 24.92% in 2023. A viscosity index is a type of an additive created to elevate a lubricant's viscosity's stability. This capability is essential for modern engines and machinery, which operate under varied and often extreme temperature environments. By preventing the lubricant from becoming too thick in cold conditions or too thin in high temperatures, VI improvers contribute significantly to engine efficiency, fuel economy, and overall longevity. Their ability to provide consistent performance regardless of temperature fluctuations has made them indispensable in high-performance and industrial applications, driving their dominance in the market. Thus, the demand for this type of Viscosity Index Improver only grows, and the market trends show it.

By Application

The engine oil segment held the largest market share around 28.56% in 2023. Engine oil is crucial for lubricating, cleaning, and protecting the internal components of an engine, ensuring smooth operation and longevity. The demand for high-quality engine oils is driven by the need for optimal engine performance, improved fuel efficiency, and adherence to stringent emission standards. As vehicles become more advanced, with features such as turbocharging and high-performance engines, the need for specialized additives that enhance engine oil's properties such as anti-wear agents, friction modifiers, and detergents has grown. This has led to a significant focus on developing advanced engine oils that can handle the increasing performance demands and regulatory requirements.

Regional Landscape:

Asia Pacific held the largest market share with around 36.03% in 2023. High demand for several lubricants and additives from the manufacturing industry and the rapid growth of the automotive industry. The expanding vehicle fleet in China and India, as well as the increasing industrial production of these two countries, are most attributed to driving demand. Increased demand for increased engine performance, fuel economy improvement, and compliance with ever-stringent environmental requirements highly impact the required advanced lubricants. The rapid development of infrastructure in the region and the increasing urbanization of consumers also contribute to the market.

Buy Full Research Report on Lubricating Oil Additives Market 2024-2032 @

Recent Developments

- In 2023, Chevron launched its new line of high-performance additives designed for heavy-duty diesel engines. In 2023, Infineum launched a new additive package that combines improved anti-wear properties with better fuel economy benefits. In 2023, Lubrizol unveiled its latest generation of engine oil additives featuring enhanced oxidation resistance and improved thermal stability.

Key Takeaways:

- The Asia Pacific region leads the market, driven by significant automotive and industrial sectors, rapid economic growth. There is a growing emphasis on developing eco-friendly and sustainable additives in response to increasing environmental concerns. Leading companies such as Chevron, BASF, Lubrizol, Afton Chemical, and Infineum are driving innovation with new product launches and technological advancements.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter's Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

7. Lubricating Oil Additives Market Segmentation, by Type

8. Lubricating Oil Additives Market Segmentation, by Application

9. Lubricating Oil Additives Market Segmentation, by Sector

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Description of Lubricating Oil Additives Market Report 2024-2032 @

[For more information or need any customization research mail us at ... ]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Akash Anand – Head of Business Development & Strategy ... Phone: +1-415-230-0044 (US)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment