403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

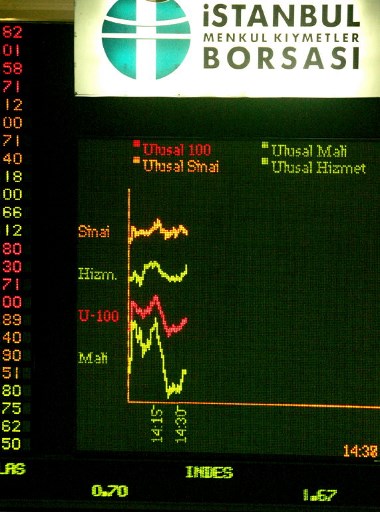

Türkiye's BIST 100 opens Tuesday’s session lower

(MENAFN) On Tuesday, Türkiye's benchmark stock index, the BIST 100, began the trading day on a lower note, opening at 10,038.19 points. This marked a modest decline of 0.16 percent, equivalent to a drop of 16.01 points from the previous close. The lower opening follows a notable gain on Monday, when the BIST 100 surged by 2.36 percent to reach 10,054.20 points. The day's trading volume was substantial, amounting to 80 billion liras, which is approximately USD2.39 billion, reflecting a significant level of market activity.

At 10:04 a.m. local time (0704 GMT), the currency exchange rates were reported as follows: the US dollar was trading at 33.7810 Turkish liras, the euro was valued at 37.4361 Turkish liras, and the British pound was priced at 43.8996 Turkish liras. In the commodities market, gold was priced at USD2,541.25 per ounce, while Brent crude oil was trading at about USD77.27 per barrel. These figures highlight the ongoing fluctuations in currency and commodity markets that are closely monitored by investors.

The focus of the financial markets is currently on the Turkish Central Bank's anticipated interest rate decision, scheduled to be announced later today. This decision is expected to be a critical factor influencing market sentiment and economic conditions in Türkiye. Investors and analysts are keenly awaiting the announcement, as it will provide insights into the Central Bank's stance on monetary policy and its potential impact on inflation, economic growth, and overall market stability.

At 10:04 a.m. local time (0704 GMT), the currency exchange rates were reported as follows: the US dollar was trading at 33.7810 Turkish liras, the euro was valued at 37.4361 Turkish liras, and the British pound was priced at 43.8996 Turkish liras. In the commodities market, gold was priced at USD2,541.25 per ounce, while Brent crude oil was trading at about USD77.27 per barrel. These figures highlight the ongoing fluctuations in currency and commodity markets that are closely monitored by investors.

The focus of the financial markets is currently on the Turkish Central Bank's anticipated interest rate decision, scheduled to be announced later today. This decision is expected to be a critical factor influencing market sentiment and economic conditions in Türkiye. Investors and analysts are keenly awaiting the announcement, as it will provide insights into the Central Bank's stance on monetary policy and its potential impact on inflation, economic growth, and overall market stability.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment