Qatar's Non-Energy Private Sector Sees Sharpest Growth In Nearly Two Years In June

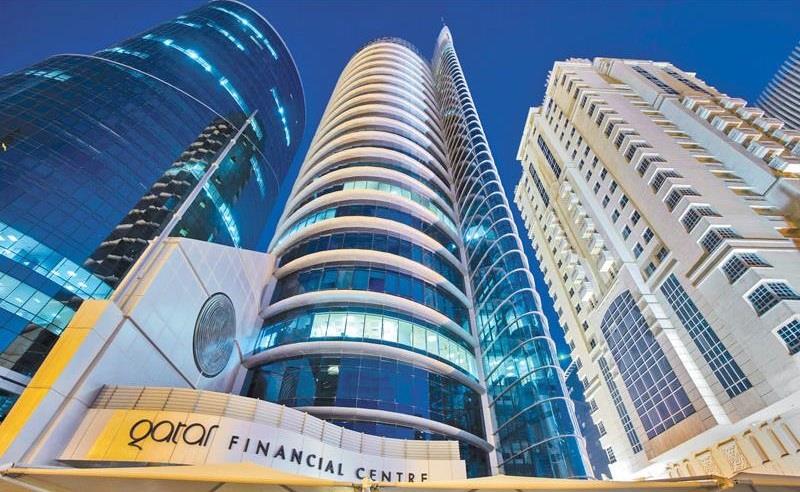

Doha: Qatar's non-energy private sector growth moved up a gear in June, according to the latest Purchasing Managers' Index (PMI) survey data from Qatar Financial Centre (QFC) compiled by S&P Global. Output increased at the fastest rate for a year-and-a-half as new business growth accelerated, while companies continued to expand employment and the 12-month outlook remained strong.

Inflationary pressures remained muted, with input prices up only slightly since May and prices charged for goods and services falling.

The Qatar PMI indices are compiled from survey responses from a panel of around 450 private sector companies. The panel covers the manufacturing, construction, wholesale, retail, and services sectors, and reflects the structure of the non-energy economy according to official national accounts data.

The headline Qatar Financial Centre PMI is a composite single-figure indicator of non-energy private sector performance. It is derived from indicators for new orders, output, employment, suppliers' delivery times and stocks of purchases.

The PMI registered 55.9 in June, up from 53.6 in May and signalled the strongest improvement in business conditions in the non-energy private sector economy since July 2022. It was also above the long-run trend level of 52.3 (since April 2017). The headline figure has risen five times in 2024 so far, and the 2.3-point increase in the PMI was among the largest registered over the past three years.

June data signalled a strengthening in demand in the Qatari non-energy economy. The level of incoming new work expanded at the sharpest rate in 13 months, and one that was faster than the long-run survey trend. Firms reported higher customer numbers, promotional activity and client trust in their products and services.

Yousuf Mohamed Al Jaida, Chief Executive Officer, QFC Authority

Yousuf Mohamed Al Jaida, Chief Executive Officer, QFC Authority said,“The PMI ascended to its highest level in almost two years in June, boosted by faster growth of output and new business and a renewed rise in inventories as firms remained optimistic in the 12-month outlook.

Additionally, the June figure of 55.9 was higher than in all pre-pandemic months in the survey history, except for October 2017 (56.3). Growth has now accelerated five times in the first half of 2024 as the non-energy economy has rebounded from a moderation in the second half of 2023.

“Moreover, the latest results point to a more broad-based upturn as manufacturing and construction have caught up with the services, wholesale and retail sectors.”

“The acceleration in business expansion has not been accompanied by rising price pressures. On the contrary, companies engaged in discounting in June to further boost sales.”

The faster increase in new business in June resulted in the strongest growth in total business activity since December 2022. Growth accelerated notably in manufacturing and construction, and remained sharp in the other sectors. Despite rising demand for goods and services, companies were able to further reduce the volume of outstanding work.

Confidence regarding the next 12 months remained strong in June. Companies linked positive forecasts to new branch openings, new customers and marketing campaigns.

Faster growth of output and new orders was reflected in another increase in employment, the sixteenth in a row. Companies reported new job opportunities due to business growth and the need to recruit highly skilled staff. Wholesalers & retailers and service providers drove recruitment.

Read Also-

Qatar offers promising investment opportunities

Demand for inputs rose in June, as purchasing activity increased for the fourth successive month. Lead times continued to improve, however, as supplier relationships continued to be developed. Input stocks rose for only the second time in seven months, and at the fastest rate in a year as companies prepared for anticipated greater new workloads.

Cost pressures rose slightly in June as average purchase prices and staff costs both increased, albeit at marginal rates. Prices charged for goods and services fell for the sixth time in the past eight months, however, and at the second-fastest rate for a year, as firms reported making discounts to boost competitiveness and win new customers.

Qatari financial services companies recorded a further strengthening in growth of total business activity and new contracts in June. The seasonally adjusted Financial Services Business Activity and New Business Indexes rose to 13- and nine-month highs of 61.1 and 59.2, respectively, well above their long-run trend levels since 2017.

Companies were also increasingly optimistic regarding the 12-month outlook, with sentiment the highest since July 2023. Meanwhile, employment growth was maintained for the fifteenth successive month.

In terms of prices, average charges set by financial services companies rose at the strongest rate since April 2023, following a marginal rise in May and discounting during the first four months of 2024. Meanwhile, average input prices fell slightly for the third time in four months.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment