403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

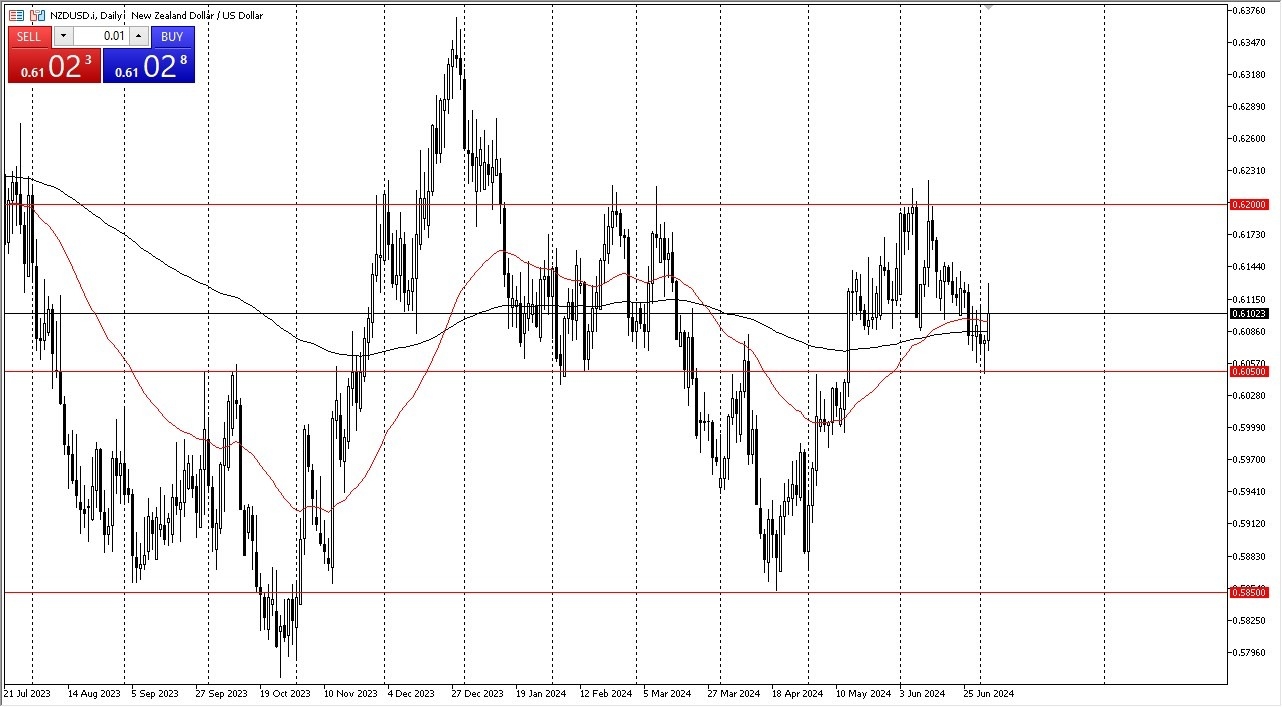

NZD/USD Forecast Today 04/7: Holiday Liquidity (Video)

(MENAFN- Daily Forex)

- The New Zealand dollar has rallied a bit during the trading session on Wednesday, as we have seen quite a bit of momentum. Now that being said, keep in mind that Thursday is Independence Day and Independence Day is going to keep the Americans out of the market. That will bring in a lot of liquidity issues, but overall, it's worth noting that we did bounce from a significant support level at the 0.6050 level. That's an area that I think continues to see a lot of support and resistance and market memory.

- 1 Get Started 74% of retail CFD accounts lose money

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment