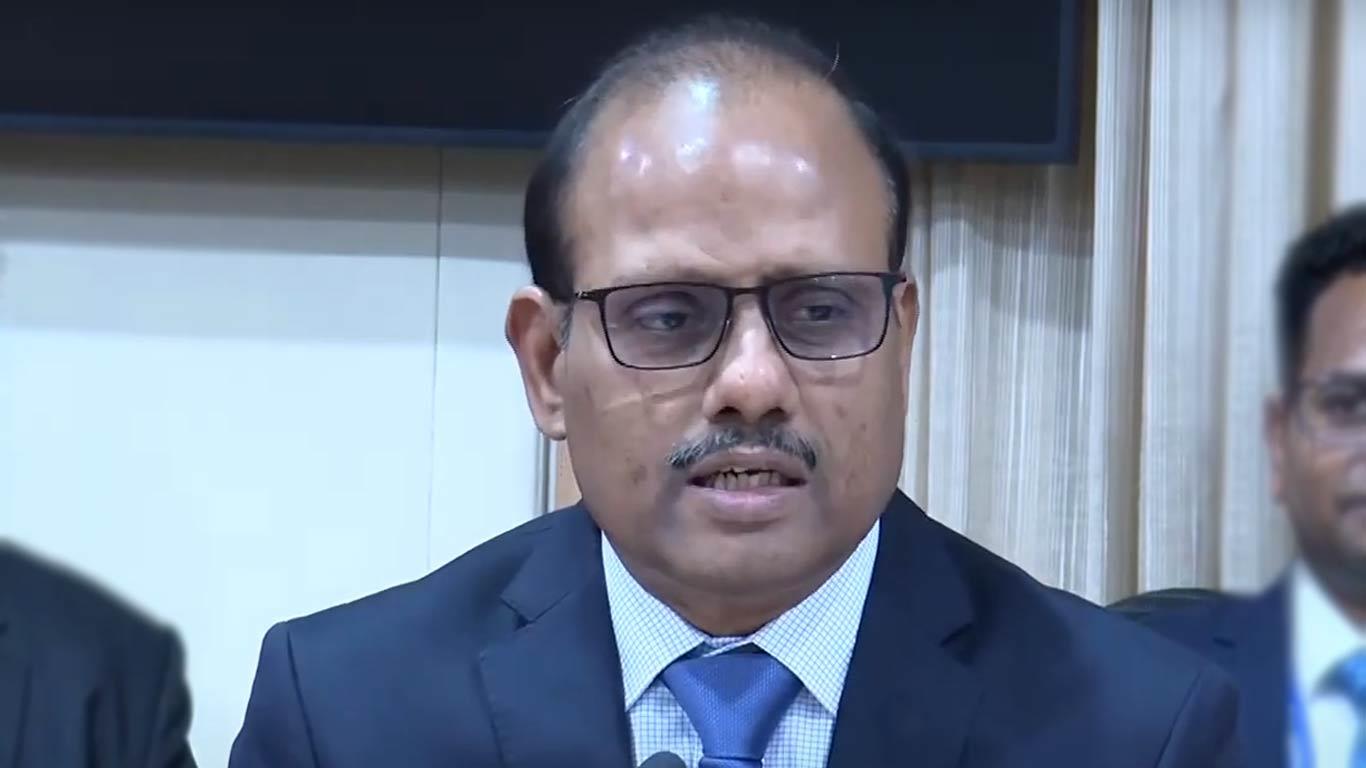

RBI Deputy Governor Highlights Challenges In MSME Credit Delivery, Calls For SLBC Role

Despite improvements in credit delivery to priority sectors, Swaminathan pointed out alarming statistics from a 2019 internal working group report on agricultural credit.

The report revealed that approximately 60 per cent of small and marginal farmers remained outside the ambit of bank credit. Additionally, nearly half of Self-Help Groups (SHGs) are yet to be credit-linked.

The Deputy Governor emphasised the critical role of SLBCs in addressing these credit gaps through a multi-faceted approach. He called for enhanced coordination between SLBCs and various governmental and non-governmental organisations to forge robust partnerships.

These collaborations are expected to align local area banking initiatives with broader developmental programs.

Swaminathan stressed the importance of working closely with local administrations to extend banking services to underserved regions, facilitate the implementation of government schemes, and tackle region-specific issues through collaborative efforts.

"There is a need for sensitising the District administration on the scope of the Lead Bank Scheme and the role of banks under it," Swaminathan stated, highlighting the importance of awareness at all levels of implementation.

The RBI official also advocated for a more scientific approach in preparing annual credit plans. He suggested the use of data analytics and field surveys to identify root causes behind sluggish credit growth in certain areas. This approach, he believes, will lead to more targeted and effective credit plans.

Emphasizing the role of technology, Swaminathan urged SLBCs to leverage fintech solutions to streamline banking operations and enhance customer service.

He highlighted how technologies like mobile banking and digital loan processing have already reduced turnaround times and increased accessibility.

The Deputy Governor's address underscores the RBI's commitment to inclusive financial growth and highlights the critical role of SLBCs in bridging the existing credit gaps, especially in the MSME sector.

(KNN Bureau)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment